It’s not that Whitney is stuck in a zombie debt situation. Her problem is that her debt never existed in the first place. She’s being billed for DSL service by “Frontier Communications” – which is a real company, but that doesn’t seem to be who she’s dealing with. The Frontier that’s billing Whitney is unreachable and apparently not real, despite their ability to generate bills, then sell them to a collection agency. If that’s the case, though, how did they get her credit card information to bill her? [More]

collection agencies

Help, Expedia Sold My Chargeback To A Collection Agency!

Ed and his wife successfully filed a chargeback against Expedia for a canceled trip earlier this year. Now he’s being dunned by a collection agency for the amount that Amex refunded him. [More]

Supreme Court Makes It Easier To Sue Debt Collectors

Last week, the Supreme Court ruled that debt collectors can’t use a “bona fide error” defense to avoid being sued for misinterpreting the Fair Debt Collections Practices Act (FDCPA). In other words, if a debt collection agency makes a demand that’s in violation of the Act, it can’t say it didn’t know any better. Well, it can, but you can go right ahead and sue. [More]

Woman Who Lost Home Over $68 Dental Bill Might Get Another Chance

Almost a year ago, Sonya Capri Ramos was in the news because she’d lost her home over a $68 dental bill. Last week, the Utah Court of Appeals gave her some hope that she might be able to get it back from the title company that bought it at auction for $1,550. [More]

Judge Tells Debt Collection Firm To Pay Stranger $115 For Dragging Him To Court

Last week, a Brooklyn judge ordered strongly suggested that the law firm of Pressler & Pressler, “one of the biggest in the collection industry,” pay a day’s worth of income to the man they falsely accused of owing an unpaid debt. To encourage the firm to do the right thing, Judge Noach Dear scheduled a sanctions hearing but told the firm’s lawyer, T. Andy Wang, that he might drop it if they pay up. [More]

Am I Responsible For My Parents' Debt?

Jay’s parents have gotten quite, uh, spendy with their retirement income, and now they’ve got a lot of debt they can’t pay off. This has become Jay’s problem not because he’s a party to any of the debt, but because they’ve put him down as a reference and now bill collectors are harassing him.

Am I Responsible For My Fiancée's Prior Debt?

A reader wants to know whether or not he’s going to be held responsible for his fiancée’s old, bad debt now that they’re getting married. Because we went to Google Lawyer University just now, we’re happy to try to help.

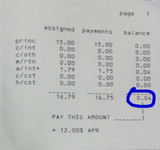

Collection Agency Sends Four Letters To Collect A $.04 Debt

Pete received a bill in the mail that has him slightly offended and amused. A health care provider has sent his balance to collections after a payment arrived late a few years ago. They will clearly be hurting if he doesn’t pay his overdue balance of ….four cents.

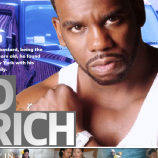

NY Attorney General Shuts Down Abusive Debt Collection Operation, Puts Owner's Rap Career On Hold

The New York Attorney General shut down a network of debt collection agencies today that were run by convicted felon Tobias Boyland, who along with his colleagues impersonated police officers, threatened debtors with arrest, and told them they were being sued in civil court. Boyland is also an author and a musician, and he has an awesome website, bagsofmoney.us, which—warning—launches into a street-friendly rap song as soon as it loads.

Budget Slaps Customer With $500 Repair Fee Months Later

When Sean returned a rented truck to Budget Truck Rental nearly a year ago, he went through the standard inspection with an employee, who then signed off on the return. Now the company has sent a $500 bill to collection for damage they refuse to provide evidence of.

How A Forgotten Blockbuster Video Caused A 2 1/2 Year Battle With Discover Card And Collection Agencies

“Universal Default” is when your credit card company adjusts the terms of your loan because you “defaulted” with another company. In reader P.’s case the “default” was a Blockbuster video that his friend forgot to return. Discover Card took this opportunity to double P.’s interest rate. When he tried to fight it by closing his account, it launched him into a 2 1/2 year legal battle with Discover, a collection agency, and now the credit bureaus.

Third-Party Debt Collectors Misusing Courts To Increase Profits

The Chicago Tribune writes that “More than 119,000 civil lawsuits against alleged debtors are clogging [Chicago] courtrooms,” but since collection agencies make money off of volume business, the suits filed are based on too little information. The result: cases based on mistaken identities, or for debts already settled, or against debtors who have made good-faith efforts to work out repayment plans. “The system is out of control,” one attorney tells the paper.

Woman Loses Home Over $68 Dental Bill

Maybe there are no more debtors’ prisons, but that doesn’t mean your life can’t be screwed up by unscrupulous collection agencies.

AOL Finally Does Something Right

Much as we love to lovingly prod AOL for their faults — or even just lovingly throw gasoline all over them, fling our zippo in AOL’s face, then urinate on the immolated corpse — we would be amiss in our duty if we left unreported an instance of AOL treating a customer right.

Cingular Sics Debt Collectors On Innocent Customer

An AT&T customer, Chris upgraded his plan after the merger with Cinuglar. A week later, Cingular sent him a bill for $300, an “early termination fee.” Welcome to the neighborhood, indeed.

Collection Agencies Add Insult to Snowboard Injury

Grant had the misfortune to get into a snowboarding accident. Then he had the further misfortune of living in America where it’s nigh impossible to get a bruise removed from your credit report.