Dan got a new job (Congratulations, Dan!) and moved from Chicago to Indianapolis. The move meant he had to close his Citibank account and open a new one. He chose Chase because they have lots of branches nearby.

checking

Four Accounts You Need, Four Accounts You Don't

It’s easy to manage your finances when you close unnecessary bank accounts and credit lines and chisel down to the bare essentials. Blueprint For Financial Prosperity has compiled an excellent list of accounts that you need, and accounts you should avoid.

A Checking Account For People Who Rack Up Tons Of ATM Fees?

Are you one of those people who is too lazy to use their own bank’s ATM, and therefore is always using ATMs that charge a fee? We noticed the other day that ETrade has a checking account where they promise to refund your ATM fees… and pay you interest.

Earn A Lot More Interest By Opening A High-Yield Online Savings Account

Your savings can earn upwards of 4 more percentage points of interest, if you put it one of these high-yield online savings accounts. Here’s seven to check out.

How To Get A Checking Account: Solutions For The "Underbanked"

There are three types of unbanked or underbanked people:

Stop Overdrafting!

Our tip box is organized by complaint category. In the “banks” section, email after email starts roughly the same way, “I overdrafted my account and then a series of horrible events ensued.”

Banks Make $50 Billion A Year From Fees

Things seems to have gotten out of hand when banks are raking in $50 billion a year just from service charges, MSN reports. Consider how banks maximize over-draft charges:

In recent years, changes in federal laws have all but eliminated “float” — the time it takes for a check to clear from the writer’s bank account. What used to take days now often takes hours or less. What hasn’t been speeded up is the time it takes for deposits to clear and be available for your withdrawal.

In other words, your money goes out faster than ever, but comes in as slow as ever. Which leads to… overdrawn checks. Which leads to… nice, juicy bank fees.

5,300 Electric Orange Checking Account Holders Mistakenly Told: "Based On Your Credit Score, We Have Decided To Close Your Account"

Nick was shocked to receive an email from ING telling him that his Electric Orange checking account would be closed because of his credit score. Nick was not the only one; similar letters were sent to 5,300 account holders.

3 Bank Laws You Need To Know

My Mint has three important banking regulations every banking customer should know about.

Checks Stolen? Maybe Leave The Account Open, Otherwise The Bank Won't Help You With The Hot Checks

Boom: they get angry and they sent many letters…

BoA Incompetence Helps Identity Thief Make Rachel Poor Broke

The Red Tape Chronicles has a story about an identity theft victim who allowed herself to be victimized over and over again. Rachel Poor (pictured) noticed some unauthorized spending on her account, reported it, but then continued to use the account and make deposits. Every time she put money end, the crook would overspend it. On top of that, she also got hit with 20 overdraft fees, and so forth. It got so bad that she had to beg her boss for a loan. The article’s author asks, “why a criminal was able to steal money from Poor’s account more than two weeks after she reported it as suspicious.”

Banking Dos And Don'ts: Answers And Clarifications

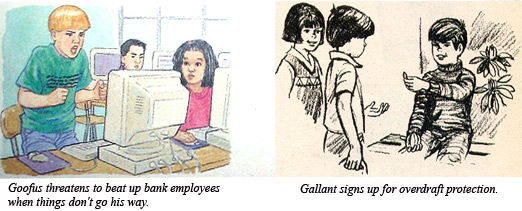

The employee who provided us the Goofus and Gallant 19 point guide to banking has some answers to your questions and clarifications, inside…

19 Banking Dos And Don'ts

A current employee in a big bank sent us a big list of banking do’s and don’ts that we know some people could stand to be reminded of [More]

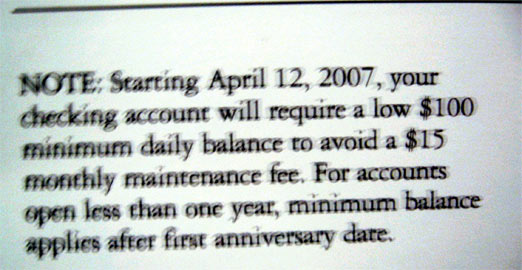

Commerce Bank's Free Checking Now Requires $100 Min Balance

Shoehorned into a postcard proclaiming the waiving all ATM fees, Commerce Bank announced their free checking will no longer be free.

WaMu's Support System Is Really Pathetic

Looks like even if WaMu’s Consumer Lending Department isn’t closed, they still have no clue what they’re doing. After La Boy transferred money from his Bank of America Account to his WaMu, he was essentially accused of trying to steal from himself. It took numerous calls to Washington Mutual to get it resolved, and most reps were more interested in passing the buck than resolving the issue.

Chase Deactivates Your Savings Account If You Don't Use It For 60 Days

If you don’t use your Chase online savings count for 60 days, it becomes deactivated. Which could be a big problem if you were counting on making a transfer to cover checks that you just wrote. What’s worse is that they don’t send you any notification that they froze your account. At least that’s how it goes according to reader Thomas’ complaint: