Here’s something that probably doesn’t happen too often. Former Federal Reserve chairman Alan Greenspan had a crappier day than you did. He had to admit before our federal government that his free-market, anti-regulation ideology was “flawed.” Ouch.

lending

../../../..//2008/10/22/wachovia-announced-their-237-billion/

Wachovia announced their $23.7 billion third quarter loss with an all-too-easy-to-mock pre-taped conference call. “Let’s just close our eyes and imagine what the combination of Wells Fargo and Wachovia will create,” said CEO Bob Steel. We suppose that does make it easier not to rudely stare at the number “23,700,000,000.” [WSJ Deal Journal]

After Losing His Home, Man Trashes House, Spray Paints Message To Bank

Here’s an odd story from the Bay Area. A man who says his house was “sold without his knowledge” to a bank after he signed a “deal” to prevent foreclosure has trashed the property — spray painting a message to the new owner.

Bank of America CEO Explains How He Beat Wall Street

Is the new financial capital of our country located in Charlotte, NC? 60 Minutes traveled down south to talk to CEO Ken Lewis about his bank, its recent purchase of Merrill Lynch, whether or not the bank bailout is “socialism” and the economic crisis in general.

10 Things That Are Going Right For Consumers

Kiplinger’s is more optimistic than we are, so they had the cheerful idea to put together a list of 10 things that are going right for consumers — despite the financial apocalypse. Hooray!

Government May Begin Buying Bank Stock Within Weeks

As it is now apparent that the credit crisis has spread to the global economy and has not been contained in any way, the Bush Administration is considering an option included in the $700 billion dollar bailout package that would allow them to invest directly in banks — buying preferred stock in exchange for a “cash injection.” White House spokesperson Dana Perino said taking partial ownership of banks and other moves associated with the financial rescue plan would not be “part of [Bush’s] natural instincts,” according to the NYT, but acknowledged that the situation has gotten sufficiently dire as to warrant a change of heart.

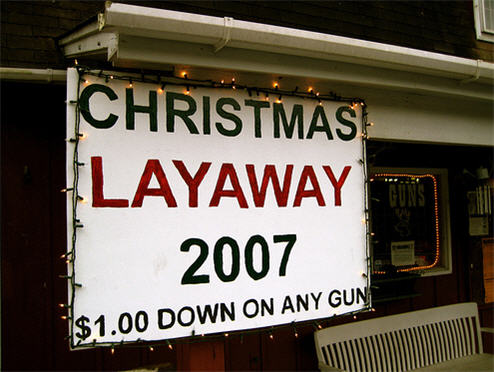

Car Title Loans Are Liable To Leave You Taking The Bus

You surely already know better, because you’re a loyal Consumerist reader, but stay far, far away from the form of legalized usury known as car title loans! CNN has published an overview of the industry, noting that APRs frequently exceed 200%, and that added fees and loan “rollover” options help keep borrowers in a cycle of debt.

Consumer Spending Will Shrink For The First Time In Nearly Twenty Years

Consumer spending, the engine that powers our economy, is probably going to shrink for the first time in nearly two decades, says the NYT — a move that will “all but guarantee” that the current economic crisis will deepen.

Why Did Everyone Buy This Stupid Toxic Debt? No One Understood It

Marketplace has the answer to one of the most troubling questions of our time. Why did people who are supposed to be smart buy all this stupid toxic risky debt? Apparently, it’s because they weren’t that smart, and they didn’t understand what they were buying or selling.

../../../..//2008/10/03/those-of-you-interested-in/

Those of you interested in watching the bailout bill debate in the House can see it streaming on CSPAN, or read a liveblog on the NYT.

The 10 Cities With The Most Crazy Expensive Loans

The Chicago Reporter took a look at some recently released mortgage data with an eye to how many successful refinances there were last year. In addition to concluding that people who most needed a refinance (those with crazy expensive loans) were also the least likely to get one, the Reporter also found that Chicago lead the nation in the total amount of high-cost loans for the fourth year in a row. High-cost loans are loans that are at least 3% above the U.S. Treasury standard.

10 Things To Expect From The New Post-Apocalyptic Economy

Kiplinger’s has put together a list of 10 things that you, fair consumer, can expect from our new post-wall-street-apocalypse economy. Should you be scared? Maybe.

Ex-Credit Card Bankers: "Every Customer Who Calls In Is A Mark. It's A Great Big Con."

CNN has an interview with two former credit card bankers who are admitting that their job was to get consumers to max out their credit cards and take on as much debt as possible, regardless of the customer’s ability to afford it. They both worked for MBNA at their “sprawling consumer call center in Belfast, Maine.” The bankers say that they were told to aggressively push cash advances, and were trained to convince consumers that they needed the maximum amount of debt at the highest interest rate.

What Else Can $700 Billion Buy?

A while back the New York Times was concerned about the cost of the Iraq War and published some estimates of what else we could have bought with that money. We didn’t find that very interesting at the time, but now, while trying to wrap our minds around just how effing huge the $700 billion proposed bailout of Wall Street really is, we decided to revisit that article. Here’s what you can buy for less than $700 billion, according to the New York Times.

House Passes Credit Card Bill Of Rights… But Senate Is Too Busy With The Bailout

The House of Representatives passed legislation that’s commonly known as the Credit Cardholders’ Bill of Rights today, but the bill is expected to be ignored by the Senate while they work on that whole $700 billion bailout thing.

Retailers Like Target May Be In Trouble As Consumers Run Out Of Money

Forbes says that Wall Street is starting to be concerned about Target because of an increase in the amount of delinquencies in its credit card operation. Uh oh…

What Will The Largest Government Bailout Of Private Industry In US History Look Like?

A bailout of some kind is coming, but no one seems to know what it will look like and who it will help. The Wall Street Journal says that Senate Banking Committee Chairman Christopher Dodd of Connecticut has some ideas that might not go over too well with the Treasury Department.

PRBC Helps You Create A Credit Score From On-Time Rent, Bill Payments

Payment Reporting Builds Credit (PRBC) is an alternative credit reporting agency that will record your payment histories for things like rent and utilities bills. PRBC says you can then use this verified credit history to supplement your FICO score and credit history from the big three reporting companies. It’s meant in part as a way to help people who don’t have extensive standard credit histories, or who have always paid monthly expenses on time but have other blots (like medical bills) on their official credit histories.