Here’s the straight scoop on what’s up with the story in that “Capital One: Waive Your Rights, Get $10 Off Your Next Overlimit Fee!” post.

overlimit fees

Capital One: Waive Your Rights, Get $10 Off Your Next Overlimit Fee!

Everett says Capital One called him up and made him an offer. If he opted out of at least one of the consumer credit protections enacted by the CARD act, Capital One would drop the overlimit fees from $39 to $29! Woo!

AmEx, Discover Ditch Overlimit Fees

American Express and Discover will no longer bill customers who exceed their credit limits, according to company spokespeople. The creditors aren’t eliminating the fees because they care about their customers. No, they’re providing what American Banker calls “the first concrete examples of how a new law will restrict issuers’ abilities to turn a profit.” The new CARD Act that Congress passed in May requires consumers to opt-in before they can exceed their credit limits. Since overlimit fees, which can reach $39, aren’t very profitable for creditors, they decided to ditch the fees altogether.

Chase Charges You Fees For The Privilege Of Being Charged Fees

Corbin had a very confusing experience with his Chase credit card. Because of a unexplained returned payment by his bank, his $30 automatic minimum payment led to $156 in late fees, overlimit fees, returned payment fees, and a fee charged, as far as I can tell, for being charged fees.

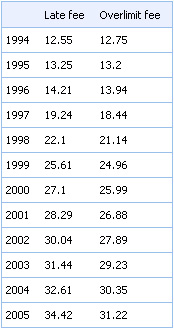

Credit Cards Fees Doubled Over Ten Years

Since 1994, credit card late and overlimit fees have more than doubled. We’re no economist, but that doesn’t seem to keep pace with inflation.