Right now, U.S. consumers can check each of their three credit reports — from TransUnion, Equifax, and Experian — once a year for free through AnnualCreditReport.com, but getting your actual credit score will probably cost you. Legislation introduced today seeks to remedy this issue. [More]

credit reports

Study: Errors Found In As Many As 26% Of Consumers’ Credit Reports

You should really check your credit reports at least once a year. If you don’t believe us, you should check out the results of the Federal Trade Commission’s latest study, which shows just how rife with errors the reports from Experian, Equifax, and TransUnion can be. [More]

Is Equifax Actually Selling Your Salary Info?

Equifax also operates an employment verification database that contains sensitive employment information for more than 1/3 of all employed Americans. Aside from being a huge pinata just waiting for a hacker’s swing, it’s unclear exactly what info is being sold to third parties. [More]

Who Is Responsible When Your Credit Report Flags You As A Possible Terrorist?

We’ve told you before about consumers who ended up being denied for loans and facing public embarrassment because their credit report included a note that the person might be a terrorist or an international drug trafficker. But no one seems to want to take the blame for when this kind of mistake happens. [More]

Equifax Caught Improperly Selling Lists Of People With Late Mortgage Payments

When you’re in financial trouble, one of your concerns is that your creditors will report you to the three major credit bureaus — Equifax, Experian, and TransUnion. But maybe you should be concerned that the bureaus are selling your sensitive information. [More]

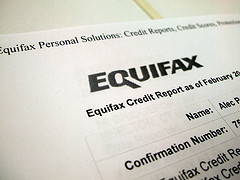

American Express Payment Plans Won't Do Your Credit Any Favors

Ryan was in a tight spot, and late with the payment on his American Express account. The problem didn’t seem as scary as it could have been, though. The company’s Web interface offered him the opportunity to sign up for a payment plan, so he could pay down the outstanding balance over a period of as long as twelve months. Neat! But the plan didn’t quite have the credit-saving effects that he expected. He was reported to credit bureaus as delinquent during the entire repayment period. That’s how the plan works. [More]

Will My Deadbeat Roommate Trash My Credit?

A terrible roommate can make your life unhappy in a lot of ways. But let’s say you have a financially irresponsible roommate who never pays their bills. Do their bad habits affect you … other than constantly having to chase down the rent? [More]

The Ins & Outs Of Getting And Using Your Free Credit Report

Regular readers of Consumerist know full well that those websites like FreeCreditReport.com and FreeScore.com (you’ll forgive us for not actually linking to them) are not exactly what their names might have you believe. But there are new consumers born every day, so it doesn’t hurt clarifying once again that there is only one place to score your credit reports with no strings attached. [More]

Does A Bad Credit Score Mean You'll Be Bad At Your Job?

A growing number of employers are running credit checks on potential hires before making a job offer. Unfortunately, there are a large number of people out there whose credit reports are still marred by the recent and ongoing economic troubles. So does it make sense to consider an applicant’s credit history? [More]

While Getting House Financed, TWC Dings Score With Unauthorized Credit Report Pull

Shawn is peeved. He’s in the middle of securing financing on a new house and the last thing you need during that time period are any surprise people looking at your credit report. These inquiries can bring your score down. But he got exactly one of those, a “hard” one, thanks to an unauthorized peek-a-boo Time Warner Cable decided to do on his credit report when called them up to ask about reducing his cable package. [More]

How Lower Credit Scores Cost You More Money

People talk a lot about credit scores. Bands play songs about them in TV ads that try to sell you credit reports. It’s generally known that a higher score is better than a lower score. But what really is the difference between a person with a 820 and one with a 620? Is one a better person than the other? Not necessarily, but the person with the 620 score can expect to pay $227 more a month on a $216,000 30-year fixed rate mortgage. Here’s the breakdown. [More]

Groups Call On TransUnion To Stop Selling Employee Credit Reports To Employers

Employers pull the credit reports of prospective employees as a way to determine whether they’re trustworthy and good at managing money. But now more than 25 civil rights groups, labor unions and consumer groups have banned together to demand that TransUnion stop selling credit reports to employers. They say the practice is invasive, discriminatory, and worst of all, doesn’t even work. [More]

Freeze Your Credit Report

One way to protect yourself from identity theft is to “freeze” your credit report. This means that no new lines of credit can be opened in your name because lenders are prevented from taking a look at your credit report. This stops identity thieves from opening credit cards under your name and going on spending sprees. It also means extra hassle for you when you want to legitimately open credit. There’s always a tradeoff between security and convenience. Here’s how to do it. [More]

5 Myths About Your Credit Score

How one’s credit score is computed is to most people a complete mystery, akin to figuring out a quarterback’s passer rating. Thus, there are numerous myths and half-truths that have attached themselves to credit scores, some of them having at least a partial basis in fact. [More]

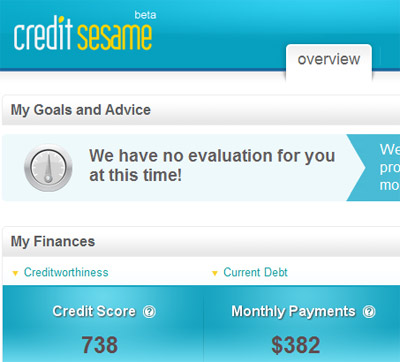

Get A Free FICO-esque Score From Credit Sesame

Credit Sesame is an advertising-supported service that gets you your credit score for free. No hidden fees, singers in Renaissance garb or gotchas. It’s not quite your FICO, but it’s close. [More]

TransUnion Wants You To Share Your Credit Score On Facebook

Social media may have created a culture of over-sharing, but what’s too personal to share with your Facebook friends? Michael was checking his credit report, and was surprised to see a “Share on Facebook” button directly below his credit score. [More]

ID Theft: Fix Some Fraudulent Accounts Before Correcting Legit Ones

One of the side effects of someone using your identity to open up a bunch of accounts and leaving you saddled with the bills is that your credit history gets trashed, which means you get victimized a second time over as your real creditors jack up your interest rates and take other adverse action. Your bank account could even get frozen, making you late on some bills. But before you go plead your case to get your credit restored with them, you’ll want to fix some of the fraudulent accounts first. [More]