Poor Jacob. He only wanted to deposit a $2,019 check with Bank of America. Apparently, this was enough to provoke the bank into shutting down his account, leading to overdraft fees whenever Jacob tried to access his money.

banking

Bank of America Mistakenly Shuts Down Access To Your Account, Charges You For The Pleasure

Polite Letter Gets Bank Of America To Refund Overdraft Fees

Jenn’s checking account with Bank of America recently had a policy change designed to increase overdraft fees, and it worked: sometime between Friday night and Saturday morning she was hit with 6 NSF charges going back the previous 48 hours, because she was about 15 minutes late transferring funds into her account the day before. Technically she had broken the new policy, but Jenn hadn’t realized or remembered that there was a policy change and she was taken by surprise. She decided to try to reason with BoA’s corporate office about the fees, and explain why she thought they were unfair.

Chase Refuses To Shut Down Broken ATM Until You Threaten To Report Them To The FDIC

Reader Keith tried to get $120 from a downtown NYC Chase ATM, but the money door never opened. When he went inside to report the malfunction, the teller told him to go outside and wait. Keith thought he was waiting for someone to come fix the ATM or take his personal information. It turns out that he was just being ignored.

WaMu Backs Down, Returns The $1500 To Bill's Bank Account

Bill, whose small business checking account had been inappropriately drafted $1500, sent us the following email late last night:

Customer Gets Slapped With "Excessive Activity" Fee For Messing With Savings Account Too Much

Thanks, Bank of America: "I Deposited A Check That Dosen't Exist, And I Have A Receipt."

It seems that everything isn’t going so swimmingly during the transition from LaSalle Bank to Bank of America. One reader says that a check he deposited and has a receipt for has mysteriously disappeared…

Commerce Bank Can't Decide Whether Funds Are Available Or Not

Meg in New Jersey wants to know what’s up with her Commerce Bank account. They say if you deposit a check before 6pm, the funds are made available that day—but when she did just that and then transferred the funds to another account, she was hit with a $35 “uncollected funds fee.” She never got a straight answer out of the Commerce CSR, and although they refunded the fee, they told her she “could only get that refund once ever,” as if to say it was her fault the fee was assessed.

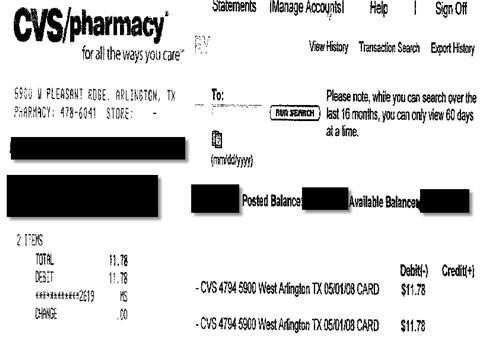

CVS Stole My $11.78, And Refuses To Give It Back!

Reader Julie ran into some trouble at the CVS when a cash register rebooted while processing her transaction and the employee, rather than voiding the messed up transaction, simply charged her twice. Julie writes:

Wachovia To Pay $144 Million For Bilking "Gullible" Seniors

Wachovia will pay $144 million for helping telemarketers prey upon the elderly. The Office of the Comptroller of the Currency spanked the morally bankrupt institution with one of the largest fines ever levied—but before seeing a penny of settlement money, seniors will need to fill out detailed claim forms and navigate a complex bureaucracy.

Wachovia Opens Bank Account Without Permission, Starts Charging Fees

John can’t understand how Wachovia charged his startup $12 in fees for failing to maintain a minimum balance when his company never opened an account with Wachovia in the first place. Apparently, his former bank manager decamped to Wachovia and, without his permission, opened a new account “to ensure certain money rates,” whatever that means. John isn’t mad, and the bank manager agreed to close the account, but John is a little worried because a collections agency has started calling and the account now lists $24.05 in fees.

Rude Service Costs Bank Of America Yet Another Customer

Jim over at Blueprint for Financial Prosperity closed his Bank of America account after a teller forced him to fill out a deposit slip. Jim doesn’t care for deposit slips, calling them “a wasted branch on a tree we’d otherwise like to keep around,” and likes tellers to double-check his math. Even though Jim yielded and started to fill out a slip, the teller tapped a reserve of rudeness that inspired him to close his account.

Bank of America To Stop Making Private Student Loans

Bank of America, the nation’s largest bank and one of our largest student lenders, today announced that it would stop making private student loans and instead “do more lending under a federally guaranteed program,” says the Wall Street Journal.

Confessions Of A Hedge Fund Manager Redux

n+1: So can you tell me what happened with Bear Stearns? What were the steps?

What Should We Do With 125,000 Out Of Work Mortgage Bankers?

Today CNNMoney profiles an out of work mortgage banker who has been sending out 10 resumes a day since he was laid off in Feburary. He just got his first interview.

FDIC: Banks Are Going To Fail, But Don't Worry About Your Money

Sheila Blair, Chairman of the FDIC, wants to let you know that a few banks will probably fail during the current credit crisis, but you shouldn’t worry about your money because its insured up to $100,000 for a regular bank account and $250,000 for a self-directed retirement account (IRA).

Q: What if banks fail in the credit crisis? Will customer money be safe?

FDIC Call Center: Former Employee Says It's A Great Place For Bank & Credit Union Info

A former FDIC employee writes that the FDIC’s call center (877-275-3342) is “a tremendously helpful place to get basic referral information if you’re having trouble with your bank, lender, or finance company.” They can’t help you with complaints, but they can route you to the correct agency, provide credit union contact info, and give you the names and numbers of state agencies where your bank is located.

Bank Of America Refunds $325 In Overdraft Fees To Customer Who Was On Cruise

Don’t say we never printed anything nice about you, BoA. One of your customers just had an experience with you that—despite still having an overdraft fee of $20 to pay—has left her feeling pretty good about you.