Nearly 25,000 Wells Fargo customers, including many servicemembers, lost their vehicles after failing to pay for unneeded, unwanted insurance the bank charged them for, according to a new report suggests. [More]

default

Report: 25,000 Wells Fargo Customers Lost Vehicles After Bank Charged For Unwanted Insurance

From Forbearance To Garnishments: 5 Things We Learned About Student Loan Debt Collection

Student loans are big business, both for private lenders and the federal government. And with $1.4 trillion dollars in education debt outstanding, it should come as no surprise that these companies and the government would want to recoup these costs. However, that often comes at a cost to borrowers, from those who have fallen on hard times, to those failing to receive proper notice and options from servicers, or those who believe they were defrauded by the educators who promised them a better life. [More]

90% Of At-Risk Student Loan Borrowers Not Signed Up For Affordable Repayment Plans

Paying back tens of thousands of dollars in student loan can be difficult, and more than 1 million Americans defaulted on their federal student loans just last year. But why are nearly all of these same borrowers failing to take advantage of programs to help them avoid defaulting again? [More]

The System To Collect Defaulted Student Loans Is No Longer Functioning

Consumers who expected their student loan payments to be deducted from their bank accounts this month have reportedly found the funds untouched, and their calls to the companies unanswered thanks to a Department of Education’s order prohibiting the debt collection companies from working on default accounts in response to two lawsuits against the agency.

City Sues Star Of HGTV’s ‘Rehab Addict’ Over Un-Remodeled Home

The premise of HGTV’s Rehab Addict is simple: The show’s star, and home remodeler Nicole Curtis buys a historic home in Detroit or Minneapolis that has been ravaged by years of neglect and returns it to its former glory. But nearly five years after purchasing one Minneapolis property, the city is suing Curtis, claiming she hasn’t done the work, resulting in complaints from neighbors and piled-up bills. [More]

More Than 1.1M Federal Student Loan Borrowers Entered Default Last Year

With the cost of college tuition continuing to increase, it likely comes as no surprise that more borrowers are finding themselves in default. In 2016 alone, 1.1 million borrowers entered default for their federal student loans. [More]

Student Loan Servicing Issues Contribute To Older Borrowers’ Defaults

In 2015, nearly 40% of all federal student loan borrowers over the age of 65 were in default, thanks in part to issues they faced when it came to the servicing of their debts, including problems enrolling in income-driven repayment plans and accessing protections as co-signers. [More]

Student Loan Companies Could Face Enforcement Actions Over Automatic Defaults

In recent years, countless private student loan borrowers have found themselves placed in automatic default – even if they were up-to-date on payments – when their co-signer died or filed for bankruptcy. Federal regulators now appear poised to rein in this often devastating practice, warning student loan lenders and servicers that they could soon face enforcement action if they continue the practice. [More]

How The Federal Government Tries To Keep Financially Troubled Colleges From Failing

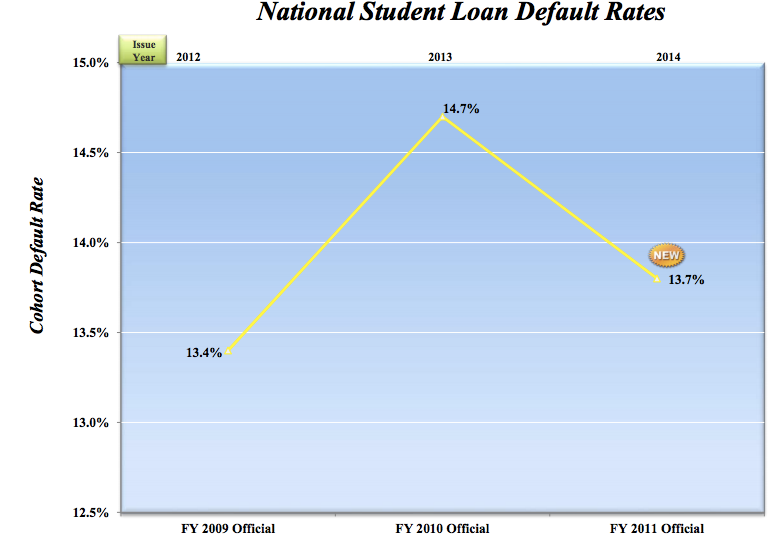

Under federal law, colleges that record a student loan default rate of 30% or more for three consecutive years – or 40% in a single year – can lose their access to federal aid. While the rule is meant to weed out bad players and schools that don’t provide students with means for gainful employment, a new report shows that the government often intervenes, propping up schools just before they fail. [More]

7 Things We Learned About Federal Student Loans & The Companies That Profit From Them

Fifty years ago, Congress created the federal loan program as a way to help Americans realize their dreams of a better life through higher education. While millions of students have no doubt benefited from the program, millions of others have found themselves burdened by mountains of debts, fielding calls from debt collectors and loan servicers, and watching as their paychecks are whittled down by garnishments. Today, seven million former college students are in default with a record $115 billion in federal loans. While those figures may be oppressing borrowers, it’s providing a stream of income – and profit – for companies contracted by the government to collect payments from debtors. [More]

CFPB Report Finds 90% Of Student Loan Borrowers Who Seek Co-Signer Release Are Denied

Last year, the Consumer Financial Protection Bureau brought our attention to a relatively new phenomenon in which more and more private student loan borrowers found themselves placed in automatic default – even if they were up-to-date on payments – when their co-signer died or filed for bankruptcy. While the agency and consumer advocates urged these borrowers to seek co-signer release from their lenders, a new report finds that’s simply hasn’t been possible. [More]

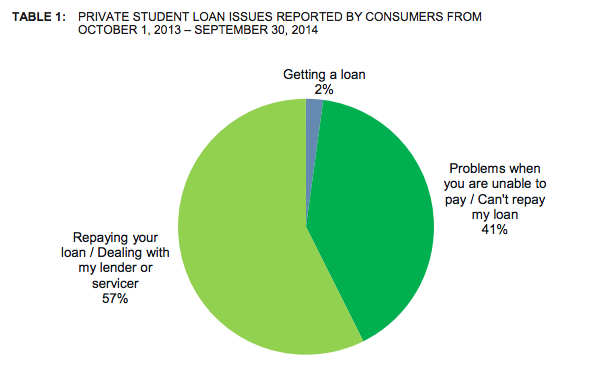

CFPB: Private Student Loan Companies Provide Few Options For Borrower, Driving Them To Default

By now we all know that for many consumers taking out private student loans is the only option when it comes to financing their higher education. We also know that many of those same borrowers will ultimately end up defaulting on their debt. A new report from the Consumer Financial Protection Bureau suggests that it’s not borrowers’ lack of willingness to repay that lands them further in debt, but a lack of resources provided by lenders that drives consumers to default. [More]

650,000 Student Loan Borrowers Who Began Repayment In 2011 Have Defaulted On Federal Loans

Maybe more consumer are realizing the long-lasting negative effects that can come from not repaying their student loans. Or maybe not. we don’t really know why, but we do know that the number of borrowers defaulting on some federal student loans is decreasing. [More]

The Debt Ceiling Crisis Is So Much More Fun With Choose Your Own Adventure Scenarios

We’ve all heard about magic trillion-dollar coins and other fantastical scenarios to save the U.S. government from finally smacking its head against the debt ceiling, but trying to really understand the whole thing and what we’re in for if something can’t be figured out is kind of intimidating. Which is why we’re really glad someone came up with a “choose your own adventure” type to see exactly what we could be getting into. [More]

Credit Unions Ask Customers To Leave

Credit unions might be attractive alternatives to big commercial banks, but they’re not crisis-proof. OregonLive says about a fifth of the nation’s credit unions are having financial troubles right now. To get in better financial health, they’re introducing fees for services that have long been free, and even asking members to move their deposits to other institutions. [More]

Citi Promises No Foreclosures Or Evictions For One Month

About 4,000 borrowers who were either scheduled to have foreclosure sales or who were going to receive foreclosure notices will be left alone until January 17th, according to CNN. [More]