Sometimes debt isn’t so bad, and sometimes it is, but one thing is clear: 80% of Americans owe someone, somewhere, some money. It might be a mortgage or student loan, or a five-year-old fee that got forgotten about, but the vast majority of us have some outstanding debt. And worse: a third of the country may have debt collectors chasing after them for that cash. [More]

kaz

Loophole Allows Auto-Title Lender To Charge Triple-Digit Interest Rates Despite Law

Consumer advocates have long claimed that usury caps are the best way to protect borrowers from predatory lenders offering payday or auto title loans. But even those protections aren’t surefire. A title loan company in Florida has been skirting the state’s cap for the past three years. [More]

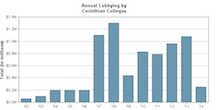

Corinthian Colleges Employee: “We Work For The Biggest Scam Company In The World”

Corinthian Colleges — the operator of for-profit school chains Everest University, WyoTech, and Heald Colleges — is selling off or shutting down campuses as it faces lawsuits and investigations from multiple state and federal agencies. The allegations involve bogus job-placement stats, grade manipulation, and misleading marketing. We recently spoke to several current and former CCI teachers and admissions staffers who confirmed these bad practices and explained that it was all done in pursuit of billions of dollars in federal aid from taxpayers. [More]

Is Cash America Getting Out Of The Payday Loan Business? Not Exactly

Sometimes there’s no better feeling than the one you get when you return to your so-called roots. Maybe that’s what Cash America International is looking for now that the company is making plans to separate itself from payday lending and returning to its first moneymaker: pawnshops. [More]

Proposed Bill Would Keep Many For-Profit Schools From Targeting Military Servicemembers

Legislation making its way though the Senate could put an end to for-profit marketing campaigns targeting servicemembers and their families by changing the way in which those schools count student aid. [More]

The CFPB Has Only Just Begun Tackling Financial Services In Its First Four Years

Four years ago, the Consumer Financial Protection Bureau was created – and three years ago it opened its doors – as a safeguard to ensure the financial industry followed the rules when selling products and services to consumers – and a lot has happened since that time. [More]

CFPB Now Accepting Consumers’ Prepaid Card, Debt Settlement And Title Loan Complaints

Just in time for the fourth anniversary of its creation, the Consumer Financial Protection Bureau announced its expanding the type of consumer complaints it accepts to include prepaid cards and other nonbank products. [More]

Your Corinthian-Operated School Is Closing, But You Might Not Be Completely Screwed

It’s not everyday that a higher education institution shuts down or announces it might be sold. But for the thousands of students attending Corinthian College Inc. (CCI) schools — like Everest University, WyoTech, or Heald College –– that’s their new reality, and it’s one that leaves more questions than answers. [More]

CFPB Wants To Let Consumers Air Financial Grievances In Publicly Viewable Forum

Sometimes consumers want to voice their complaints knowing it will remain a private matter; other times they just want to shout it for all to hear. A new proposal from the Consumer Financial Protection Bureau would give consumers that option when voicing their grievances about consumer financial products and services. [More]

Corinthian Employees: School Manipulated Grades, Job-Placement Stats To Score Federal Aid Money

When a college touts its job-placement statistics to prospective students and investors, does that number only refer to graduates who have jobs in their field of study? What about people who have decent jobs that aren’t in that field, but which they wouldn’t have gotten without the extra schooling? And should that stat include every grad who is earning any sort of paycheck, regardless of how meager the income or how unrelated to their education? [More]

Report: Most Consumers Don’t Care If The Post Office Offers Financial Services

At first glance it wouldn’t appear that the United States Postal Service and banks have much in common. But that might soon come to an end if an idea to expand banking services to local post office branches in an attempt to meet the needs of the underbanked. [More]

Phony Payday Loan Brokers Must Turn Over Rolls Royce, Maserati, Ferrari To Feds

When someone goes hunting for a payday loan — just looking to get their hands on a small amount of cash to tide them over until the next paycheck — it’s bad enough that they can end up trapped in a hellish debt cycle that sees them taking out loan after loan. But the FTC says a Tampa-based operation preyed upon these already-desperate victims by tricking them into applying for payday loans, only to steal their info and what little money they had. [More]

CFPB: ACE Cash Express Must Pay $10M For Pushing Borrowers Into Payday Loan Cycle Of Debt

Another payday lender faces a hefty fine — to the tune of $10 million — for allegedly pushing borrowers into a cycle of debt. [More]

Everest University Campuses Closing; Senator Warns Consumers Not To Enroll

Students at Everest University (also known as Everest College) – one of the schools owned by under-fire for-profit education group Corinthian Colleges Inc. – received some not so comforting news yesterday: their schools are on the chopping block as part of group’s deal with the Department of Education. And that doesn’t come a minute too soon for one legislator who is now warning consumers not to enroll at the campuses. [More]

Corinthian Colleges To Sell Off 85 Campuses; Close 12 Others

While most of us spent the July 4th weekend relaxing and trying to not think about work or school, the folks at faltering for-profit education company Corinthian Colleges — operators of Everest University, WyoTech, and Heald College — were busy slapping For Sale signs on almost all of their campuses around the country. [More]

The Government Has 1.2 Billion Reasons To Keep Corinthian Colleges Afloat

For the last week, we’ve been telling you about the ongoing negotiations between the U.S. Dept. of Education and Corinthian Colleges, the operators of the for-profit Everest University, WyoTech, and Heald College chains, that would sell off some of the schools and wind-down the others. Some people have asked why the government doesn’t just let Corinthian collapse. Part of the reason is that it would leave some 72,000 students in the lurch, but a big motivating factor is that the government could end waving bye-bye to more than $1 billion in student loan debt. [More]