Just because the monthly debit card fee battle has been won doesn’t mean banks are gonna stop trying to squeeze more profit off basic checking accounts. Here’s a bunch of the recent fees banks have invented: [More]

checking

Bankers Association Defends Checking Rate Hikes: "We Don't Expect To Pay Nothing To Ride The Train"

Bankers are sure trotting out the appealing straight talk to defend the recent increase in rates on various consumer banking services. First it was Bank of America CEO Brian Moynihan telling folks that adding a $5 monthly fee for debit cards was okay because they “have the right to make a profit.” Now an American Bankers Association has an interesting turn of phrase to defend the jackup in checking account costs, most recently done by Citibank. [More]

Citibank Jacks Up Monthly Fees On Checking Accounts

Citibank sent customers a letter informing them that starting in December, they’re raising monthly fees on checking accounts, in some cases by double. [More]

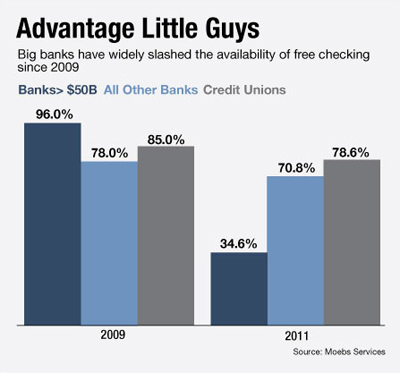

Chart: This Is How Dead Free Checking Is At Big Banks

This chart from American Banker shows just how many nails are in the coffin of free checking at big banks in a post-Durbin amendment world. That is a whopping drop from 96% of large banks offering free checking in 2009 to only 34.6% in 2011. What’s also amazing is just how resilient free checking is at the credit unions and smaller banks, which continue to use it as a marketing tactic to attract customers. [More]

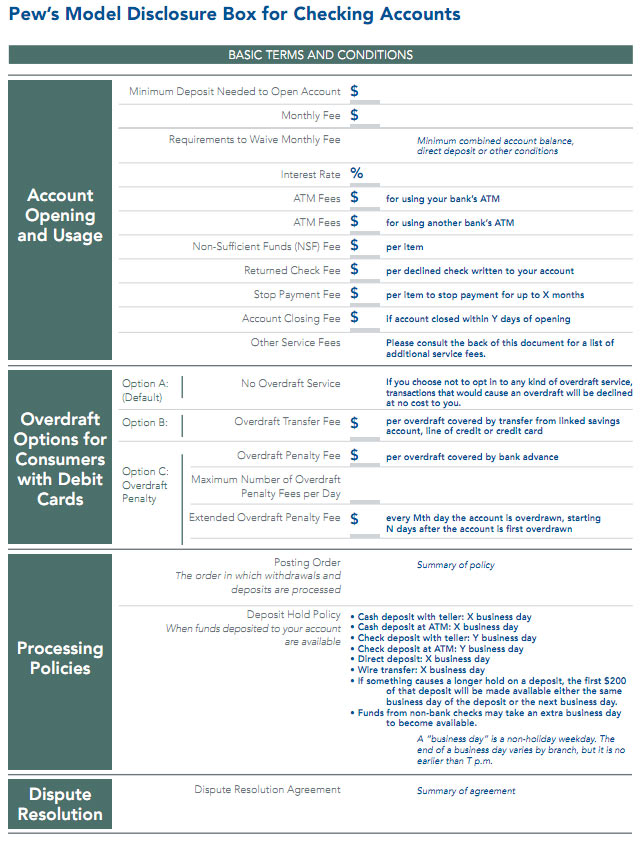

Wouldn't It Be Nice To Find Out Your Checking Fees With A One-Pager Like This?

Wouldn’t it be really cool if your checking account disclosure form looked like this nice one-pager the Pew Research Group mocked up? Naw, just kidding. We know you love reading paragraphs of tiny text that have the important clauses buried in the middle of longer sentences. Playing a scavenger hunt to find out what fees you have to pay is part of the fun of having a checking account! [More]

High-Yield Checking Isn't Dead, You Just Have To Look Harder

You would almost think that high-yield checking was dead from the massive pullback over the past few years from previous leaders like HSBC, ING Direct and Smartypig, but it’s possible to find banks offering checking accounts still offering rates as high as 4% and even 6%, as long as you follow the new, stricter, rules. [More]

Best Student Checking Accounts

New freshman entering college this Fall should take the time right now to get their banking account set up if they don’t have one already. Consumerist Commentary rounds up the best student checking accounts and compares their benefits and fees. The good news is that the best of the crop have no fees, or fees waived if you can meet some pretty easy requirements. [More]

Weighing The Pros And Cons Of Rewards Checking

Banks try to lure customers with rewards checking accounts the offer promises of bonuses for certain spending benchmarks and other behavior. A ComplexSearch post helps you sort out whether or not such accounts are the right fit for you. [More]

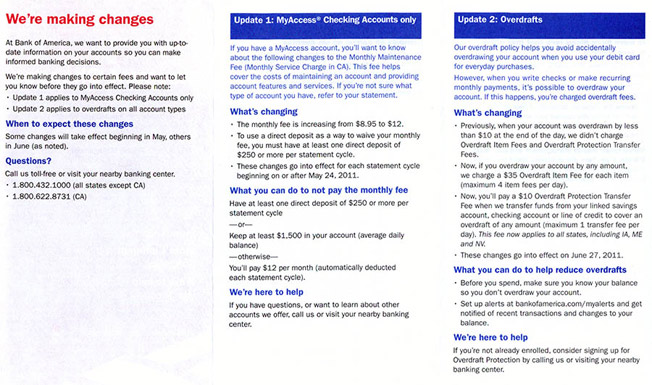

Bank Of America Adds New Checking Account Fees

Now that the regulatory heat is off on overdrafts, Bank of America is jumping back in with overdraft-related fees. They are also increasing the monthly fee and changing their requirements for avoiding it. [More]

Tricking Yourself Into Saving By Rounding Up Every Check In Ledger?

While trying to find an article in the Twin Cities Pioneer Press archive, I found a letter from one of their readers who had a unique way of tricking herself into saving money. Whenever she writes a check, she rounds it up in the check register. When she deposits a check, she rounds it down. At the end of the year she finds she has a cache of “ghost money” that she uses to buy new shoes, go to the movies, make donations and do home improvement projects. Depending on how you look at it, this is either the dumbest savings method ever, or an incredibly smart one. [More]

US Bank Replaces "Free Checking" With "Easy" Checking (Hint: It's Not Free)

US Bank was one of the last large banks to keep offering free checking but that will be no more after May 15. All customers will migrated over from “Free Checking” to “Easy Checking.” While it’s not certain how it might be any easier, like a US Bank truck drives to your house and picks up your deposits and gives you a free lollipop, it is certain that the checking accounts will have monthly maintenance fees. But you can avoid those fees if you sign up for the right level package and abide by certain behaviors. [More]

Even With New Fees, Most Checking Accounts Beat Prepaid Debit Cards

Pushers of prepaid debit cards say the fees they charge are comparable to a checking account, but a new study by Consumers Union, publishers of Consumer Reports and this blog, finds that by and large, checking accounts are still a better deal. [More]

Apocryphal And Hilarious "Letter A 98-Year Old Woman Wrote To Her Bank" Makes The Rounds Again

An amazing letter that a 98-year old woman wrote to her bank to protest a bounced check is making the rounds. She complains about a check getting bounced from her account because it occurred “three nanoseconds” before her pension got direct-deposited. She then says that going forward the bank will have to appoint a special rep to open her mortgage and loan payments, he has to use a 28-digit PIN to talk to her, and will have to go through a lengthy phone tree. It’s quite clever, but it’s not real. Not exactly. [More]

BofA Tests New Checking Accounts With New Fees

Bank of America is trying out a new system of checking accounts with new rules—and new fees for breaking them. [More]

More New Debit Card Fees Loom

Banks are making less money when you swipe your credit and debit cards because of new caps on interchange rates, the fee that they charge to process each of these transactions, that go into effect on July 1st. They have to make the money up somehow! We’ve seen new fee-incurring tripwires on checking accounts, and now they’re dreaming up even more fees for debit cards. Here’s what’s on their wishlist: [More]

Chase Kills "Free Checking" For Ex-WaMu Customers

Starting Feb. 8 2011, former WaMu account holders gobbled up by Chase will become the latest batch of customers to lose their free checking privileges. They will still get “free checks for life”, but their “free” checking is about to become “fee” checking. [More]

Remember: Checks Can Still Overdraft

Just remember, even though starting this week banks can’t charge you overdrafts unless you opted into their overdraft program, they can still authorize overdrafted checks, ATM withdrawals, and automatic bill payments at their discretion and charge you a fee for it. [More]