../../../..//2008/09/18/were-not-the-only/

We’re not the only ones with a credit crunch. HBOS, Britain’s biggest mortgage lender, is going under.

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2008/09/18/were-not-the-only/

We’re not the only ones with a credit crunch. HBOS, Britain’s biggest mortgage lender, is going under.

About a year ago, CNBC’s Jim Cramer completely lost his sh*t on CNBC, screaming at Bernanke to lower interest rates before millions of borrowers went into foreclosure. Now, as the “Armageddon” that he was carrying on about is in full swing, Cramer is taking this opportunity to gloat.

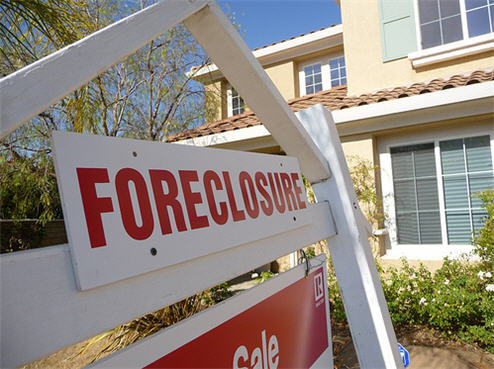

ABCNews says that more and more people who are facing foreclosure are just buying cheaper homes and then just walking away from their original mortgage. It only works for people who can afford the down payment on a new home and carry both mortgages until they’re in the new home, but for some people whose payments are about to balloon, it’s the most attractive option out there right now.

Once upon a time, Peter Finch won an Oscar for telling us to go to our window, open it, and yell, “We’re mad as hell and we’re not going to take this anymore!” Now thousands and thousands of consumers are doing just that, but instead of yelling out their windows, they’re yelling at the Federal Reserve in the form of a record breaking number of public comments about some proposed credit card reforms. Not as sexy as yelling like a madman, but far, far more effective.

Everyone knows that your money is safe in an FDIC insured bank because if the bank fails (Hello, IndyMac!) the FDIC will step in and repay your money (generally, up to $100,000.) But what if the FDIC runs out of money? It doesn’t have an unlimited supply and enough bank failures could completely drain its fund, says ABCNews:

Reader Brian says he saw the above pictured infomercial on CNBC this Sunday, and is wondering how they get away with such a “blatant attempt to take advantage of those same mortgage consumers who where hoodwinked in the first place.”

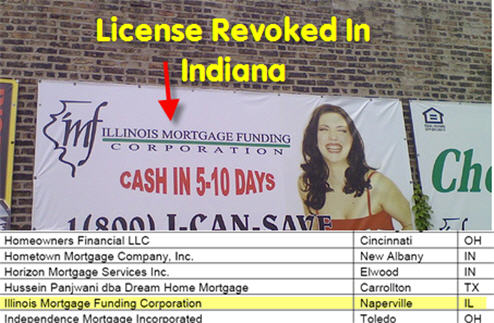

40% of Indiana’s mortgage brokers have lost their licenses because they did not comply with a new law aimed at “raising the standards” of the mortgage lending industry. The law requires mortgage brokerages to “name a principal broker with at least three years experience who has passed a state exam and will oversee his company’s business affairs,” says BusinessWeek. Sounds reasonable, doesn’t it?

A new bill that will help 1-2 million homeowners escape their unaffordable mortgages by refinancing into new low-cost fixed-rate loans insured by the Federal Housing Administration (FHA) has passed the House and will now move on to the Senate. If it is eventually passed by the Senate and signed by the President (who is no longer threatening to veto it), will it help you?

../../../..//2008/07/24/tragic-a-woman-facing-foreclosure/

Tragic: A woman facing foreclosure commits suicide, faxes note to her mortgage company that said “by the time they foreclosed on the house today she’d be dead.” [Boston]

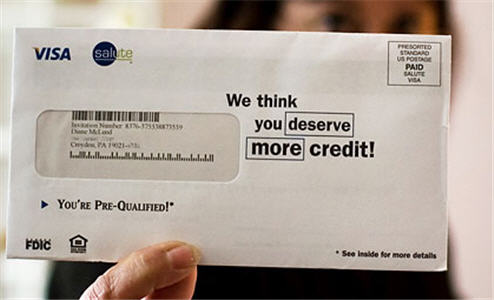

The New York Times has an article that tells the unfortunate tale of Diane McLeod and her love affair with debt. She started out “debt free” when she got married, but after a divorce she’d managed to accrue $25,000 in credit card debt. Despite not having a down payment or any assets, Diane was given a $135,000 mortgage. Over the next few years, illness, underemployment, and shockingly irresponsible spending combined disastrously with the bank’s willingness to refinance her loan as her home appreciated (for a fee, of course). 5 years later, Diane owes $237,000 on her mortgage. She’s in foreclosure now, and a recent sheriff’s auction of the home did not draw a single bidder. A similar house down the street recently sold for $84,000 less than she owes on her home.

The party is over. If you want a mortgage you’re going to have to be able to afford it. Oh no! Now what are you going to do? Kiplinger’s has an article that explains how mortgage lending works when there are “standards” involved. How quickly we all forget…

Countywide CEO Angelo Mozilo thinks his company being treated unfairly by the media according to a article in BusinessWeek. At the Countrywide annual shareholders meeting, Mr. Mozilo said:

Shaq has a plan to save Orlando from the mortgage meltdown. Sort of. The Orlando Sentinel says that word leaked out that Shaq was working on a plan to buy the troubled mortgages of Orlando homeowners and refinance them so that families could stay in their homes — and hopefully turn a small profit by doing so. The trouble is, the demand is overwhelming and Shaq doesn’t have anything set up yet. That’s not stopping him, though.

Bank repossessions (that’s when not even the bank can sell your house) are up 48% from a year ago, as falling house prices trapped borrowers in mortgages they couldn’t afford, says Bloomberg.

Does Angelo Mozilo spend all of his time thinking of ways to be shady? Now ABC News says that Countrywide had a special “VIP desk” that gave out below market rate loans to Senators and other politically connected people.

Grim numbers today from the Mortgage Bankers Association. 2.5% of all mortgages serviced by the association’s members are now in foreclosure — 1.1 million homes. The rest of the numbers aren’t any more cheerful. Both the rate of new foreclosures and late payments were the highest on record going back to 1979, says the AP.

Over on the Credit Slips blog, Elizabeth Warren posted an email from a bankruptcy lawyer who was stunned at the horrible deal one of her clients got from Wells Fargo on an equity loan on a car.

Gov. Ted Strickland, of the great state of Ohio, has signed a bill that punches the rapidly growing payday lending industry in the face. As we’ve mentioned before, the bill will cap interest rates at 28% and limits consumers to 4 payday loans per year. A typical payday loan charges around $15 per $100 borrowed on a 2 week loan, which works out to an interest rate of 391%.

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.