Dale writes to us that his two kids came home tasked with a lame magazine subscription assignment on behalf of a classroom magazine called Weekly Reader. It’s a little sleazy to use kids to pry cash out of the pockets of relatives and friends, and I hold that opinion as both a kid who has had to do it and an adult who has received the manipulative “please help my school!” plea in the mail. [More]

education

Detroit Schools Teach Kids To Work At Walmart

Walmart is teaming with inner-city Detroit schools to offer classes on how to land entry-level jobs, the raw story reports, citing the Detroit Free Press. [More]

New Med Schools Cropping Up To Deal With Impending Elderly Boom

Note to Baby Boomers: You might dress, look and behave significantly more youthful than your forebears, but you are still getting older. That inexorably means retirement and declining health. Unfortunately, a ton of the doctors currently practicing will be retiring along with you. The solution? More medical schools to churn out more M.D.s. [More]

Don't Sign Your Soul Over To Student Loan Debt

Welcome to the American Dream. To follow that dream, you borrow heavily to get the education you need for your chosen career, in the mistaken belief that you will be able to get a better-paying job in that career once your education is completed, and repay the loans. Borrowing the money for education isn’t always an investment in yourself–often, it’s committing yourself to decades of commitment to a debt that is difficult to discharge or negotiate when you encounter a bad job market or other hard times. [More]

These Fake Plastic Pennies Cost Only 4.5 Cents Each

It’s never too early to teach your kids about financial responsibility. That’s why play money is a fun idea. What we find fiscally suspect, however, are plastic pennies from Learning Resources. 100 plastic pennies for the low, low price of $4.50. Yes, that’s four cents per penny, and even more than the U.S. Mint pays to make real pennies. [More]

U.S. Department Of Education Cracking Down On For-Profit Colleges

The combination of record unemployment and federal stimulus money destined for education has led to an education boom of sorts. Especially for for-profit colleges. Now the U.S. Education department is taking another look at for-profit schools…particularly the tactics used by their admissions staff, and the compensation structures for employees. [More]

Creator Of Baby Einstein Vids Admitted In 2005 She Didn't Know What She Was Doing

A website that focuses on female entrepreneurs interviewed the creator of the Baby Einstein video line back in 2005. As Boing Boing pointed out yesterday, her explanation of how she developed the videos is pretty funny. Well, Boing Boing calls it “damning,” but it’s funny that everyone—Disney included—took the product line so seriously.

Kids Design Cute Heinz Ketchup Packets, Learning Important Early Lessons In Mass-Market Commodification

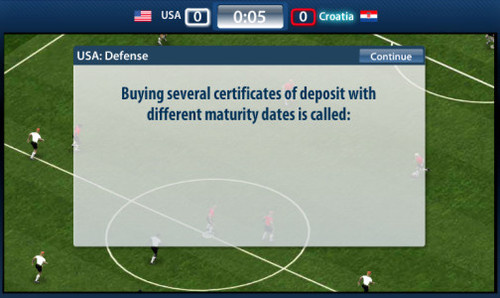

Prove You're Financially Literate And Win At Online Soccer!

We’re not sure what “soccer” is—it looks like it might be some sort of real-world Quidditch without the brooms—but Visa and a bunch of soccer players have released a fancy-schmancy (for a website, at least) online version that tests your financial literacy. You can try it out at financialsoccer.com instead of working this morning.

University Launches Free Financial Education Website

We love free, and we love attempts to make people savvier about personal finance, so we really like this new personal finance website from the University of Idaho. It’s got all the basics covered, and there are things like checklists and downloadable worksheets so you can practice what they’re preaching. Some of the information is geared specifically to Idaho residents, but for the most part this is useful content that anyone can take advantage of.

FAFSA To Get Dramatically Shorter, Less Painful

The Department of Education has announced that the FAFSA, considered (by me) to suck worse than any form ever, is getting shorter and less painful. Most importantly for those of you who have procrastination-prone parents that just don’t enjoy filling out forms (me, again), the FAFSA will allow students applying for financial aid in the spring semester of 2010 to “seamlessly retrieve their relevant tax information from the IRS for easy completion.”

Stay Away From The Nigerian Tutoring Scam

Are you a student looking for a summer or long-term tutoring gig? Be sure to stay away from the foreign tutoring scam, especially if you’re looking for work on Craigslist.

Save On Federal Student Loans July 1

If you have a bunch of variable rate Federal student loans, July 1st could be your lucky day. July 1st is when the interest rates on Federal student loans changes, and one financial id expert is predicting they’re going to drop to “historic lows.” What this means is you will have an opportunity to consolidate your variable rate Federal student loans together at the new, lower, rate, and save yourself some cash. How much?

How To Raise A Smarter Kid

It turns out kids in wealthier homes have higher IQs, not because of genetics but because of environment. Surely you can be frugal (or just plain poor) and raise a smart one? A psychology professor suggests you focus on praising effort over achievement, and teach delayed gratification—something that also helps when it comes to financial responsibility, so it’s a win/win skill. You should also explain that IQ is expandable, not inherent: “Students exposed to that idea work harder and get better grades.”

A Big-Ass List Of Student Loan Resources

It’s a tough economic climate to be graduating from school — and maybe an even tougher one for those of you trying to get financial aid. We’ve put together a list of some financial aid and student lending resources to help make things easier.

How To Teach Children To Manage Money

The “Dollars & Sense” column in the Milwaukee-Wisconsin Journal Sentinel has an interesting list of ideas for how to instill some financial competence in your child. It starts with the basic skill of learning how to delay gratification, then moves on to increasing levels of personal responsibility, so that by the time you’re dealing with a teenager who craves independence, you’re handing out a full year’s allowance in January and tasking him with managing it properly.

Private School Tells 300 Students To Pay Up Or Get Out

A new quarter just started this week at Marian Catholic High School in Chicago, and on the first day back, 300 students were pulled out of class and lined up outside the school, then told to contact their parents and pay their outstanding tuition or they’d have to leave. The Chicago Tribune writes that “by lunchtime, about 100 students were sent home-some confused, some embarrassed and a few angry.” The school says parents owe around $450,000 in outstanding tuition payments, far higher than usual, and that they’re trying to avoid layoffs and other budget cutbacks. Will the poor economy lead to higher attendance at public schools? “If you want a good education, you have to dish it out,” one parent told the paper.