The insurance industry seems to have a love-hate relationship with smart gadgets: auto insurers want drivers to use tracking technology so they can offer more personalized rates (something many drivers don’t want), but home insurance companies aren’t likely to give homeowners with internet-connected safety systems a break on their bills. [More]

insurance

Labor Group: High-Pressure Sales Goals Led T-Mobile Workers To Add Services Customers Didn’t Want

Selling consumers services they don’t need is nothing new; recent examples include Wells Fargo’s fake account fiasco and Office Depot’s computer virus scanning program. Now, a labor group has filed a complaint with federal regulators accusing wireless carrier T-Mobile of using similarly aggressive sales goals, driving employees to enroll users in services they don’t actually want or never asked for. [More]

Prudential Employees: We Were Fired For Blowing Whistle On Alleged Wells Fargo Fraud

The taint of scandal surrounding the Wells Fargo fake account fiasco has spread to Prudential, with three employees of the insurance giant claiming they were retaliated against — and ultimately fired — for trying to blow the whistle on possible insurance fraud being perpetrated by Wells Fargo employees. [More]

Former Pharma Execs Accused Of Boosting Fentanyl Sales By Bribing Doctors With Sham Speaking Engagements

Fentanyl is an incredibly potent opioid painkiller; it acts quickly and powerfully, but doesn’t last as long as others, meaning its medical application is limited. So if you’re a drug company trying to boost sales of your new fentanyl spray, how do you sell more of a product that very few people have a real need for? You could bribe doctors with paid “speaking engagements,” take them out and show them the “best nights of their life,” all so they write prescriptions for patients who probably shouldn’t be getting your drug. [More]

Should Your Job Be A Factor In How Much You Pay For Auto Insurance?

While many consumer advocates believe that drivers’ auto insurance rates should be based on factors that only relate directly to their activity on the road, many states allow insurers to use a wide variety of considerations — including education, marital status, homeownership, and occupation — to help set those rates? With one state looking to halt the use of occupation data, we wanted to know what our readers think. [More]

Costco Credit Card Switch Came With Unexpected Side Effect: Lost Insurance

When Costco announced it was ditching its exclusive co-branded American Express card in favor of a Citibank-issued Visa card, customers worried about the various ways this switch could affect their finances and credit, but one family says the change in card networks resulted in them losing an insurance policy. [More]

MetLife Cutting Snoopy And The Peanuts Gang Loose After Three Decades

The days of gazing upward to the skies at a football game to see Snoopy’s face gliding by on a blimp will soon be over, as MetLife has announced it’s cutting ties with the cartoon pooch and the rest of the Peanuts gang after more than 30 years together. [More]

Patients Say UnitedHealth Illegally Overcharged For Prescription Drugs

With the high costs of some prescription drugs facing increased scrutiny, some consumers are fighting back against insurance companies who cover a portion of those costs. Case in point: some UnitedHealth customers are suing the insurer claiming it overcharged for prescription drugs. [More]

State Farm Already Figuring Out How To Insure Autonomous Cars

If error by fallible human drivers causes 90% of car crashes, what will happen in the future when most or all of the cars on the road are autonomous? Insurance companies are already working on the answer to that question, and one of them, State Farm, had a few years’ head start. [More]

How To Finally Get Insurance To Approve A Wheelchair For A Kid: Go Viral On Twitter

Kids grow. This may not come as a surprise to most of us, who were ourselves children one, but health insurance companies are not necessarily prepared for this facet of reality. And where reality and bureaucracy can really come into hard conflict is when kids who need durable medical equipment might — gasp — outgrow the tech, which doesn’t grow at all. [More]

State Farm Patents Wearable Device System That Could Poke Drowsy Or Distracted Drivers

Unfortunately, we don’t all carry little elves on our person who can administer a hefty poke when we need to snap to attention. State Farm is working on a way to solve that issue with a patent for a wearable device system that can alert drivers who might be nodding off, distracted, or intoxicated behind the wheel. [More]

AT&T Is Holding Open Enrollment For Phone Insurance, If You’re Into That

Open enrollment for insurance is the very special time of year when at your job or on a health insurance exchange, you are able to add or drop insurance or change plans for any reason or for no reason. It also exists for other kinds of insurance, like insurance on your mobile phone. AT&T is running an open enrollment period now, if you want phone insurance but failed to sign up within 30 days of buying yours. [More]

Google Shutters Comparison Shopping Website

Less than a year after Google jumped into the insurance business with the launch of comparison tool Google Compare, the company has decided to scrap the service. [More]

$164 Per Mile: Surprise Ambulance Bills Are A Growing Problem & Difficult To Avoid

We’ve already seen that unconscious patients can end up with huge medical bills when an ambulance takes them to a hospital that doesn’t accept their insurance. But even if you’re conscious enough to point the driver toward the right hospital, you could still be stuck owing hundreds, even thousands, of dollars because that ambulance ride isn’t covered by your insurance. [More]

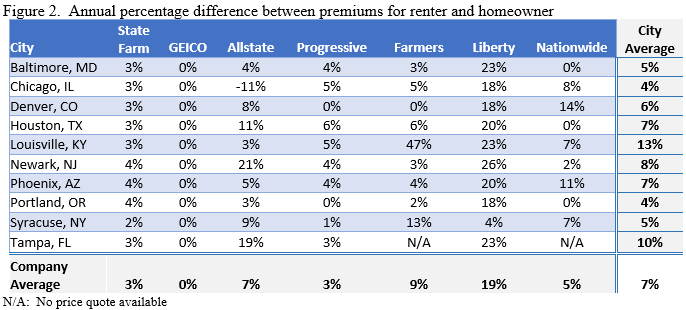

Home Renters Pay Up to 47% More For Car Insurance Than Homeowners

Renting a home means that you’re not responsible for fixing the leaky roof or replacing the broken furnace, and you aren’t wedded to a mortgage for the rest of your life. But according to a new analysis of auto insurance rates, it also means you could be paying a lot more to insure your car. [More]

When It Comes To Privacy, Some Americans Are Willing To Negotiate

We recently wrote about the apparent reluctance of drivers to join auto insurance programs that could save them money in exchange for giving up some of their privacy. While many people want little to do with this sort of tracking, there are still a large number of consumers who don’t take such a hardline stance and are willing to consider ceding their privacy if they receive some benefit in return. [More]

Some Drivers Don’t Want Insurance Companies Tracking Them, Even If It Means Discounts

A longstanding complaint against auto insurance is that it sometimes lumps in drivers based on things — like location, type of car, and age — that may have little-to-nothing to do with a particular driver’s behavior or history. In recent years, some insurers have begun offering drivers a way to get more personalized rates by allowing the insurance company to track their vehicular movements, but many American consumers simply aren’t willing to share that information. [More]