This a freakin’ awesome cartoon that explains how the credit crisis began, played out, and exploded in our face. I know you’ve seen and heard a million of these by now, but this one is highly visually engaging and entertaining, enough so I could see it being used in the classroom and kids not getting (too) bored. Graphic designer Jonathan Jarvis. Especially good is how it explains leverage.

credit crisis

California Man Barricades Himself Inside Foreclosed Home

Carson, California has over 1,100 homes in foreclosure according to its mayor, and barricaded inside one of them was Frank Torres, an oil-refinery worker who lost his home to foreclosure after work was scarce last year. Now he’s working full-time and he wants to buy his house back — but he says the bank won’t listen. That’s why he painted a message on the roof of his former home and held the building hostage for 5 hours.

Europe vs USA: Who's Handling The Crisis Better?

The debate on the BBC news right now is who is cooler, America or Europe. Europe is getting props for acting speedily and decisively in contrast to Paulson’s pace, which is getting characterized as dawdling and indecisive. Some of the very policies Treasury derided, they’re now considering since Europe enacted them. The ex-Reagan economic adviser talking head says it’s nationalizing risk, a backdoor way of calling them socialists. However, it wasn’t until Europe’s “socialistic” actions did the markets rebound. Who is right? Only time will tell; we’ll see if the rally sustains or is just another fitful shiver in this economic fever dream. The key here is confidence, and it seems to be the most precious and rare commodity on the face of the earth right now.

Government May Begin Buying Bank Stock Within Weeks

As it is now apparent that the credit crisis has spread to the global economy and has not been contained in any way, the Bush Administration is considering an option included in the $700 billion dollar bailout package that would allow them to invest directly in banks — buying preferred stock in exchange for a “cash injection.” White House spokesperson Dana Perino said taking partial ownership of banks and other moves associated with the financial rescue plan would not be “part of [Bush’s] natural instincts,” according to the NYT, but acknowledged that the situation has gotten sufficiently dire as to warrant a change of heart.

Get All Gawker Networks' Economic Crisis Coverage At Economy.Consumerist.Com

Gawker has launched Economy.Consumerist.com to make it easier for you to stay smarter than your cubicle mate by keeping track of the latest in the global money meltdown as reported across the entire Gawker Media Network…

Iceland Is Screwed

The Icelandic government seized the nation’s largest lender, Kaupthing Bank. “Effectively the krona can’t be traded at the moment because there are no more banks to clear the trade,” a foreign-exchange trader told Bloomberg. Things have gotten so bad there that Bjork was forced to take out a second mortgage on her collection of screaming children made of glass hiding under a field of sugar.

Financial Crisis Grips Earth

Just when you thought you were beginning to barely understand the financial cancer destroying America, it metastasized. Now it’s global.

The Economist Sums Up Financial Crisis: "Oh Fuck!"

If you feel at a loss for words to describe the now global financial cover, this spoof cover floating around the internet for September’s Economist says it all: “Oh fuck!” Download the large version, suitable for framing or desktop wallpaper, inside…

A Blacker Monday

The Dow is down over 800 points, and the day isn’t even over. This beats last week’s all-time record of 777 points. A global credit crisis is in full swing, with versions of what just decimated Wall Street repeating itself across Europe as governments swoop in with bailouts of high-profile banks. Verily, blood is in the streets. Hm, what’s that old saw? Oh. Right. Buy when there’s blood in the streets.

If Enough Banks Fail, The FDIC Could Run Out Of Money

Everyone knows that your money is safe in an FDIC insured bank because if the bank fails (Hello, IndyMac!) the FDIC will step in and repay your money (generally, up to $100,000.) But what if the FDIC runs out of money? It doesn’t have an unlimited supply and enough bank failures could completely drain its fund, says ABCNews:

../..//2008/07/24/bad-news-sales-of-existing/

Bad News: Sales of existing homes slide to a 10-year low, despite a drop in prices and a glut of available homes. [Reuters]

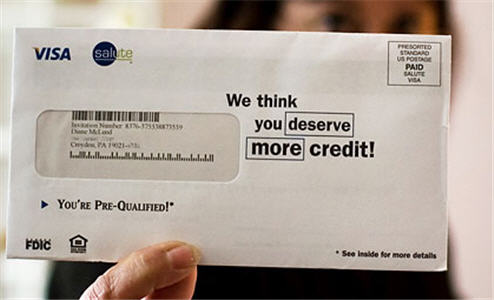

Debt Slavery: Why Are Americans So Willing To Dig Themselves Deep Into Debt?

The New York Times has an article that tells the unfortunate tale of Diane McLeod and her love affair with debt. She started out “debt free” when she got married, but after a divorce she’d managed to accrue $25,000 in credit card debt. Despite not having a down payment or any assets, Diane was given a $135,000 mortgage. Over the next few years, illness, underemployment, and shockingly irresponsible spending combined disastrously with the bank’s willingness to refinance her loan as her home appreciated (for a fee, of course). 5 years later, Diane owes $237,000 on her mortgage. She’s in foreclosure now, and a recent sheriff’s auction of the home did not draw a single bidder. A similar house down the street recently sold for $84,000 less than she owes on her home.

../..//2008/06/19/two-former-bear-sterns-executives/

Two former Bear Sterns executives were arrested today for securities fraud. [NYT]