650,000 Student Loan Borrowers Who Began Repayment In 2011 Have Defaulted On Federal Loans

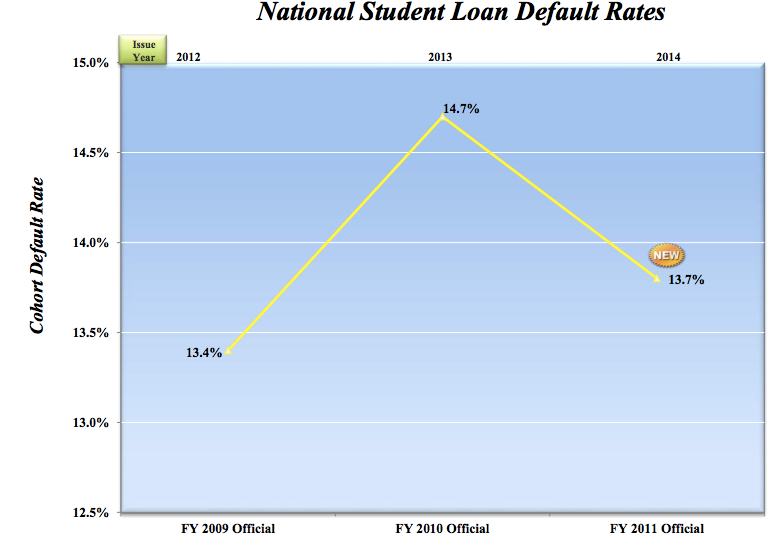

The number of students defaulting on some federal loans within three years of beginning repayment has decreased.

A new report from the Department of Education [PDF] found a drop in the percentage of borrowers who are defaulting on their student loans in the first years they are due.

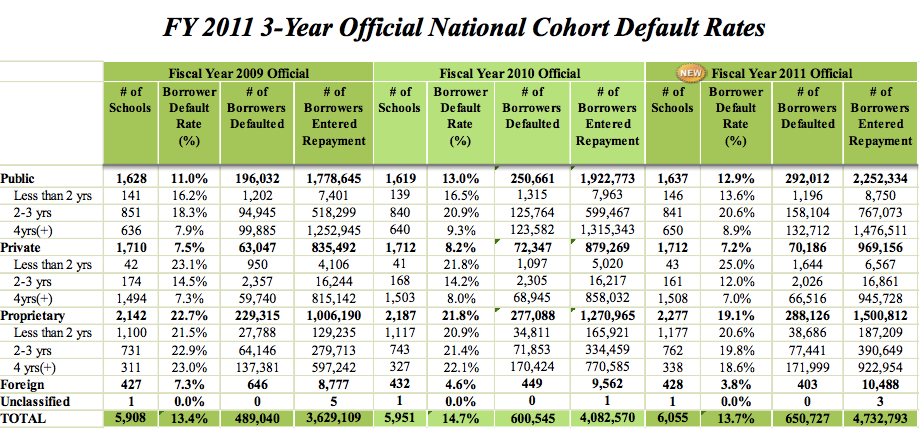

Of the more than 4.7 million borrowers who began paying back their student loans in 2011 only 650,000 have defaulted. That number represents 13.7% of borrowers, a full percentage point less than the default rate of those who began repayment the year before.

In all, the default rate dropped for each of the three main college sectors. The default rate was 12.9% for students at public schools; 7.2% for students at private, nonprofit schools; and 19.1% for students at for-profit colleges.

The Department of Education released figures for for-profit, public and private colleges’ default rates.

To arrive at the figures, the Dept. of Education examined the number of borrowers who default on Federal Family Education Loan (FFEL) Program or William D. Ford Federal Direct Loan (Direct Loan) Program loans within three years of entering student loan repayment – or the cohort default rate (CDR). In this case the figure is based on students who began repaying student loans in 2011.

The Dept. of Education uses the cohort default to determine a school’s eligibility to receive federal financial aid funds. If a school’s CDR is too high, then students of that school are not allowed to participate in the programs.

Any school with a default rate of 30% or more for three consecutive years, or a 40% rate for one year, faces the loss of access to those federal programs.

This year, the Department identified 21 schools that had default rates high enough to lose eligibility for federal aid programs. Of those schools, 20 were from the for-profit sector. Each school will have an opportunity to appeal the loss of funds.

While a decrease in the number of borrowers defaulting on student loans is certainly a welcome improvement, consumer advocates say the number of borrower who have defaulted is way too many.

The Institute For College Access & Success (TICAS) issued a statement [PDF] following the release of the new CDRs, calling on the Dept. of Education to better hold schools accountable for manipulating default rates.

According to TICAS, some schools have combined default data from multiple campuses or have pushed students into forbearance in order to escape sanctions.

“Colleges that manipulate their default rates appear safer than they really are for both students and taxpayers,” Debbie Cochrane, research director for TICAS, says in a statement. “The Department needs to act quickly to ensure that unscrupulous schools aren’t able to evade accountability.”

Despite Lower Rates, More Than 650,000 Defaulted on Federal Student Loans [TICAS]

Three-year Official Cohort Default Rates for Schools [Department of Education]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.