Government-sponsored mortgage lender Freddie Mac, the second largest U.S. mortgage company, posted a $2 billion loss for the third quarter and warned that it may not have enough cash to cover its mortgage commitments.

loans

../../../..//2007/11/15/the-hot-new-financing-trend/

The hot new financing trend that’s taking the mortgage industry by storm: 30-year fixed mortgages! [Bankrate]

Buying A Home? Don't Rack Up Debt Between Approval And Closing

Don’t open any new lines of credit or go crazy with the credit card purchases between your home loan’s approval and the actual closing date, warns Ilyce R. Glink (doesn’t it look like we just tapped a bunch of keys at random to spell that name?) at Inman Real Estate News. Your lender will pull a second credit report before closing to make sure that you’re still capable of paying your loan—so if you’ve done anything in the interim that could impact your ability to pay, rest assured it will show up.

../../../..//2007/11/14/8-foreclosure-dos-and-donts/

8 foreclosure do’s and don’ts. Some could save you your house. [Bankrate]

HSBC Says Subprime Meltdown Spreading Into Credit Cards, Other Loans

HSBC warned today that the subprime meltdown is spreading into credit cards and other types of consumer loans, says the NYT. The bank announced that it will be taking a larger write down than it forecast, due to the spreading delinquencies.

Where To Get Your Real Credit Score

Finding your credit score can be hard if you’ve never done it before. There’s scam sites, conflicting information, and the credit bureaus offering their own version of the credit score. But if you want your FICO, the real score looked at by lenders to determine your credit-worthiness and interest rates, here’s where you can go:

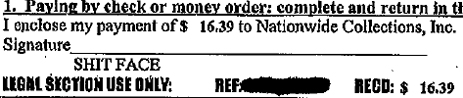

Racial Slur-Dropping Debt-Collection Agency Settles With FTC For $1.3 Million

A debt-collection agency settled with the FTC for $1.3 million after thousands of complaints were lodged against the company for abusive and illegal practices. LTD used threatening language and racial slurs against debtors. They also threatened they would garnish debtor’s wages, something that can’t happen without a trial. Company managers were found to be complicit in its employees illegal actions. LTD collected debts for major credit card companies and retail chains.

Don't Wait Too Long To Get Help With Money Problems

Too many people wait until they hit rock bottom before seeking help from credit counseling agencies, says a New York credit counseling service. The consequence is that consumers end up limiting “the options available to them without having to make major, and often very difficult lifestyle changes. If they wait too long, debt repayment plans become unaffordable—leaving them more vulnerable to losing assets or having to file bankruptcy.”

So how do you know when it’s time to ask for help? If your monthly payments are exceeding your monthly income, it’s probably a good time. To find an agency, check out wikiHow’s How To entry, and use this list provided by Bankrate to ensure the agency will be able to provide the services you need.

Debt Collector Addresses Notice To "SHIT FACE"

Collection agency addresses collection notice to “SHIT FACE.” The letter begins, “Dear SHIT…” Below a line where the debtor is supposed to sign, the pejorative again appears. Best of all, the debt is only $16.39, for Columbia House (purveyors of fine 1cent for 624,215 CD offers). The debtor signed an affidavit saying he didn’t sign up under that name, nor did he use profanity in his correspondence. Consumer lawyer and sometimes Consumerist contributing blogger Sam Glover thinks the sobriquet is a deliberate touch by the debt collector. Debt collectors frequently resort to intimidation, though they “don’t usually document their harassment.”

3 Ways To Take Advantage Of The Fed Rate Cut

Bankrate shares three ways consumers can take advantage of the recent federal interest rate cut.

../../../..//2007/11/05/could-credit-cards-be-the/

Could credit cards be the next subprime meltdown? [Fortune]

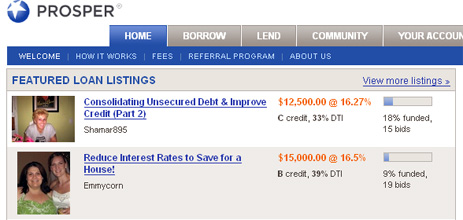

Make And Take Person To Person Loans With Prosper

Person-to-person lending site Prosper.com lets you take and make loans to other average citizens. Prospective borrowers register and let Propser review their credit history. They can request from $1,000 to $25,000 in an unsecured loan and specify an upper limit of interest they’re willing to pay. Then, other users check out the borrower’s profile and decide whether to fund them. You can bid as little as $50 on other people and fund multiple borrowers, spreading out the risk. Depending on the type of loan, you can earn upwards of 9% interest on your investment. The loans are for three years and there’s no prepayment penalty.

Usury Is Good For You

Usury is good for you. That’s the lesson from an article in today’s WSJ using empirical evidence to defend the practice of charging 200% interest rates.

5 Expenses You Can't Afford If You Have Credit Card Debt

5) Cable. Your Excuse: “But, but, but I need cable! I get a good deal! It’s only $100 a month! I use it a lot! It’s bundled with my phone and my internet. I’ll only save $30 a month if I cancel it.”

The Mom With $135,000 In Credit Card Debt Who Spends $400 A Month On Starbucks

“I love new clothes. However, I like getting rid of the clothes just as quickly to go buy new ones.”

College Costs Rising At Double The Inflation Rate

College costs are accelerating in price, according to a new study released this morning.