We’ve been getting a lot of shocked letters from Capital One customers asking how the company can get away with raising their interest rates on their cards when they “haven’t even been late with a payment.” There is, in fact, no such thing as a fixed rate card and credit card companies don’t need a “reason” to raise your rates. They can do it whenever they like.

capitalone

Capital One: Sorry, Due To "Extraordinary Changes In The Economic Environment" You Need To Pay More

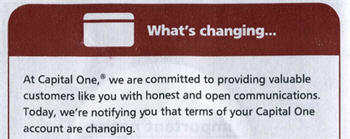

Capital One apparently believes in “honest and open communications” (even though they’ve been accused of purposefully dicking their customers around in the hopes of generating more fees). How do we know this? Because they’ve written their “valuable customers like you” letters letting you know that due to “extraordinary changes in the economic environment,” everyone needs to pay a little more interest. Don’t worry, you haven’t done anything wrong. That’s just the Capital One honesty you’re feeling. Read the letter inside.

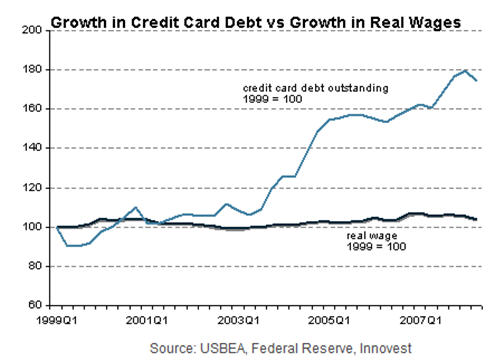

Hold On To Your Hats And Sunglasses, Here Comes The Credit Card Meltdown

We hope you’re enjoying our current economic roller coaster because it’s likely to continue — According to a new report from research firm Innovest Strategic Value Advisors, titled “Credit Cards at the Tipping Point,” the fun has only just begun. As the credit crunch begins to affect consumers, they’re going to have more difficulty paying their credit card bills. The report suggests that credit card companies’ misleading practices and cavalier extension of credit may come back to bite them. Who should be worried? Capital One.

Worst Company In America "Elite 8": Capital One Vs Diebold

Here’s your second “Elite 8” match-up: #12 Diebold VS #36 Capital One

Worst Company In America 2008 "Sweet 16": eBay/Paypal VS Capital One

Here’s your fourth “Sweet 16” match-up: #20 Ebay/PayPal VS #36 Capital One.

Mugger Used Our Credit Card, Now CapitalOne Sued Us Without Us Knowing For $1200 And Won

Andrew’s wife got mugged, the thief rand up purchases on her credit card, and now CapitalOne has sued them for $1200 and won. How can this be? Andrew writes:

In May of 2005 my wife was mugged at one of the elevated train stations in Chicago. After calling the police and filing a police report, she started calling each credit card company to cancel each account. Except she forgot about one card, her CapitalOne card. A card hardly ever used and only had a $500.00 limit…

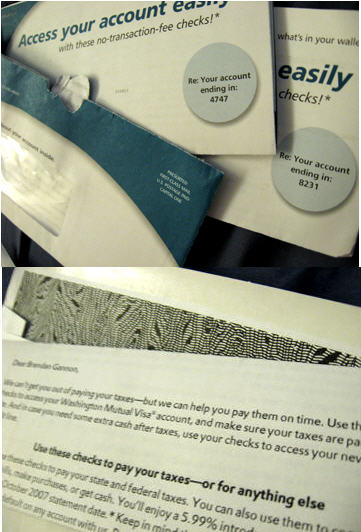

CapitalOne Sends Blank Checks From Someone Else's Account

So, I wrote in recently to mention that WaMu had sent me blank “checks” in an open, unsealed envelope. I complained, of course, and got a generic reply. Today I got another unsealed envelope of blank checks from Washington Mutual. Hmm.