Compared to what some other banks and card companies are doing to reduce their exposure to debt, we guess Citibank’s cash back offer isn’t that bad—it’s sort of a “let us help you help yourself get rid of your debt” scheme. It’s funny, however, if only because it’s such an elaborate way to get customers to self-select for a reduction in credit.

credit cards

Citibank Comes Up With Elaborate Cash Back Offer That Reduces Credit Limit And Temporarily Suspends Card

../../../..//2009/06/03/should-you-co-sign-for-your/

Should you co-sign for your teenager’s credit card? The CARD act makes it more difficult for credit card companies to extend credit to people under 21 who don’t have their own independent income. Should you co-sign so that your kid can get a card anyway? Michelle Singletary of the Washington Post says, “No.” [Washington Post via Public Citizen] (Photo:foundphotoslj)

Are You A Deadbeat? Suddenly You're Attractive To Card Companies Again

“Revolvers”—customers who keep a revolving balance on their credit cards—used to be the cash crop for credit card companies. But now more and more of them are turning into expensive charge-offs, and the new CARD act is going to make it harder to acquire those riskier customers anyway. As a result, card companies are beginning to look more closely at the customer who was most hated back in the credit-orgy years: the deadbeat.

Have A Discover Card? Check Your Due Date For June

An anonymous reader says both his and his wife’s Discover cards—the accounts are separate—had their due dates moved up by four days in June. He called Discover, “and they stated that they sent out notices in the mail 45 days in advance warning of the change, which I don’t remember seeing. Regardless, they were able to revert my due date starting in July. You may want to have your readers closely check their Discover Card statements.”

Video: Comedic Rendering Of Banks' Reaction To The CARD Act

From FunnyOrDie.com, here’s a comedic rendering of what credit card companies‘ reaction to the CARD Act must have been like. Warning: language and content not safe for work, children, or people who don’t like steak.

Visa Black Card Comes With A Sense Of Self Importance, $495 Annual Fee

Two different readers recently received an application for the Visa Black Card from Barclays. With its “patent pending carbon” material and “exclusive rewards program,” it’s not for everyone. With its $495 annual fee (plus another $195 per each authorized user), it’s not for anyone, not even the supposed 1% of the population Barclays says they’re marketing it to. We take that back—if Gob Bluth could get his own credit card, this would be the one he’d sign up for. C’mon!

Ask The Consumerists: Small Business Credit Cards

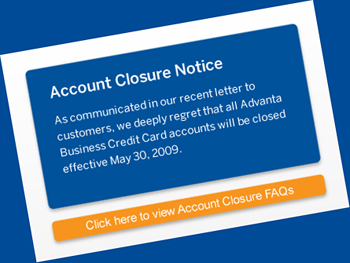

We’ve heard from many, many readers who are Advanta cardholders since bringing the impending account freeze to their attention before the company did. Some people are just annoyed. Others don’t know what to do to keep their businesses afloat.

Make Jewelry From Your Discarded Credit Cards

Sure, you could cut up your credit and debit cards and throw them away once they’re closed, expired, or the account number has been stolen in a massive data breach. Or, with a few simple tools, you could re-purpose them into lovely pieces of jewelry.

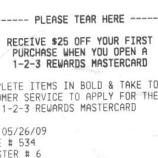

Kroger Receipt Comes With Mastercard Application Attached

Hey, grocery shopper! You look like a responsible consumer, what with your grocery buying and standing upright. Why not take a moment to fill out an impulse-buy credit card application? If you’re approved, we’ll give you $25 you can spend on your first charge!

Don't Be Alarmed By Zombie American Express Bills

A system error at American Express led to their computers kicking out bills with $0.00 balances for accounts that were long ago closed…or never activated in the first place. If you receive one, don’t be alarmed. Annoyed, maybe.

Credit Card Processors Launch A New Strategy To Defeat Theft

This fall, credit card processors will being rolling out a new approach to preventing data theft, based on the assumption that it’s impossible to thwart every attack. Instead of keeping 100% of criminals out, they’ll segment and encrypt the data into such small chunks that it will no longer be a cost-effective crime.

Advanta Notifies Customers About Impending Credit Shutdown

T-Minus four days to the closing of Advanta accounts to new charges this Saturday, the small business credit card issuer sent an e-mail out to customers explaining the situation and how it will affect them.

If You Used Your Credit Card At Olive Garden They Might Owe You Some Dough. Or At Least Some Bruschetta

If you paid with plastic at Olive Garden in 2006-2007 then they might just owe you a $9 appetizer. The Italian eatery was recently sued in a class-action lawsuit stemming from a 2006 change to the Fair and Accurate Credit Transactions Act, which made it illegal to print more than the last five digits of a customer’s credit card number on a receipt. Olive Garden never stopped its practice of printing the last six digits, and could soon be issuing $9 “apology” vouchers to every customer affected.

Which Parts Of The Country Are Carrying The Most Credit Card Debt?

Forbes wanted to know which states had the highest average balances per household in May, so they took the total amount of debt in 50 major metropolitan areas, divided that by the number of households, then divided that by the median household income for that area for May. Here are some of their results.

Which Credit And Debit Cards Are The Best To Use Overseas?

Spending money costs money when you’re abroad, but a list of cards and fees compiled by USA Today can help you decide which card to pack before you leave.

In Which NPR And Congressional Oversight Panel Chair Elizabeth Warren Hate Each Other

While we were concentrating on other things (Snuggie testing, for example), there has apparently been something of a backlash going on against NPR’s Planet Money podcast for its rude treatment of Congressional Oversight Panel Chair Elizabeth Warren. NPR’s Adam Davidson has since expressed regret that he talked over Ms. Warren in a rude way — but despite the mea culpa, a series of links about the issue has popped up in our inbox more than a week later.