Lenders can use the data from your credit report to deny you credit for any one of several reasons. If you are denied, you receive a letter identifying the credit reporting agency that provided the report, along with a risk factor reason code. Bargaineering published a list of the common risk factor codes that lenders use to deem you unworthy of credit. For all three reporting agencies, the cardinal sins are owing too much and failing to pay your bills. The list of codes, inside.

fico

Credit Card Companies Are Warming Up To Reduced Payoff Deals

If you’ve fallen into a debt pit and can’t make your credit card payments, and now you’re watching them steadily mount with penalties, fees, and steep interest rates, consider negotiating a lower payment. The New York Times reports that while most card companies won’t admit it officially, they know when they’ve got a customer who can’t pay, and they’re much more willing to settle for a lower amount than they were a year ago.

Citibank Comes Up With Elaborate Cash Back Offer That Reduces Credit Limit And Temporarily Suspends Card

Compared to what some other banks and card companies are doing to reduce their exposure to debt, we guess Citibank’s cash back offer isn’t that bad—it’s sort of a “let us help you help yourself get rid of your debt” scheme. It’s funny, however, if only because it’s such an elaborate way to get customers to self-select for a reduction in credit.

Spread It Around: A Low Balance On Each Card Is Better

When the little trolls with the green visors determine your credit score, a big factor in their abacus-shuffling is how much percent of your credit limit you’re using. However, it’s not just your total credit utilization, all of your credit limits added together and divided by how much of that you’ve tapped, but also how much of each credit line you’re using, the individual credit utilization. Say what?

Amex Hikes Rate, Drops Balance, Then Tries To Bribe Customer To Pay Off Debt Early

Courey Gouker’s recent experience with American Express encapsulates every trick the company has pulled in the past few months to drive away their customers, including dropping the credit limit, hiking the rate, and even offering him a cash bonus to pay off his balance in full. In addition, the company’s CSRs made promises to him that they didn’t keep, and notes on his account have gone missing. About the only thing they haven’t done is email a photo of the CEO flipping him the bird.

How Accurate Are Credit Score Estimators?

Did you try Bankrate’s score estimator when it was featured on the Consumerist two years ago? I did and I wondered how accurate that 12-question quiz was. Answer? Not bad.

HSBC Canceled My Card Due To Inactivity And Ruined My FICO Score!

Reader Travis recently found out that one of his oldest cards had been canceled due to inactivity. This caused quite a dent in his FICO score and he’s about to go shopping for student loans— so he’s understandably freaking out.

A Big-Ass List Of Student Loan Resources

It’s a tough economic climate to be graduating from school — and maybe an even tougher one for those of you trying to get financial aid. We’ve put together a list of some financial aid and student lending resources to help make things easier.

FICO Confirms: Reduced Credit Lines For Good Borrowers

A study from Fair Isaac confirms that even the best borrowers are seeing their credit lines slashed as banks move to boost profitability during the recession. 16% of Americans have seen their credit lines reduced by an average of $2,200, and of them, 11% had no late payments or negative marks on their credit report.

Experian Stoppped Selling FICO b/c Contract Dispute (FICO '08 Related?)

Just like I figured, the reason Experian won’t sell you your FICO score anymore is because of a contract dispute with the Fair Issac corporation, and I’m guessing it has to do with the rollout of FICO ’08

VantageScore And PlusScore Are Garbage Credit Scores

Would you buy a credit score that lenders don’t even use? Check it, when Consumer Reports went over the the fine print, Experian’s “VantageScore” says that it’s “for educational purposes only.” And their “PLUSscore” is “not currently sold to lenders.” What good does that do you? None. It’s just something for them to market and make money money off people who don’t know any better.

Experian Yanks FICO Score Away From Consumers

Soon consumers will only be able to see two out of the three credit scores lenders use to judge their credit worthiness. Out of nowhere, Experian announced it will no longer be selling its version of the FICO score through myFICO.com.

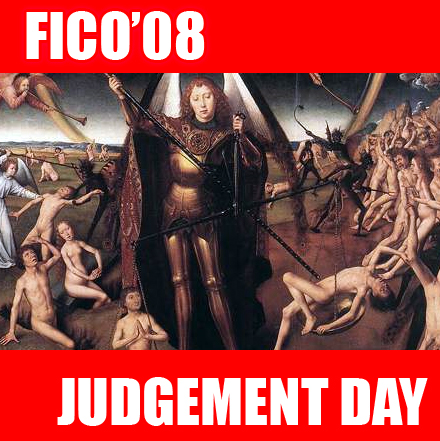

6 Ways Your Credit Score Changes Thursday

A new system for determining your credit-worthiness, FICO ’08, rolls out this Thursday, and there’s nothing you can to do stop it. By these 6 changes, ye shall be judged:

Can Canceling A Credit Card Really Hurt My Score, Or Did Discover Card Lie?

Reader David said he called Discover Card to cancel his account — but was advised against it because canceling credit cards can hurt your credit score. He wants to know if it’s true.

No More Free FICO Scores For WaMu Customers After March 9

It looks like after March 1, 2009 quondam Washington Mutual cum Chase customers won’t be able to get their FICO scores for free anymore through their bank. Those people in the picture look pretty excited about yet another WaMu feature being taken away. Woohoo, indeed. [Chase] (Thanks to Luke!)

What's Your FICO?

FICO: I’ll show you mine if you show me yours. Take our poll and see how you measure up.

Bad FICO? Here's Three Other Credit Scores That Can Help

FICO score isn’t the only credit score game in town. That’s good news for people who have low scores thanks to being an immigrant, divorcee, or don’t have the means to acquire the credit in the first place. It’s one of those quirks of the system. To get credit, you have to have a credit history. To get a credit history, you need to be able to get credit. Thusly, some people find themselves a bit stuck. To meet the needs of these these “thin credit file borrowers”, some alternatives to the standard FICO score are out there. Let’s look at three.