In January, federal regulators announced they had put a stop to an apartment rental scam in which homes (that may not exist) are listed online with the sole purpose of tricking prospective renters into paying for “credit checks” that will never be done. Now, the operators of the scheme must pay $762,000 to put an end to the Federal Trade Commission’s allegations. [More]

Paying Up

Company That Sold Fake Payday Loan Debts To Collectors Must Pay $4.1M

We’ve heard it before: A debt collection company engaged in a “phantom” debt scheme in which they try to entice unsuspecting individuals into paying debts they don’t actually owe. While federal regulators have cracked down on these unscrupulous organizations in the past, they are now turning their attention to the companies providing information on these supposed debts. To that end, the Federal Trade Commission today ordered one such data company to pay $4.1 million. [More]

JPMorgan Chase To Pay $4.6M For Allegedly Failing To Ensure It Furnished Accurate Customer Information

When opening a checking account, a bank will review a customer’s past banking history supplied from their previous financial institution. JPMorgan Chase allegedly failed to ensure this information was accurate and often left customers in the dark about why their applications were denied or who to contact to dispute these findings. For this, the company will pay a $4.6 million fine. [More]

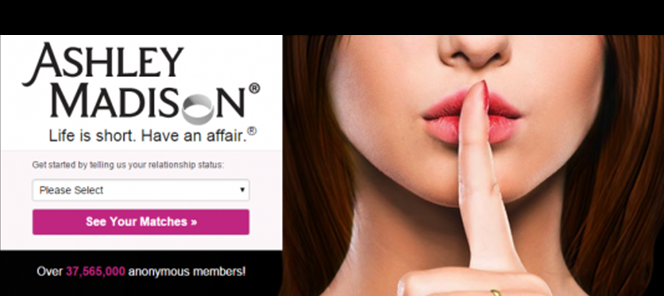

Ashley Madison Breach Victims Could Receive Up To $3,500 Each

Seven months after Ashley Madison agreed to pay $1.65 million to settle federal and state probes into its lax security and deceptive practices, the company is back with another settlement that will see users whose personal information was breached when the adultery site was hacked in July 2015 recoup up to $3,500 for their troubles. [More]

TransUnion Must Pay $60M For Mistakenly Tagging People As Possible Terrorists

A federal jury in California has ordered credit reporting agency TransUnion to pay $60 million to individuals it wrongly tagged as terrorists or drug traffickers. [More]

Bank Of America To Pay $2M Over Calls Recorded Without Customer Consent

Bank of America has agreed to pay $2 million to settle allegations that it violated California law by failing to alert some customers that their phone calls to the bank were being recorded. [More]

Toyota To Pay $14M To Victims Of Crash Involving Camry

Eleven years after a crash caused by a Toyota Camry that accelerated uncontrollably, killing three people and injuring several others, a judge upheld a jury’s finding that Toyota was liable for the incident, ordering the carmaker to pay $14 million.

Kawasaki To Pay $5.2M To Resolve Allegations It Didn’t Properly Report Defects, Injuries Related To Recall

Under federal law, manufacturers, distributors, and retailers are required to immediately report information regarding possible safety defects to the Consumer Product Safety Commission within 24 hours of obtaining reasonable supporting evidence. Kawasaki allegedly failed to do this with regard to defects in thousands of eventually recalled recreational off-highway vehicles (ROVs) and now the company has agreed to pay a $5.2 million penalty. [More]

NetSpend To Pay $53M To Resolve Allegations It Misled Prepaid Card Customers

NetSpend, one of the nation’s largest providers of prepaid debit cards, will pay $53 million to resolve federal regulator’s accusations that it misled users about access to funds deposited to the cards. [More]

Bank Of America Ordered To Pay $46M Over Improper Foreclosure

Bank of America must pay $46 million for improperly foreclosing on a California couple’s home in 2010. [More]

Experian Fined $3M, Accused Of Misleading Consumers About Usefulness Of Credit Scores

Two months after federal regulators fined two of the nation’s largest credit reporting agencies — Equifax and TransUnion — $23 million for misleading consumers about the cost and usefulness of credit monitoring services, the Consumer Financial Protection Bureau has announced a $3 million settlement with Experian over allegations that the credit agency misled consumers about the usefulness of the credit scores available for purchase. [More]

Keurig To Pay $5.8M Over Failure To Report Defective Coffee Brewers

Under federal law, manufacturers, distributors, and retailers are required to immediately report information regarding possible safety defects to the Consumer Product Safety Commission within 24 hours of obtaining reasonable supporting evidence. Keurig allegedly didn’t follow that rule when it came to the Dec. 2014 recall of 7 million MINI Plus Brewing Systems, and now the company must pay $5.8 million. [More]

Operator Of Foreclosure Rescue Scheme Sentenced To Four Years In Prison

During the housing crisis, consumers in danger of losing their homes were often approached by unscrupulous companies making false promises they could help consumers delay foreclosures or evictions. One such company brought in nearly $3 million, and now the man behind the scenes is headed to prison. [More]

Student Loan Debt Collector To Pay $700,000 For Unlawful Collection Practices

With more than 40 million consumers holding thousands of dollars in student loan debt, it’s no surprise that student loan debt collection is a growing business. Yet, these collectors must follow federal rules when it comes to enticing debtors to repay their obligations. Despite this, federal regulators say one company wasn’t following the rules, and must now pay $700,000. [More]

Lenders, Real Estate Brokers To Pay More Than $5M For Alleged Kickback Scheme

The home buying process is complicated and expensive enough without mortgage servicers and real estate brokers tacking on illegal and costly fees. To that end, the Consumer Financial Protection Bureau has ordered Prospect Mortgage and three other companies to pay more than $5 million to settle allegations they participated in an illegal kickback scheme. [More]

IKEA To Pay $50M To Families Of 3 Toddlers Killed In Dresser Tip-Overs

Six months after IKEA and the Consumer Product Safety Commission announced the recall of more than 29 million topple-prone Malm dressers now linked to four deaths, the furniture maker has agreed to pay $50 million to three of the affected families. [More]

McDonald’s Will Pay $3.75M To Settle Franchisee’s Alleged Labor Violations

Two years after the National Labor Relations Board General Counsel declared that McDonald’s could be held responsible for franchisees’ bad labor practices, the fast food giant has agreed, for the first time, to pay $3.75 million to settle a lawsuit that claimed the company was liable for labor law violations by a California franchisee. [More]

Kia, Hyundai Agree To Pay $41.2M To 33 States & D.C. Over Fuel Economy Issues

Hyundai and Kia agreed Thursday to pay $41.2 million to dozens of states four years after it was revealed that the carmakers overstated the fuel efficiency of certain vehicles. [More]