The New York Times has an interesting article about a couple in California who are suing their real estate agent (who is conveniently also a mortgage broker) for allegedly artificially inflating the appraisal on their home by $100,000. A few days after moving in to their new home, says the NYT, “they got a flier on their door from another realty agent. It showed a house up the street had just sold for $105,000 less than theirs, even though it was the same size.”

loans

Launch An ACS EECB

Here are email addresses you can use to launch an EECB (executive email carpet bomb) against ACS, a student lending company that’s a subsidiary of PNC bank.

World Economy Feels The Mortgage Meltdown

On a day when United States markets were closed in observance of Martin Luther King’s Birthday, the world’s eyes were trained nervously on the United States. Investors reacted with what many analysts described as panic to the multiplying signs of weakness in the American economy.

Payday Lenders Can't Afford To Lend You Money At Only 36%

The Leftwing Conspiracy blog scanned a cute pamphlet that a payday lender is distributing to try to drum up sympathy now that there’s a rate cap on loans given out to military personnel. Boohoo!

../../../..//2008/01/18/now-that-salliemae-buy-out-deal/

Now that SallieMae buy-out deal has crumbled and they’re facing much higher borrowing costs due to the subprime fiasco, the unpopular student lender will shed 3% of its workforce, or 350 jobs, mostly CSRs at their call centers.

The Downside To Alternate Payment Systems

If you use services like Bill Me Later, eBillme, or Pay Payl’s Pay Later—payment options designed to let you pay online without using a credit card—you should be aware of the risks as well as benefits that come with them, writes SmartMoney. The most important thing to consider: as far as FICO is concerned, you’re applying for a line of credit (with the potential for high interest rates) when you pay with one of these systems, and your credit score may drop accordingly.

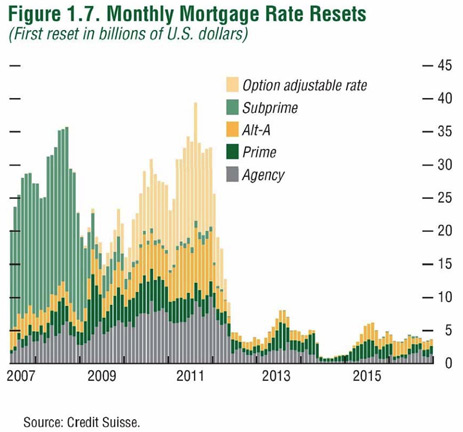

Monthly Mortgage Rate Resets, 2007-2016

Credit Slips’ Adam Levitin takes a look into the possibly even grimmer future of the housing market. We’ll let him explain it because he’s smart:

…this graph from Credit Suisse is the most sobering thing I’ve seen in a while. Mortgage_rate_resets It shows that most of the interest rate resets ahead aren’t subprime, but are instead Alt-A and option-ARMs…

The Impact of Extra Mortgage Payments

The web is full of opinions listing the pros and cons of making extra mortgage payments, but there are surprisingly few pieces on how extra payments impact your mortgage payments. Turns out that the answer depends on which of the four main types of mortgage you have. Yahoo Finance gives thoughts on each of these including standard fixed-rate mortgages, standard adjustable-rate mortgages, interest-only mortgages, and home ownership accelerator loans. A few interesting highlights listed from least responsive to most responsive extra-payment home loans:

../../../..//2007/12/20/woman-loses-house-to-foreclosure/

Woman loses house to foreclosure because her lender underestimated her escrow. [South Florida Sun Sentinel]

../../../..//2007/12/17/fewer-borrowers-will-qualify-for/

Fewer borrowers will qualify for mortgage insurance, due to tightened restrictions following the subprime…

../../../..//2007/12/14/if-it-sounds-like-legal/

“If it sounds like legal loan-sharking, it’s not. ‘Loan sharks are actually cheaper,” leader of the Ohio Coalition for Responsible Lending, talking about payday loans. [CNN Money]

Paying Off Consumer Debt: Home Equity Or No Home Equity?

If you have consumer debt, you’re probably looking for a strategy to pay it off. Some people use a home equity loan as a way to get a lower rate, others use 0% balance transfers, still others just call their credit card company and ask them to lower their rates.

Citibank Charges Student Loans Late Fee From 2005

Sean writes:

When I went to check the statement on my wife’s student loan through CitiBank for November, I noticed a late fee listed. As we signed up to pay via direct debit for the interest rate deduction, we get no paper statements. I checked my records, and our last payment had been processed for the full amount, on the due date. I asked my wife to call and find out why we were being charged a late fee. The representative told her that it was to correct an error from 2005. There is no explanation on the site, and when my wife asked to speak to a supervisor, the supervisor told her that there were no plans to notify people being charged these fees. My wife had to specifically request that a letter be sent detailing these fees.

../../../..//2007/11/26/woman-pays-debt-on-foreclosed/

Woman pays debt on foreclosed home, only to have it sold out from under her anyway. [Newsday]

Helpful Website For Student Loan Borrowers

The National Consumer Law Center and the Project on Student Debt have launched a joint website that offerers information for student borrowers who are behind on their loans, or those who just want to learn more about their options.

Say Goodbye To Mark Ernst, CEO Of H&R Block

H&R Block Inc., our nation’s largest tax preparer, is now missing CEO Mark “Anybody Wanna Buy A Subprime Lender?” Ernst, after losing $1 billion in the subprime meltdown.