How one’s credit score is computed is to most people a complete mystery, akin to figuring out a quarterback’s passer rating. Thus, there are numerous myths and half-truths that have attached themselves to credit scores, some of them having at least a partial basis in fact. [More]

fico

Denied For A Credit Card Or Loan? Lenders Will Soon Have To Show You Your Credit Score & More

If you’ve ever been turned down for a credit card, auto or student loan — or maybe your application was accepted but you didn’t get the best interest rate — and wanted to see a copy of the actual credit score used in the lender’s decision-making process, you were probably out of luck. But starting July 21 lenders will be required to show you the score. [More]

FICO Sells New Score That Predicts Whether You Will Take Your Medicine

Are you going to be a good boy and take your medicine? Next time your Mom won’t have to ask you. She can just check your FICO Medication Adherence Score. The same people who make the standard credit scoring model have turned their data mining drills and abacuses onto medicine. They’re selling a new score that says can predict if you will take your medication correctly. [More]

Being 30 Days Late On House Payment Can Knock 100 Points Off Credit Score

Usually very closed-mouth about how it calculates scores, FICO released a whole bunch of data about how being late on your mortgage payments affects your credit score. For instance, being 30 days later on a mortgage payment can chop your 780 credit score down to 670. And a short sale or deed-in-lieu of foreclosure will hurt your score just as bad as a foreclosure if the service reports it as having a deficiency amount or an unpaid balance. Yikes! Here’s some sexy tables with more details: [More]

Banks Concocting New Ways To Spy On You

Feel the hair on your neck rising? Your bank is watching, with greater scrutiny then ever before. Banks are figuring out new scores and models to figure out your credit worthiness, using everything from how you deposit and withdraw money to how you pay your rent. [More]

Help, Expedia Sold My Chargeback To A Collection Agency!

Ed and his wife successfully filed a chargeback against Expedia for a canceled trip earlier this year. Now he’s being dunned by a collection agency for the amount that Amex refunded him. [More]

25 Percent Of American Consumers Now Have Low Credit Scores

Before the recession hit, roughly 15% of Americans had FICO credit scores below 600. But after the past couple of years of late payments, defaults, and foreclosures, that number has grown to 25%, or about 43 million people. At the same time, the number of people with excellent scores (800 to 850) has increased nearly 5% from pre-recession average, which the Associated Press says is partly a result of people cutting spending and working to pay off loans more quickly. [More]

Are Credit Monitoring Sites Really Worth The Money?

Now that everyone is so obsessed with their credit reports and FICO scores, credit monitoring services have popped up everywhere. For a modest recurring fee–one that easily adds up to over $100 a year–you can have a company constantly watch your credit report and alert you of any changes in it, so you can always be on top of your creditworthiness. But should you bother? The consumer director of the U.S. Public Interest Research Groups federation (U.S. PIRG) tells BusinessWeek that credit monitoring is a “protection racket” that turns people into “financial hypochondriacs… who are scared of their own financial shadows.” [More]

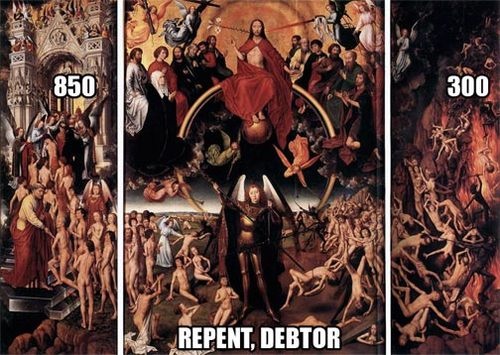

Is A Perfect Credit Score of 850 Even Possible?

A perfect credit score of 850 is technically possible, according to FICO spokesperson, Craig Watts but may not be possible for anyone. [More]

Go Ahead And Cancel Your Credit Card, The Score Ding Is Minimal

New answers pried from the secretive FICO corporation that overlords our credit scores kill a longstanding myth. It turns out that cancelling your credit cards won’t destroy your credit score. [More]

Bank Of America Only Lends You Money When You Have No Income

Reader James writes in with a story we hear a lot lately. During the run up to the credit meltdown –Bank of America kept raising James’ limit. He ran up a balance while caring for someone who eventually died — and now that he has paid off his debt, his limit has been cut. In the long run, however, he feels that he’s better off without credit cards. [More]

Is That Credit Score FICO Or FAKEO?

Donny just bought a bunch of credit scores. But they’re all from different companies and none of them are the same. What gives? [More]

Don't Flush Your Credit Down The Drain

We don’t like services that charge for access to your credit reports, but we are in favor of making it easier to learn about the risks of runaway debt. So, we think you should go ahead and take a look at this chart from . Just stay away from those “Free Credit Report” links and head over to AnnualCreditReport.com instead.

New Rules Require Lenders To Say Why They're Gouging You

Under new rules issued by the Federal Trade Commission and the Federal Reserve Board, lenders will be required to tell consumers why they’re sticking them with high rates or other lousy terms. How will creditors perform this incredible feat? By lying, of course. No, just kidding. They’re going to give you a free credit report and a note explaining their decision. [More]

Capital One Invents Its Own Christmas Creep, Raises Interest Rate On December 26th

When Wally first got his Capital One credit card, the interest rate was 12 percent. Then they raised it to 22.9 percent. Now they’re going to raise it again—the day after Christmas—to 25.9 percent.

Old Debts Under $100 Don't Matter Under FICO '08

An update to how the new FICO ’08 scoring system got revamped this year:

Does Living In California Make You A Higher Credit Risk?

Paul Smith, who lives in San Diego and has a credit score of 751, had his HSBC credit card limit lowered from $7,000 to $1,400 recently for mysterious reasons. He called HSBC to find out why.