../../../..//2008/08/27/fdic-chairs-assessment-of-the/

FDIC chair’s assessment of the banking situation: worse and getting worser. [NYT]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2008/08/27/fdic-chairs-assessment-of-the/

FDIC chair’s assessment of the banking situation: worse and getting worser. [NYT]

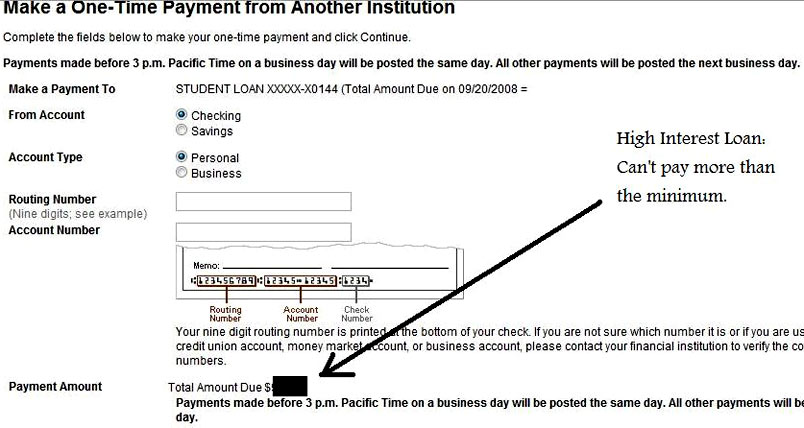

According to reader Caleb, Wells Fargo seems to have recently crippled their loan repayment system in a way that makes it impossible for borrowers to pay off loans the way they want to. That is, unless you prefer to let your highest-interest loans ride for as long as possible while you pay off your lower-interest loans…

Who isn’t suing Countrywide lately? Phuong Cat Le from the Seattle Post-Intelligencer says that a group of homeowners are now suing Countrywide, alleging that the lender steered them toward high-risk loans without disclosing the inherent risks.

Each year banks give states $4.7 billion belonging to people who failed to “initiate a transaction or communicate with the financial institution” in the past three years. The money isn’t lost forever, but getting it back can be a bureaucratic hassle full of forms and headaches.

A Texas cannery has been using shredded checks from the local bank as packing materials for the past twenty years. The WHH Ranch Company claims that Michelle McBride of Kansas is the only customer to ever complain about the checks, which plainly displayed routing and account numbers for hospitals, medicare, schools, businesses, and personal accounts.

Banks need your money. They’re not doing too well on their own, and you’re not screwing up enough to generate the fees they need to make their shareholders happy. That’s why they’ve set up sneaky ways to maximize your every mistake—or in some cases, ways to change the rules so that you make new mistakes where you didn’t before—in order to penalize you. Here are five things SmartMoney says to watch out for.

Douglas writes, “Coinstar wants you to ‘recycle’ your coins in their machines, and save the environment! Minus their 8.9% fee of course.” They even have a little wizard on their website that estimates how many parts of the environment—water, energy consumption, and geological waste—you save by putting those coins back into circulation, instead of hoarding them like the polar bear murderer you are. They don’t provide any source for these estimates, though, and we’re not convinced you’re doing anything “green” other than lining Coinstar’s pockets.

Citibank’s website isn’t reliable, at least according to them. Matt assumed that a website from a bank could be trustworthy, and that if there was no scheduled payment showing up, then he must have forgotten to arrange it. He scheduled a second payment, but then both payments went through one day apart. Now Citibank refuses to give him a refund: he should have called or emailed before rescheduling, they’ve told him, and not trusted what the website was telling him.

Gramps could go any minute, but banks only fail on Fridays, giving the FDIC carcass crew plenty of time to line up potential buyers, scrap outdated letterhead, and hire hypnotists to help bank employees remember vault codes…

Someone hacked into super-famous blogger Chris Pirillo’s PayPal account and bought $450 worth of iTunes cards. On his birthday, no less. After a review Paypal declared to him,”We have completed our investigation of your claim and have determined that this is not an instance of unauthorized account activity.”

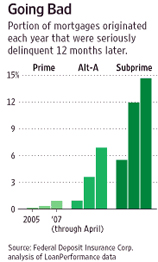

Man, remember those mortgages made in 2006? That was some bad juju. Whooee. But if you thought those were bad, wait till you get a load of the mortgages made in 2007. As the graph shows, people are defaulting on them at an even higher rate than the ’06 ones. How could this be? By 2007 the bubble was popping and lenders could all see that they needed to stop giving making loans to underqualified borrowers, right? That was exactly the problem: “Mortgage originators who profited handsomely from the housing boom “realized the game was completely over” and pushed mortgages out the door,” reports WSJ.

“Maybe I should call the E*Trade Baby. He might give me better customer service.” Matt’s mother died last year and he has been trying since last year to liquidate her E*Trade CD and put it in the family trust. Every other financial institution has been able to liquidate the assets with no problem, but it seems after blowing their wad on funny Superbowl ads, E*Trade has nothing left over for customer service. Here’s Matt’s story, and our advice on how can get his problem fixed:

Claudia’s father couldn’t get a loan because Sears reported to the credit bureaus that he was dead. In fact, it was her mother who had died. After complaints, Sears credit cards, run by Citibank said they fixed the problem. Then Claudia’s dad tried to get a loan but couldn’t. His credit score was zero.

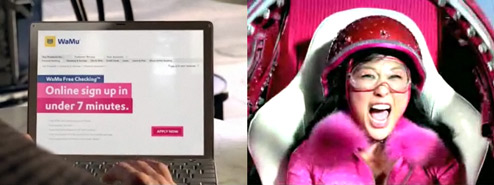

With all the focus on the girl rocketing across the desert in a supersonic purple dildo, Washington Mutual forgot to mention one thing. When you sign up for a new account with them online instead of in person, be prepared to be treated like a criminal at every turn. Here’s Brett’s story of why he and his partner don’t bank with WaMu, and never will again…

Much like that nasty little gas station problem we talked about awhile back, hotels just love to slap holds on your debit or credit card accounts for “incidental charges.” There’s nothing wrong or uncommon about the practice, but its difficult or impossible to tell exactly how much the hold might be — and for some consumers who aren’t expecting it, the holds can cause big problems. Reader Eric recently got slapped with a $253.13 hold from the Crowne Plaza Hotel in Kansas City, and he’s a little irked because they didn’t disclose the hold when he was checking in, and they only refunded $160 of it when he checked out.

Tip for the savvy traveler visiting New York: all the McDonald’s in New York have ATMs with only 99-cent fees. However you will probably have to put up with a freelance “doorman” bumming for change on your way out.

Have you ever wondered what it would be like if you responded to one of those Nigerian scam emails, offering fabulous riches for just a small amount of work? Here’s the story from an unsuspecting college student who totally fell for one. An impecunious immigrant to this country from rural China, he made the perfect target for “Dr. Mike Johnson.” The good doctor was looking to hire some employees. The job? Cashing Traveler’s Cheques and forwarding the money on to Nigeria… In other words, the job was to be a victim of check fraud. Here’s the story…

We’ve posted a lot of stories of businesses requiring customers who pay with a credit card to make minimum purchases, or pay a surcharge, or show ID. And as we’ve repeatedly said, the businesses’ merchant agreements with the credit card companies forbids these practices. A reader wrote in to argue that this might not be true, as many businesses contract with third-party credit card processors, and are not bound by the merchant agreement. So we did some investigating.

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.