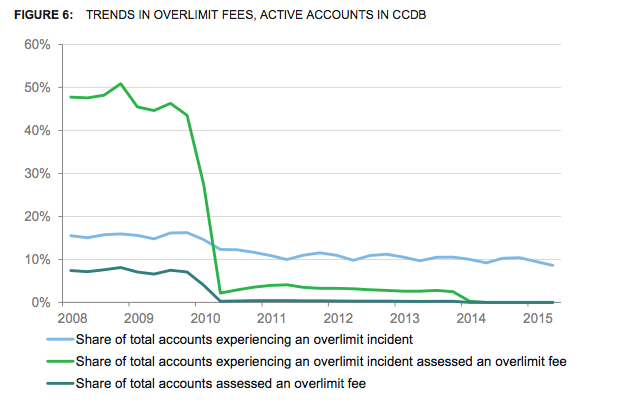

In 2009, lawmakers passed a massive set of reforms for the credit card industry – known as the Credit Card Accountability Responsibility and Disclosure Act (CARD Act) — aimed at protecting consumers though transparency, fairness, accountability and better access to an array of financial products. A new report from the agency tasked with enforcing these rules, finds that nearly six years after implementation, consumers have saved nearly $16 billion in fees. [More]

card act

My Credit Card Interest Rate Is Going Up. What Are My Options?

Earlier this week, American Express announced that it would be raising annual interest rates on more than 1 million accounts, leading lots of people to ask if this could happen to their credit card — and what they should do about it. [More]

CFPB Wants Better, Faster Database Of Credit Card Agreements

Much like a restaurant that has to shutter for a short time while installing new kitchen equipment, federal regulators occasionally have to press pause on an important process to fix things for the long haul. So in order to improve the Consumer Financial Protection Bureau’s public database of credit card agreements, the agency is planning to give banks a brief break from having to file those documents with the system. [More]

The 10 Colleges That Received The Biggest Payouts From Credit Card Issuers Last Year

Last year, a group of around 15 credit card issuers paid a total of more than $50 million to various schools and school-affiliated organizations in order to market credit cards to people at those educational institutions. Around 70% of that money came from a single Bank of America-owned credit card company, and though hundreds of schools received some sort of payment for helping introduce cards to college students, just the 10 largest single payments account for nearly 30% of the $50 million. [More]

The $1 Billion Tragedy: Unredeemed Gift Cards In America

Gift cards can be a truly great gift…to the retail sector. While only 1% of gift cards go unredeemed, with about $116 billion in gift card sales annually, that’s more than $1 billion that we’re just leaving in a drawer until retailers take it back. [More]

Consumers Saved $4 Billion In Credit Card Fees Last Year, But Fewer Have Access To Credit

It’s been four years since lawmakers passed the CARD Act, a massive set of reforms for the credit card industry. As a result, consumers have saved billions in fees and other charges, but access to credit has also become more difficult for some people. [More]

Small Business Credit Cards Come With Risks That Your Personal Card Doesn't

In spite of the “small business” name, there is nothing about most so-called small business credit cards that requires the cardholder to actually own or operate a business. In fact, over a five year period ending last December, credit card companies sent out more than 2.6 billion business card offers to regular Janes and Joes in the U.S. But while these cards are available to the everyday consumer, they do not come with all the protections associated with non-business credit cards. [More]

Fed Clamps Down On Credit Card Loopholes

To shut down “fee harvesters” and other crafty tricks credit cards cooked up to escape the CARD act, the Federal Reserve has proposed three ways to tighten and clarify the rules. [More]

Credit Card Interest Rates Hit 9-Year High. Thanks, CARD Act!

Average interest rates have hit a new 9-year high of 14.7%, and we have credit card reform to thank for that. Por-kay? Unable to keep soaking you on the backend with hidden fees, tricks, and traps, issuers now have to push their profit-taking to the fore. [More]

3 Credit Card Act Protections Went Live Sunday

Three of the provisions of the CARD Act, the legislation passed this year to improve consumer protection in the credit card arena, went into effect yesterday. Here’s what you need to know to sound smart around the water cooler: [More]

Your Credit Card APR Might Fall Starting This Sunday

Some Americans might be getting a break on their credit card interest rates very soon. [More]

Look Out For These Fees As Bank Legislation Goes Into Full Effect

This is the first business day financial institutions have been required to give existing checking account customers the choice to opt in to overdraft protection. Since banks are looking for ways to make up for the lost revenue by sticking it to customers in other ways, they’ve dreamed up some new ways to trick you out of your money. [More]

Banks Told To Target Financially Unsavvy For Overdraft Reup

Consulting firms are telling banks to hone in on the financially precarious to sign back up for costly overdraft protection that will only further erode their bank account. Here are some quotes from their strategies: [More]

When It Comes To Overdraft Opt-In, Chase Won't Take No For An Answer

According to Robert, Chase is taking the Steve Urkel approach to persuasion, asking him again and again if he would like to partake in its delicious overdraft protection, brushing off his continuous “no” answers as Steve always did to Laura in Family Matters. [More]

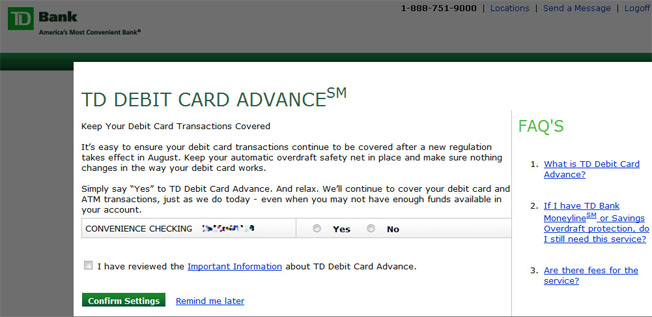

TD Ratchets Up Overdraft Opt-In Push With Pop-Up Scare Tactics

TD Bank is really stepping up its efforts to try to get customers to sign back up for “overdraft protection,” which really just protects their right to charge you $35 if you want to buy a $2.00 candy bar and only have a $1 in your account. Now they’re greeting customers accessing their accounts online with pop-up ads trying to scare them into agreeing to signing up for the service. [More]

Hunt Down Your Credit Card Contract Online

Hey, you can now look up your credit card contract online. There’s a searchable database over at the Federal Reserve that lets you check them out in both text and PDF form. [More]