For as much as exotic dancers (you might call them strippers) show off when they’re spinning around the brass pole on stage at the club, most of them are pretty private about their profession when they’re not at work. That explains why a former dancer of the exotic type filed a lawsuit after she saw a picture of herself being used on a billboard — for a club she never even worked at. [More]

scores

Does Living In California Make You A Higher Credit Risk?

Paul Smith, who lives in San Diego and has a credit score of 751, had his HSBC credit card limit lowered from $7,000 to $1,400 recently for mysterious reasons. He called HSBC to find out why.

The 8 Secret Credit Scores

Remember when AMEX lowered the credit limit of Kevin Johnson because he shopped at the wrong store? It finally showed the world that credit card companies rely on more than a FICO credit score to make decisions.

AmEx Denies Existence Of A Store Blacklist, Will Slash Your Credit Whenever They Want

Despite sending customers letter saying otherwise, American Express now insists that it never blacklisted cardholders based on where they shopped. Those notes explaining that “other customers who have used their card at establishments where you recently shopped have a poor repayment history with American Express?” Whoops! Just a big misunderstanding! Not unlike the comment they gave to ABC explaining that “shopping patterns” were used as a “contributing factor” in slashing credit lines, a statement AmEx later retracted. So what’s really going on? Let’s explore…

NewCreditRules Asks, Which Of These Stores Will Get Your AMEX Card Reduced?

Last month we posted about Kevin Johnson, a 29-year-old self-employed businessman with excellent credit and an established history with American Express, who had his credit limit cut by 65% because AMEX said he was shopping at the wrong sorts of stores. Johnson has created a website called NewCreditRules.com to try to uncover what, exactly, he did wrong to fall under AMEX’s high risk category.

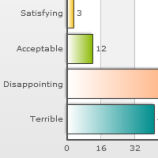

Nearly 25% Of Nursing Homes 'Much Below Average'

Of all the unusual gifts you can give Mom or Dad this holiday season, none would be more surprising than a simple card saying, “We’re putting you in a home.” Just make sure you don’t pick a bad one, because nearly a quarter of nursing homes were rated “much below average” in a new monthly federal evaluation.

The 10 Most Reputable Companies In The U.S.

The Research Institute has compiled a list of the most reputable companies in the U.S., “calculated by averaging perceptions of trust, esteem, admiration, and good feeling obtained from a representative sample of 100 local respondents who were familiar with the company.” (Then they do some statistical stuff to it.) Coming in at #1 is Google, which we think is remarkable considering how much data the company has managed to collect over the past several years, and continues to collect with new record-keeping initiatives like Google Health.

Don't Wait Too Long To Get Help With Money Problems

Too many people wait until they hit rock bottom before seeking help from credit counseling agencies, says a New York credit counseling service. The consequence is that consumers end up limiting “the options available to them without having to make major, and often very difficult lifestyle changes. If they wait too long, debt repayment plans become unaffordable—leaving them more vulnerable to losing assets or having to file bankruptcy.”

So how do you know when it’s time to ask for help? If your monthly payments are exceeding your monthly income, it’s probably a good time. To find an agency, check out wikiHow’s How To entry, and use this list provided by Bankrate to ensure the agency will be able to provide the services you need.

6 Basic Things Teens Should Know About Credit Cards

Organizations like the Jump$tart Coalition and NFCC have rolled out programs that help you teach your kids about the ins and outs of credit cards, credit ratings, interest rates, etc., but Janet Bodnar at Kiplinger says that there are some basic facts that you should focus on. She thinks too much detail bores a kid; we think it depends on the kid, but agree that at the very least, hitting each point on the following list would give your offspring a decent foundation for making good credit decisions.

Should Car Insurance Rates Be Based On Your Credit Score?

For a decade now, all the major auto insurers have used a customer’s credit rating to some degree in determining premiums. They claim that it results in lower rates for “most” customers, and that the data prove that people with lower credit scores make more claims and for higher amounts. The FTC released a report this summer that validated the practice—but also confirmed an unpleasant truth critics have been saying for years: because a higher percentage of Hispanics and African-Americans have low credit scores, there’s a good chance they’re disproportionately affected.