Credit cards, while often a risky financial product, can at times prove to be a proverbial lifesaver when you get into a pinch. For that reason, most consumers who apply for a card envision using it as a valid form of payment for any number of reasons. While a Texas-based company marketed their credit card as general-use, consumers quickly found out that wasn’t actually the case. And so, the Consumer Financial Protection Bureau has filed suit against the company for its allegedly deceptive ways. [More]

credit card companies

If I Can't Check ID's, How Am I Supposed To Prevent Credit Card Fraud?

We’ve told you that it stipulates in the contract between merchants and credit card companies that stores aren’t allowed to force you to show ID when you buy stuff, but what about the other side of the story? Alex is a 26-year old small business owner and Consumerist lover, but he doesn’t know how he’s supposed to prevent fraud if he can’t check people’s ID’s. Contrary to what some commenters assume, when a stolen credit card is used, the money gets yanked out of Alex’s bank account and he is unlikely to get it or the missing merchandise back. He gets jacked twice: once by the fraudster, and once by the credit card company. What should he do? Switch to cash only? His story, inside… [More]

HSBC Really, Really Doesn't Want Reader To Cancel Best Buy Credit Card

James applied for a Best Buy Mastercard from HSBC. The initial application was easy enough, but the three separate confusing calls from outsourced customer service reps, and the low limit and annual fee on the card he eventually received led him to cancel his account. This should have been a straightforward transaction, but company representatives tried to bully James into keeping the credit card.

Ending The 0% Balance Transfer Era

Ah, the glory days of American credit cards. When your credit card’s interest rate went too high, you could find a different card with a deliciously low promo balance transfer rate, and revel in your low interest. At least, until you let the card sit idle too long or made a late payment, and then started the cycle over again. But no more.

Banks Introduce Comprehensible Credit Cards Before Reforms Apply

Instead of waiting around for the CARD act, which restricts the ways they are allowed to squeeze money from customers, some banks are introducing simpler, CARD-compliant credit cards meant to be less confusing to consumers, and maybe make us all hate the credit card industry a little less.

Bank Of America Leaves Mandatory Arbitration Behind

Another bank is ending mandatory arbitration for their customers. Not just any bank, either—it’s Bank of America!

Don't Put These Items On Your Credit Card If You Can Help It

A few months ago, we reminded you that your credit card company is building a psychological profile of you. But what about a short, convenient list of things that get credit card companies‘ notice? Marketplace has you covered.

Have Your Say About Credit Card Reform

We’ve been keeping you posted about the progress of credit card reform, and sharing stories of readers who have already been affected by credit card companies‘ policy changes. Now the nice folks at Consumers Union want to hear about what kinds of stunts credit card companies are trying to pull on their customers. Won’t you share your stories with them?

Video: Comedic Rendering Of Banks' Reaction To The CARD Act

From FunnyOrDie.com, here’s a comedic rendering of what credit card companies‘ reaction to the CARD Act must have been like. Warning: language and content not safe for work, children, or people who don’t like steak.

Ask The Consumerists: Small Business Credit Cards

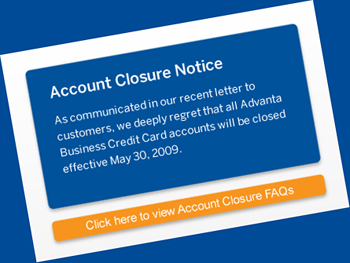

We’ve heard from many, many readers who are Advanta cardholders since bringing the impending account freeze to their attention before the company did. Some people are just annoyed. Others don’t know what to do to keep their businesses afloat.

Chase Invites Customers To Skip A Payment, Accrue Finance Charges Instead

Chase is being awfully nice to their customers in tough economic times. Many of their customers received statements this month with a minimum payment of $0, even though they have balances. How nice! Customers take a month off, Chase will just let finance charges accrue for them.

Chase Charges You Fees For The Privilege Of Being Charged Fees

Corbin had a very confusing experience with his Chase credit card. Because of a unexplained returned payment by his bank, his $30 automatic minimum payment led to $156 in late fees, overlimit fees, returned payment fees, and a fee charged, as far as I can tell, for being charged fees.

How To Get Your First Credit Card

I got my first credit card from one of those guys on campus with a folding table and free tshirts. Back then, they gave give credit to anyone who could fog a mirror. No income? No assets? No clue? No problem! The tshirt wasn’t even cool, it was for AT&T, and I got it as easily as my first beer. Nowadays, what the meltdown of our financial system and all, they actually have some requirements to pass before giving you a credit card. Crazy. So what’s a young consumer looking for fresh plastic to do?

Help, A Colony Of Ants Attacked My Enterprise Rental Car And Ruined My Vacation!

Steven was enjoying his drive down the California coast in his Enterprise rental car when he noticed a few ants marching across his dashboard. Before long, he “saw a large ant colony coming out of the inside of the car door.”

Credit Card Expert Disputes Erroneous Charge, Frustration Ensues

Georgetown law professor and Credit Slips blogger Adam Levitin is having trouble disputing an erroneous $176.96 charge on his Citibank Amex card from PACER, the federal court’s online docket system, which he accesses for free. The professor is a consumer credit expert and should have no problem understanding and fixing the error, right? Fat chance.