Ever hear of IndyMac Bancorp? Well, it’s gone! Federal regulators seized the California bank spawned by Countrywide founder Angelo Mozilowhich, which had giddily doled out mortgages to lenders without requiring proof of income. Rather than blame the second largest bank failure in U.S. history on the subprime meltdown, the charmingly politicized regulators at the FDIC blamed the bank’s demise on Senator Charles Schumer (D-NY). Huh?

banking

Both Dell And AT&T Cash Checks Not Made Out To Them, Cause Much Sadness

It’s sure to be a pain in the butt if you accidentally switch two of your payments — but we’d always assumed that companies like AT&T and Dell wouldn’t cash checks that were not even made out to them. We we wrong!

Bank Of America Gives You A Sales Pitch When You Call To Ask Them To Stop Giving You Sales Pitches

Jasper got a notice in the mail about marketing from Bank of America, so he called them up to opt-out. After agreeing to stop spamming him, the Bank of America CSR launched into a sales pitch for their “credit protection” services…

../../../..//2008/07/03/google-now-helps-catch-criminals/

Google now helps catch criminals. The FBI identified a Citibank PIN thief by cross-referencing security camera footage with an ICQ handle and personal photos on ham radio enthusiasts sites. [Information Week]

Worst Company In America "Elite 8": Countrywide VS Bank of America

ATTENTION: Bank of America is currently in the process of purchasing Countrywide, but the transaction is not yet complete. For the purposes of this contest we ask that you evaluate their track record with consumers separately. Thank you.

Chase Bank Teller Allegedly Fleeces 86-Year-Old Out Of More Than $300,000 In Savings

A Chase Bank teller who befriended an 86-year-old senior allegedly fleeced the women out of most of her $400,000 in savings, says the Chicago Sun-Times, and even though the bank caught the teller and fired her… they’re taking a long time to repay the stolen money.

Bank of America: "Free" Checking Means You Have To Call And Have The Fee Waived Every Month

Reader Tara has a checking account with Bank of America that’s supposed to be “free” if she meets 1 of 3 balance requirements. She meets one of them, but Bank of America keeps charging her $20 — and they don’t intend to stop.

Shaq Wants To Save Orlando From The Mortgage Meltdown

Shaq has a plan to save Orlando from the mortgage meltdown. Sort of. The Orlando Sentinel says that word leaked out that Shaq was working on a plan to buy the troubled mortgages of Orlando homeowners and refinance them so that families could stay in their homes — and hopefully turn a small profit by doing so. The trouble is, the demand is overwhelming and Shaq doesn’t have anything set up yet. That’s not stopping him, though.

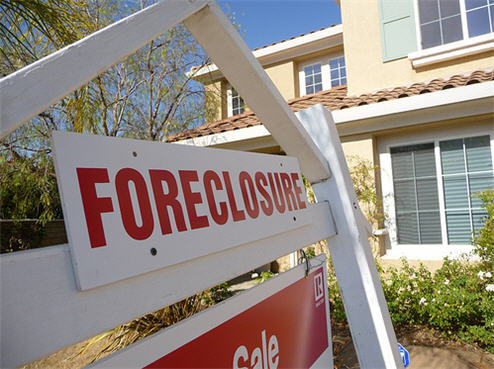

More Than 1 Million Homes Are Now In Foreclosure

Grim numbers today from the Mortgage Bankers Association. 2.5% of all mortgages serviced by the association’s members are now in foreclosure — 1.1 million homes. The rest of the numbers aren’t any more cheerful. Both the rate of new foreclosures and late payments were the highest on record going back to 1979, says the AP.

Bank Of America Tries To Ruin Your Vacation For Your Own Protection

Reader Drew went out of his way to ensure that he’d be able to get money from ATMs (using his Bank of America card), while on vacation. Despite his best efforts, he learned that a) putting a note on your account saying that you’ll be in England and b) drawing less than the maximum daily amount from your account is still not enough to keep BoA from putting a hold on your account. He’s written in with some advice for other Bank of America customers who are planning on traveling soon…

Bank Of America: Let's Charge Three Overdraft Fees To The Account Flush With Cash!

Bank of America charged Jason three overdraft fees for the hell of it, even though his account balance never approached $0. Jason called the bank for an explanation, and was told that due to some mathematical wormhole controlled exclusively by Bank of America, he now owed $105. Tired of the bank’s nonsensical jibber-jabber, Jason printed out his statement and headed to the local branch…

Is This Woman The Smoking Gun Of The Mortgage Meltdown?

Meet Tracy Warren. NPR says she’s not surprised by the mortgage meltdown because she was supposed to be in charge of preventing it. Tracy worked for a quality control contractor that reviewed subprime loans for investment banks before they were sold on Wall Street, and her company’s biggest client was none other than Bear Stearns. Tracy says she found plenty of loans to reject. The trouble is, according to Tracy, after she rejected them… her bosses unrejected them.

Chase: Thanks For Depositing $3,193, Here's $200 In Non-Sufficient Funds Fees

Johanna deposited a financial aid check from her university into her Chase checking account. She’d done this before without incident, but this time something went wrong.

L.L. Bean Is Breaking Up With Bank Of America, Effective July 1, 2008

Reader Tim scanned a letter he got from Bank of America announcing that the bank and retailer L.L. Bean were breaking up.