The “credit union on steroids” has gone to mandatory binding arbitration for all disputes, removing customers’ ability to successfully sue them if things go wrong. Previously, USAA had arbitration as an option, but allowed members to opt out. Now, if you want to opt out of arbitration, you’ll have to close your accounts.

mandatory arbitration

Bank Of America Leaves Mandatory Arbitration Behind

Another bank is ending mandatory arbitration for their customers. Not just any bank, either—it’s Bank of America!

Class Action Against Credit Card Companies Conspiring To Make Us All Accept Mandatory Arbitration Revived

Ross vs Bank of America is a class action suit…

Sex Assault Suit Vs. Halliburton Goes To Arbitration

A woman who says she was sexually assaulted by co-workers while working for a contracting company in Iraq, KBR, affiliated with Halliburton, lost her chance to get her case heard in a real court of law. A judge ruled yesterday that the mandatory binding arbitration clause in her contract holds firm and so its off to kangaroo court she goes. The unfortunate court decisions is a rape of justice, this is an instance where the arbitration clause should have been ruled unconscionable. [More]

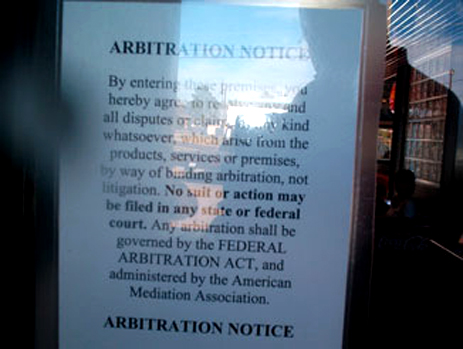

The Burger Of Mandatory Binding Arbitration

If you step into this Whataburger in Kilgore, Texas, you automatically agree to the burger joint’s mandatory arbitration clause. At least that’s what the sign on the door says. According to Mother Jones:

Sorey says when he went in, he told a befuddled cashier that he didn’t think that the arbitration notice was enforceable, that anyway he wasn’t agreeing to it, and, “I need a taquito and a coffee.” He says he sat down, watched some traffic, and ate his taquito. “I didn’t choke, I didn’t burn myself, and I didn’t sue ’em,” he reports.

That’s one burger that’s hard to swallow. Might choke on your after you read this sign. That’s one raw burger. Etc.

Jordan Fogal Responds To Your Comments About The Rotten Lemon Tremont Homes Sold Her

Two: We did not understand the true ramifications of arbitration, or it’s unfairness. No one who has not been caught in this snare does. We did not know that almost always big business wins. We thought it was like, OK kids lets sit down and not argue and fix this situation. We did not know the system was rigged. We did not understand the builders were repeat clients and the arbitrators meal tickets. No one understands arbitration companies are just the middle men. You still have to put on a trial and have all the costs associated: witnesses, subpoenas, expert testimony you even have to pay for the room to hold the arbitration in… We would not have had to pay a judge as we did an arbitrator or room rent or the astronomical fees charged by arbitration companies. Our arbitration fees alone were $9300. dollars. That does not include going to the kangaroo court where the rules of law no longer apply behind close doors. That was nearly $30,000 dollars…

Tremont Homes Sells Rotten Lemon, Provokes Victimized Homebuyer Into Five-Year Consumer Crusade

“We always wondered what life would be like in our sixties, our credit is ruined; we have stored, sold, and given away years of our memories; and for the last three years we have been holed up in a third story apartment.

Cingular's Class Arbitration Waiver Ruled "Unconscionable" By 9th Circuit Court Of Appeals

Like many many companies, Cingular has a little thing in their contracts saying that if you use their service, you void your right to a class action lawsuit and instead have to go through “mandatory binding arbitration,” which is basically an extra-judicial corporate court exempt from many of the basic rules and laws and procedures and rights of real court. Well, today, that clause was ruled “unconscionable” by the 9th Circuit Court Of Appeals. Therefore, lawsuits can proceed against Cingular and go to real court, not monkey court. Hooray!

9th Circuit Court Says Companies Can't Change Contract Terms Simply By Posting Changes On A Website

Parties to a contract have no obligation to check the terms on a periodic basis to learn whether they have been changed by the other side. Indeed, a party can’t unilaterally change the terms of a contract; it must obtain the other party’s consent before doing so….

Are Aribitrators Punished By Credit Card Companies For Ruling In Favor Of The Consumer?

According to a study by the Christian Science Monitor, the top 10 most used arbitrators ruled for consumers only 1.6% of the time, as opposed to 38% for those who were not dependent on arbitration fees.