We understand why someone might opt for getting a payday loan online instead of doing it in person. It’s easier, faster, doesn’t require going to a shady-looking storefront operation where some trained fast-talking huckster might try to upsell you unnecessary add-ons or tack on illegal insurance policies. But the truth is that people who get their payday loans online often end up in a worse situation than they would have if they’d applied in person. [More]

kaz

Online Payday Loans Cost More, Result In More Complaints Than Loans From Sketchy Storefronts

Defense Dept. Aims To Close Predatory Lending Loopholes For Military Personnel

While the Military Lending Act aims to protect military personnel and their families from predatory lenders’ often unsavory lending practices that include high interest rates and excessive fees, it still allows for clever lenders to get their hooks into borrowers. That’s why the Obama Administration and the Department of Defense announced a proposed overhaul of the rules – much to consumer advocates’ delight. [More]

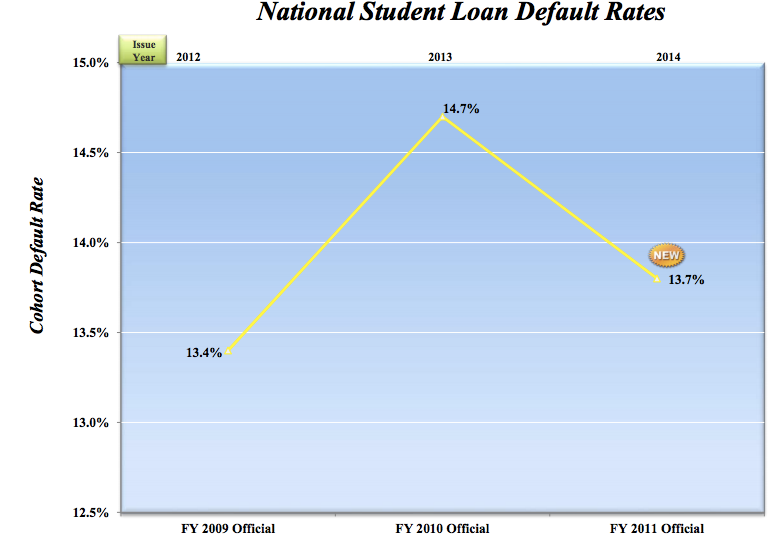

650,000 Student Loan Borrowers Who Began Repayment In 2011 Have Defaulted On Federal Loans

Maybe more consumer are realizing the long-lasting negative effects that can come from not repaying their student loans. Or maybe not. we don’t really know why, but we do know that the number of borrowers defaulting on some federal student loans is decreasing. [More]

ITT Educational Services Under Increased Scrutiny From SEC, Department Of Education

Could ITT Educational Services be the next large for-profit company facing collapse? Things might not be that dire for the parent company of ITT Technical Institute, but the institution recently revealed it’s under increased government examination that could result in the loss of federal funds. [More]

Group Makes Debt Disappear, Pays $3.9M Toward For-Profit Students’ Outstanding Private Loans

If you’re one of the millions of consumers saddled with hard to repay student loan debt, you’ve probably dreamed of the day when your repayment obligation is finished. While it will take most of us years to reach that fine day, others are finding their student loan debt have been paid in full by a group of strangers. [More]

Court Shuts Down Payday Lenders Who Made Millions Off “Loans” Borrowers Didn’t Ask For

Whether you think that payday loans are a necessary financial offering for people with bad credit to get low-value, short-term loans or a predatory product that only results in more debt for the nation’s poorest consumers, you’d agree that no loans should be doled out without the borrower’s approval. But one network is accused of putting unauthorized payday loans in consumers’ bank accounts so it can eventually siphon off even more money. [More]

Feds Sue Corinthian Colleges For Pushing More Than $560M In Predatory Loans On Students

Tens of thousands of students were duped by Corinthian Colleges Inc. into taking out costly predatory, and often financially devastating, private student loans to finance their post-secondary education, the Consumer Financial Protection Bureau alleges in a recently filed lawsuit against the large for-profit education company. [More]

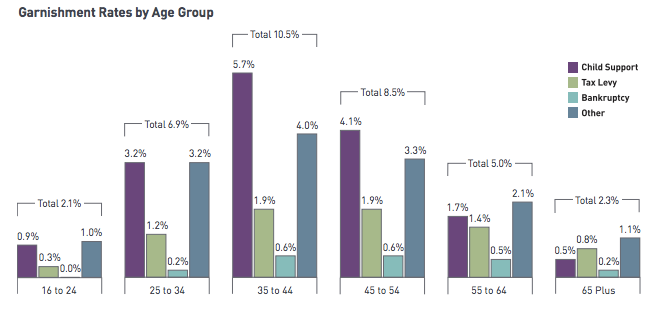

Report: Nearly Four Million Workers Had Wages Garnished For Consumer Debts In 2013

For most Americans every penny counts when it comes to their paycheck, but for some workers nearly a quarter of their wages are taken to pay for past debts in a process known as garnishment. The prevalence of this type of pay seizure grew significantly in the last few years leaving more consumers struggling financially. [More]

John Oliver On For-Profit Colleges: You Might As Well Go To Hogwarts

What would it look like if you condensed all our hundreds of stories about student loans and for-profit colleges into a profanity-filled, hilarious rant that takes a brief detour to discuss Lyndon Johnson’s scrotum? John Oliver answered that question on Sunday night. [More]

Is ActiveHours A True Payday Alternative Or Just Another Too-Good-To-Be-True Letdown?

We’re largely a society built on convenience: fast food, one-stop shops and other we-need-it-now services. Unfortunately, that need for timeliness seeped in to the financial system in the way of quick-fix payday loans, which can provide the convenience of a quick, low-value loan but which often result in a revolving cycle of high-interest debt. Now a new lending product aims to take the predatory stigma out of short-term loans, but, like many payday alternatives of the past, a closer look reveals reason for concern. [More]

Regulations Help To Rein In Runaway For-Profit Colleges, But Schools Still Find Loopholes

If a company routinely charges more for its products than the competition and its product is often inferior to the more affordable option, that business won’t remain open for long. But thanks to deep-pocketed backers and a government that has handed over hundreds of billions of dollars in federal student aid without asking too many questions, the for-profit college industry continues to rake in the bucks while frequently leaving its students with subpar educations and faint employment hopes. Some federal regulators have attempted to make the industry more accountable, but these schools continue to take advantage of loopholes while legislators and consumer advocates scramble to make reform. [More]

There Are So Many Things Wrong With This Everest University Job Posting That We Might Cry

Earlier this summer Corinthian Colleges proved to be in it for the long haul when, despite striking a deal with the Dept. of Education to either sell off or close most of its schools, it continued to pepper television airways with ads and badger attendees at college fairs in order to entice students to enroll. Now the company is showing that those questionable marketing skills aren’t just for students, but also to hook potential educators and support staff. [More]

Corinthian Colleges Subpoenaed In Possible Criminal Investigation

Corinthian Colleges — the company that operates for-profit college chains like Everest, WyoTech, and Heald — is already under investigation by various state and federal regulators, but the company has disclosed to its investors that it may also be the subject of a criminal probe by federal prosecutors. [More]

“Payday Syndicate” Accused Of Charging Illegal Triple-Digit Interest Rates In NY

States have usury laws to limit illegal lending from loan sharks and organized crime. Some states’ laws limit interest rates on loans so much that payday lending and other predatory financial products are effectively banned. New York is one such state, and prosecutors there have filed charges against the operators of a “payday syndicate” that allegedly issued loans with illegally high, triple-digit interest rates. [More]

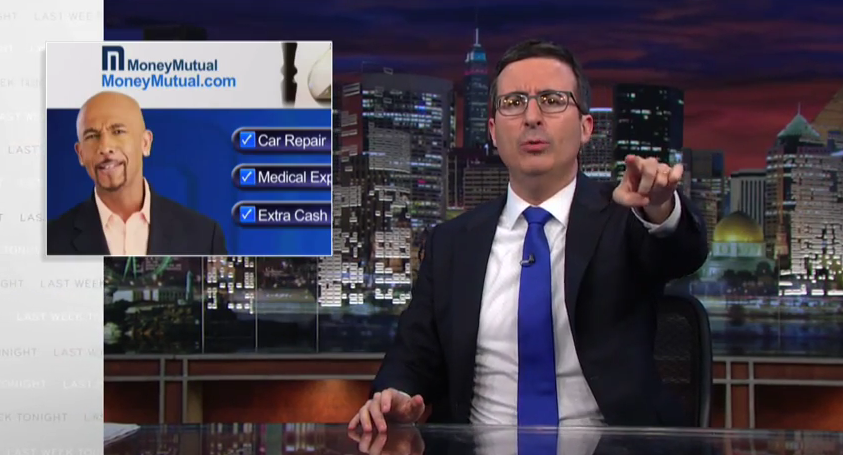

The Best Lines From John Oliver’s Takedown Of The Payday Loan Industry

As regular readers of Consumerist know, we’re not exactly fans of the payday loan industry. If we were snotty teens and lived in the same neighborhood as Mr. Payday, we’d leave a flaming bag of dog poo on his doorstep. That’s why it was so nice to see our disgust for payday loans shared by John Oliver on HBO’s Last Week Tonight. [More]

Comcast Makes Money Off Everest University Ads, Even As Schools Are Being Sold Or Closed

Earlier this summer, facing lawsuits and investigations from multiple state and federal agencies, Corinthian Colleges Inc. struck a deal with the U.S. Dept. of Education to either sell off or wind-down most its schools, including Everest University, WyoTech, and Heald College. Yet Corinthian continues to plague the airways with ads, enticing potential students into enrolling in schools that may not exist in a few months. And guess who is making money off the ads? The folks at Comcast. [More]

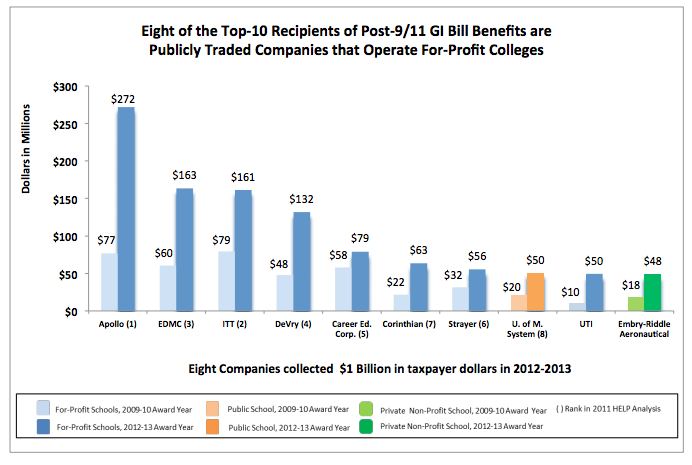

Aggressive Recruiting At Military Bases Pays Off: For-Profit Schools Received $1.7B Of Post-9/11 GI Bill Funds

The Post 9/11 GI Bill aims to further the education of United States servicemembers and their immediate family members, but a new government report reveals that most of those funds are going to further increase the bottomline at for-profit colleges. [More]

Order Provides $92M In Debt Relief For Servicemembers And Others Deceived By Lending Scheme

Despite laws protecting servicemembers from some forms of shady lending, many continue to fall victim to too-good-to-be-true schemes. One company that offered questionable financing to military borrowers and private citizens has been ordered today to provide millions of dollars in debt relief to the consumers it deceived. [More]