Google Launches Car Insurance Comparison Site

Google officially jumped into the insurance business today with the launch of its car insurance comparison website in the United States.

The New York Times Bits Blog reports that Google introduced its car insurance shopping site Google Compare in California on Thursday.

The comparison site, which has already been operating in Britain, allows consumers to view the similarities and differences of national and local insurance providers.

“This represents the newest addition to a suite of Google Compare products designed to help people make confident, more informed financial decisions,” Google says in a statement.

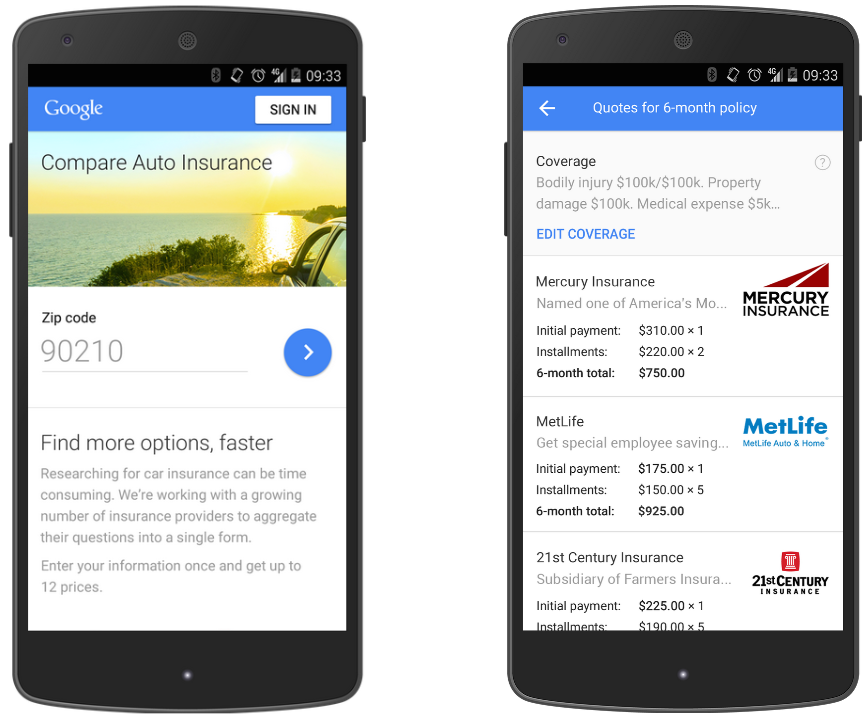

According to Google, insurance shoppers can enter their information into the search engine, which then generates quotes for side-by-side comparison, much like travel sites do for hotels and flights.

So far, Google Compare, which will roll out to other states in coming months, has already signed up major insurers MetLife and Mercury Insurance and entered into partnerships with other comparison sites CoverHound and CompareNow.

Consumers can either purchase policies from the site online or by calling the insurance company directly. Google will receive a referral fee from the insurance company each time a policy is bought.

Google’s foray into the U.S. insurance market comes nearly a year after Walmart began offering a similar service.

Last April, the big box store teamed up with AutoInsurance.com to begin a comparison service that aims to help drivers buy and save on their auto insurance policies.

Google and Walmart just a few of the company that have delved into the insurance industry. The moves have resulted in considerable concern for U.S. insurance brokers, since the sites allow users to buy directly from insurers and eliminate the fees going to agents.

Google Introduces Long-Anticipated Insurance Shopping Site [New York Times Bits Blog]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.