If your FDIC-insured bank implodes, how long does it take for the FDIC to start paying depositors? Ever since IndyMac imploded, the question has no doubt been on many people’s minds. One reader emailed me saying that he had asked the his banker about how long it might take. Allegedly, the banker squirmed around before finally saying that the FDIC had 20 years to pay people back. This is not true.

banks

HSBC Extends 3.5% APY Online Savings To Sept 15

HSBC sent around a big cheery email to let everyone know that they’ve extended the promotional 3.5% rate on their online savings account until September 15th.

Halt Foreclosure Proceedings By Challenging Your Bank's Claim To Your House

Banks don’t always own the homes they’re trying to repossess, a crucial oversight that residents facing foreclosure can exploit to stay in their homes—though not without effort. Mamie Ruth Palmer successfully sued the Bank of New York after the bank tried to foreclose her home without possessing the note securing the property. After six years in court, the bank agreed to slash her outstanding mortgage in half and waive $12,000 in foreclosure fees so she could keep her home.

Two More Banks Fail, Including The Largest Arizona-Based Bank

Yesterday the FDIC shuttered the 28 branches of the First National Bank of Nevada and the First Heritage Bank. Federal regulators will perform a nifty little magic trick over the weekend, and on Monday, the branches will reopen as Mutual of Omaha Bank. Aren’t bank failures fun?!

96 Numbers For Wells Fargo Card Service Senior Management And Their Direct Reports

If you have a problem with your Wells Fargo-issued credit card and regular customer service isn’t helping you, you might want to try one of the 96 people whose phone numbers we have posted inside. Just like with tier 1 customer service, you want to be polite, professional, and able to calmly tell them exactly what you want in a sentence or two. This primer on using executive customer service should help too. Time to put that stagecoach on turbo!

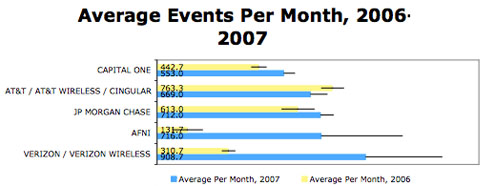

Verizon Was The Most Frequent Target For Identity Theft Scams In 2007

Identity theft reports to the Federal Trade Commission show that Verizon was the most frequently named company, averaging over 900 events per month in 2007. According to an updated study by Chris Hoofnagle, senior fellow at the Berkeley Center for Law and Technology, the number of complaints involving Verizon nearly tripled from 2006. Rounding out the top five are AFNI (a collection agency), JP Morgan Chase, AT&T, and Capital One.

Customers Claim That Wachovia Is Handing Out Counterfeit Bills

Something shady may be afoot at a Central Florida Wachovia branch…two customers say that a teller gave them counterfeit bills, according to Local 6 news in Orlando. The bank is refusing to give them a refund, claiming that they have no way of knowing if those counterfeit bills are the same ones the teller gave out, but Local 6 says that they’ve learned that Wachovia previously gave a customer with a similar story a refund.

Debt Slavery: Why Are Americans So Willing To Dig Themselves Deep Into Debt?

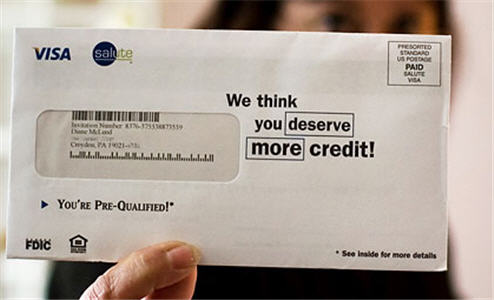

The New York Times has an article that tells the unfortunate tale of Diane McLeod and her love affair with debt. She started out “debt free” when she got married, but after a divorce she’d managed to accrue $25,000 in credit card debt. Despite not having a down payment or any assets, Diane was given a $135,000 mortgage. Over the next few years, illness, underemployment, and shockingly irresponsible spending combined disastrously with the bank’s willingness to refinance her loan as her home appreciated (for a fee, of course). 5 years later, Diane owes $237,000 on her mortgage. She’s in foreclosure now, and a recent sheriff’s auction of the home did not draw a single bidder. A similar house down the street recently sold for $84,000 less than she owes on her home.

Wachovia: We Just Lost $8.9 Billion!

Wachovia just lost $8.9 billion dollars, and will cut 6,350 workers as the credit crisis keeps on truckin’, says the Associated Press. This is um, a lot more than Wall Street had been expecting. Earlier this month, Wachovia had projected a $2.6 billion loss.

What It Takes To Qualify For A Mortgage In A World With Standards

The party is over. If you want a mortgage you’re going to have to be able to afford it. Oh no! Now what are you going to do? Kiplinger’s has an article that explains how mortgage lending works when there are “standards” involved. How quickly we all forget…

Beware Long-Term Cardholders With Perfect Payment Histories, Your Credit Lines May Be Slashed

Oliver paid off his Citibank platinum card on time, in full, every single month since 1989, but that didn’t stop Citibank from slashing his credit limit when a minor mistake popped up on his credit report.

10 Banks That Could Be Next To Go Under

IndyMac bank going under probably has you wondering, is my bank next? Various analysts are predicting that hundreds of small and regional banks could collapse in the next year. Here’s the top 10 list of the nation’s most troubled banks…

Banks Put 8-Week Hold On IndyMac Checks

People who got their money from IndyMac are facing new challenges as other banks put extended holds on releasing the funds when the checks are deposited. WaMu is putting 8-week holds on the checks. Wells Fargo is putting holds on amounts over $5,000. If you deposit more than that, Wells Fargo will only let you have access to the first $5,000. The Office of Thrift Supervision is looking into whether this is ok or not. Good, we needed something like this, that panic wasn’t looking frothy enough.

UPDATE: Bank Of America Has No Idea Whether It Treats Parking Meter Payments As A Cash Advance

Remember our reader who tried to use his Bank of America debit card on a parking meter and was charged a $10 cash advance fee? One of our commenters did a little investigation on our story and got two conflicting responses from Bank of America.

Regulators Seize IndyMac In The Second Largest Bank Failure In U.S. History

Ever hear of IndyMac Bancorp? Well, it’s gone! Federal regulators seized the California bank spawned by Countrywide founder Angelo Mozilowhich, which had giddily doled out mortgages to lenders without requiring proof of income. Rather than blame the second largest bank failure in U.S. history on the subprime meltdown, the charmingly politicized regulators at the FDIC blamed the bank’s demise on Senator Charles Schumer (D-NY). Huh?

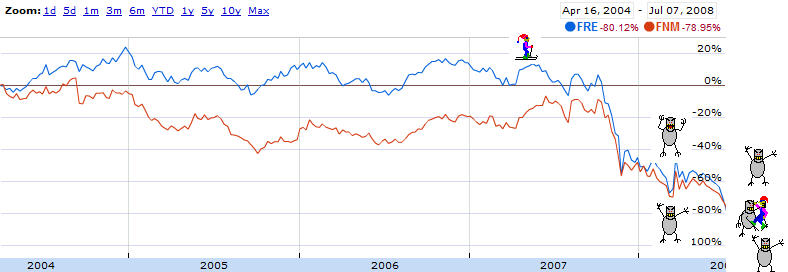

Mortgages Of The Apocalypse: Are Freddie And Fannie Going To Collapse?

Freddie Mac and Fannie Mae, the “government sponsored” enterprises that are supposed to bail us out of the current mortgage crisis, may be in danger of collapsing, according to William Poole, the former president of the St. Louis Federal Reserve, who told Bloomberg the companies are already “insolvent.”

Bank Of America Gives You A Sales Pitch When You Call To Ask Them To Stop Giving You Sales Pitches

Jasper got a notice in the mail about marketing from Bank of America, so he called them up to opt-out. After agreeing to stop spamming him, the Bank of America CSR launched into a sales pitch for their “credit protection” services…

Email Addresses For 17 Bank Of America Executives

Here are 18 working Bank of America executive/employee email addresses. A Consumerist reader launched a EECB (executive email carpet bomb) that got his overdraft fees refunded; these were the ones that didn’t bounce back, plus some more we found recently.