Patient Faces Bankruptcy After Ambulance Takes Her To Out-Of-Network Hospital

Most of us know that it could cost us everything we own if we go to a hospital that isn’t covered by our insurance plan. But what if you’re unconscious and have no say in the matter? That’s the case for a Wisconsin woman who owes $50,000 to a hospital that claims she should just pay up and be happy she’s still alive.

Most of us know that it could cost us everything we own if we go to a hospital that isn’t covered by our insurance plan. But what if you’re unconscious and have no say in the matter? That’s the case for a Wisconsin woman who owes $50,000 to a hospital that claims she should just pay up and be happy she’s still alive.

The woman tells WISC-TV [via Reddit] that in Sept. 2013 she went into cardiac arrest and was taken by ambulance to a hospital that was out of her insurance network instead of the one — only a few blocks farther away — that accepts her Anthem Blue Cross coverage.

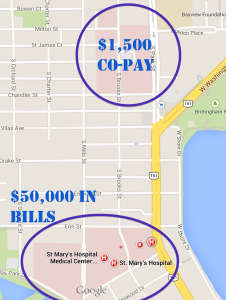

A Tale of Two Hospitals:

Had the patient been taken to one hospital, she would only owe $1,500 to her insurance company. But because she was comatose, the ambulance took her to an out-of-network hospital only a few blocks away, to which she now owes more than $50,000.

“I was in a coma,” explains the woman. “I couldn’t very well wake up and say, ‘Hey, take me to the next hospital.'”

The hospital that treated her billed the patient for $254,000. Her insurance company paid $156,000, which is 100% of what it would have paid to an in-network hospital. That left a balance of $98,000, which the hospital slashed after negotiations with the patient, but still leaves her with bills from individual physicians, the ambulance service and other charges.

Anthem is pointing the finger at the hospital, saying that the insurance company can’t control the prices at a hospital it doesn’t have a contract with.

The hospital is basically telling the patient to just be glad she’s still breathing.

“When you’re looking at saving a life, you’re not looking at whether or not you can save them money,” a rep for SSM Health Care, which runs 19 hospitals in four states. “I can only do so much. The hospital can only do so much. And I think the best outcome is the person walked away from the emergency room.”

The patient and her boyfriend have postponed their engagement while she awaits her latest appeal to Anthem, part of WellPoint, the nation’s largest health insurance provider. They may need to take on second jobs, cash out their retirement accounts or take out loans, possibly file for bankruptcy if she can’t get the debt decreased.

“It’s devastating for people who plan, who get insurance, get coverage, do everything they can and then, at 29, have a heart attack and get taken to the wrong hospital, and can’t get married, can’t do anything because they have to declare bankruptcy because they can’t afford to have gone to the hospital,” says Meg Gaines of the Center for Patient Partnerships, a consumer health care advocacy group at the University of Wisconsin-Madison Law School. “I mean, it’s not enough to worry about having a heart attack at 29, you end up with a secondary one or a stroke because of your medical bills. I mean, it’s just ridiculous. The level of frustration is astronomical.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.