Nearly 41,000 former students of now-defunct for-profit educator Corinthian Colleges will soon receive refunds for the private student loans they received to attend college, after a coalition of state attorneys general and federal agencies reached a $183.3 million settlement with Aequitas Capital Management, the issuer of these loans. [More]

private student loans

Betsy DeVos To Put $1.3 Trillion Student Aid Office In Hands Of Exec From For-Profit Student Loan Company

The top official at the federal Office of Financial Aid recently resigned after butting heads with new Education Secretary Betsy DeVos and her plan to make sweeping changes to federal student loan programs. Now DeVos has announced a replacement who is more likely to follow her lead: Dr. A. Wayne Johnson, the CEO of a private, for-profit student loan company. [More]

Amazon No Longer Marketing Private Student Loans To Prime Members

Just a month after Amazon announced it would partner with Wells Fargo to offer Prime members a discount on private student loans, nearly all traces of the criticized program have disappeared. [More]

Military Personnel Face Student Loan Issues Despite Required Protections

The Servicemembers Civil Relief Act (SCRA) provides a number of protections for military personnel and their families when it comes to private and federal student loans. While these benefits aim to alleviate the burden servicemembers face when paying back their educational debts, a new report from the Consumer Financial Protection Bureau shows that many student loan servicers continuously fail to uphold their end of the SCRA requirements. [More]

CFPB Report Finds 90% Of Student Loan Borrowers Who Seek Co-Signer Release Are Denied

Last year, the Consumer Financial Protection Bureau brought our attention to a relatively new phenomenon in which more and more private student loan borrowers found themselves placed in automatic default – even if they were up-to-date on payments – when their co-signer died or filed for bankruptcy. While the agency and consumer advocates urged these borrowers to seek co-signer release from their lenders, a new report finds that’s simply hasn’t been possible. [More]

More Banks Are Offering Student Loan Refinancing, But Is It Really Safe & Beneficial?

For the last several years legislators have repeatedly introduced a bill that would allow student loan borrowers to refinance their private and federal student loans to the lower interest rates at which new loans are currently being issued. Although the legislation hasn’t managed to make it into law, that hasn’t stopped banks and credit unions from creating their own refinancing programs to help alleviate the debt burden for student loan borrowers. [More]

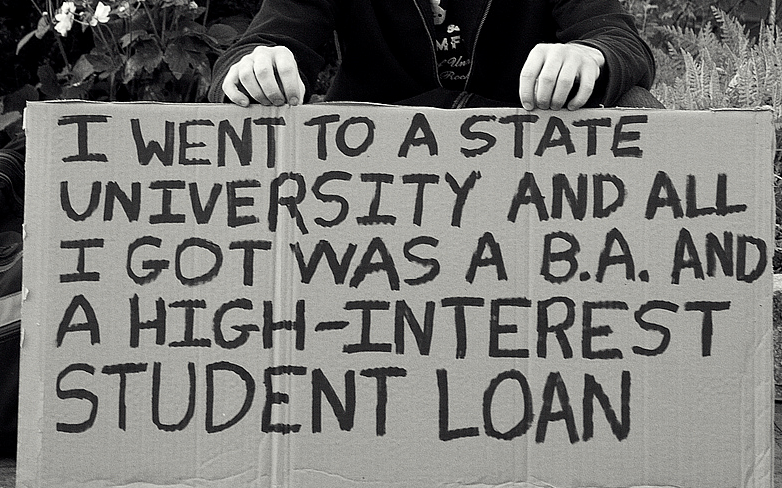

You Can’t Discharge Your Student Loans In Bankruptcy Because Of Panicked 1970s Legislation

Although bankruptcy should only be viewed as the last option for consumers drowning in a sea of debt, even this final-straw course of action won’t help Americans with getting out from under hefty student loans — but it wasn’t always this way. [More]

Legislation Would Require Private Student Loans Be Forgiven If Borrower Dies

Shortly after the death of their daughter, a New York couple’s grief was interrupted by a battle with an entity they never imagined: her private student loan lender. Inheriting a dead child’s student loan debt is a problem too many parents have had to face, and one that a new piece of legislation aims to eliminate. [More]

Senators Introduce Legislation To Make Private Student Loans Dischargeable In Bankruptcy

Since 2005, student borrowers have been unable to discharge their private student loans through the process of bankruptcy. But that could soon change after a group of 12 senators introduced a bill aimed at addressing the current student debt crisis by restoring the bankruptcy code to hold private student loans in the same regard as other private unsecured debts. [More]

Discover, Wells Fargo To Offer Private Student Loan Modifications

Consumers facing difficulty in paying back their private student loans often have a difficult time receiving any relief from lenders. While some smaller banks have relaxed their repayment terms for good borrowers in the past, two of the nation’s largest private lenders are set to make the same opportunities available to private student loan borrowers. [More]

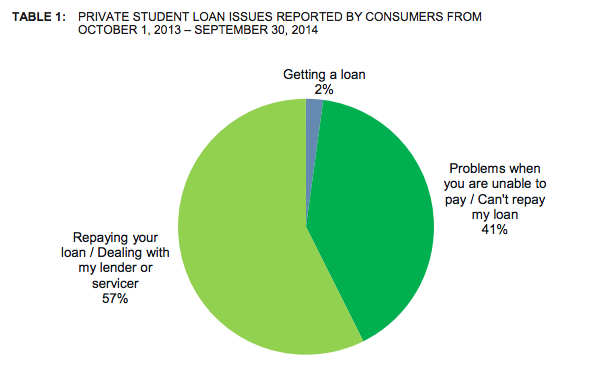

CFPB: Private Student Loan Companies Provide Few Options For Borrower, Driving Them To Default

By now we all know that for many consumers taking out private student loans is the only option when it comes to financing their higher education. We also know that many of those same borrowers will ultimately end up defaulting on their debt. A new report from the Consumer Financial Protection Bureau suggests that it’s not borrowers’ lack of willingness to repay that lands them further in debt, but a lack of resources provided by lenders that drives consumers to default. [More]

Parents Stuck With $200K In Student Loan Debt After Daughter Dies

The last thing families want to deal with after the death of a loved one is a phone call reminding them of their departed’s debt. But that’s the case for a number of parents who have inherited the obligation to repay the student loans they co-signed for their deceased child. [More]

Am I Completely Screwed If My Student Loan Co-Signer Dies?

Imagine this scenario: You’ve been out of college for several years, have a good job and you have no problems making your student loan payments in full and on time. Then tragedy hits; your parent dies or declares bankruptcy. If this loved one was a co-signer on your student loan, this change can trigger an often-overlooked clause that allows the lender to claim you are in default on your loan, potentially wreaking longterm havoc on your credit and finances. [More]

Private Student Loan Borrowers Face Automatic Default Because Of Co-Signer Provisions

College graduates with private student loans know the importance of staying current on their payments. But a new report by the Consumer Financial Protection Bureau finds that even consumers who pay their loans on time are finding themselves placed in default when the co-signer of their loan dies or declares bankruptcy. [More]

Some Banks Reward Private Student Loan Borrowers With Refinancing Options

Recent college graduates face a number of barriers after getting their diplomas – finding a job, moving out on their own and paying back thousands of dollars in student loans. But now consumers struggling to pay back private student loans might find a bit of relief in new refinancing options from banks. [More]

Student Loan Bubble Eerily Similar To Subprime Mortgage Debacle

Billions in high-interest loans being handed out to people who probably shouldn’t qualify for them, who may not understand the full terms of the loans, and who will likely have trouble paying the money back. Sounds a lot like the stories we were writing five years ago as mountains of subprime, adjustable rate mortgages were coming due, but now it’s about the massive number of student loans written in recent years. [More]

Have A Private Student Loan Horror Story? Today Is The Last Day To Tell The CFPB

We see enough horror stories about private student loans that we know there must be quite a few of them out there. If you’d like to contribute to the public good by sharing your experience, the Consumer Financial Protection Bureau would like to hear what you have to say. And if you actually had a good experience the CFPB would like to hear about that, too. [More]