HSBC’s core banking system has been hosed for almost a week, preventing thousands of customers from knowing how much money is stashed in their accounts. The widespread problem is limiting access to HSBCDirect accounts, and at least 8,000 Catholic Health System employees up in Buffalo are still waiting for their direct deposit payments to materialize.

banking

Use Your Bank Accounts Every Three Years Or They Will Go To The State

Each year banks give states $4.7 billion belonging to people who failed to “initiate a transaction or communicate with the financial institution” in the past three years. The money isn’t lost forever, but getting it back can be a bureaucratic hassle full of forms and headaches.

WHH Ranch Company Uses Shredded Checks As Package Cushioning

A Texas cannery has been using shredded checks from the local bank as packing materials for the past twenty years. The WHH Ranch Company claims that Michelle McBride of Kansas is the only customer to ever complain about the checks, which plainly displayed routing and account numbers for hospitals, medicare, schools, businesses, and personal accounts.

Watch Out For These 5 Overdraft Traps

Banks need your money. They’re not doing too well on their own, and you’re not screwing up enough to generate the fees they need to make their shareholders happy. That’s why they’ve set up sneaky ways to maximize your every mistake—or in some cases, ways to change the rules so that you make new mistakes where you didn’t before—in order to penalize you. Here are five things SmartMoney says to watch out for.

Yes, "Tightwad Bank" Is A Real Bank, And It's FDIC Insured

Tightwad, Missouri, population 63, doesn’t have much, but it does have a bank. A bank where the most common question people ask isn’t “Do you have free checking?” It’s: “Is this actually a real bank?” Well, the answer is “yes.”

Bank Of America: Exploding Dye Packs Aren't Just For Heist Movies Anymore

A Bank of America customer got a nasty surprise after withdrawing cash to pay her employees — a dye pack exploded in her car. When she went back to the bank to complain she says she didn’t even get an apology.

Citibank's Website Glitch Tricks Man Into Overpaying $755, But They Won't Issue Refund

Citibank’s website isn’t reliable, at least according to them. Matt assumed that a website from a bank could be trustworthy, and that if there was no scheduled payment showing up, then he must have forgotten to arrange it. He scheduled a second payment, but then both payments went through one day apart. Now Citibank refuses to give him a refund: he should have called or emailed before rescheduling, they’ve told him, and not trusted what the website was telling him.

Your Bank Is Dead. Quick, Call The Hypnotist!

Gramps could go any minute, but banks only fail on Fridays, giving the FDIC carcass crew plenty of time to line up potential buyers, scrap outdated letterhead, and hire hypnotists to help bank employees remember vault codes…

Not Good: Fannie Mae Loses $2.3 Billion

Fannie Mae is the nation’s largest mortgage finance company and it’s just not doing too well, says the AP. Increasing losses from foreclosures are wiping out Fannie’s revenue.

The Subprime Meltdown Will Be Nothing Compared To The Prime Meltdown

James Dimon, the chairman and chief executive of JPMorgan Chase, is not optimistic about the mortgage market. He told investors that he expects the losses mortgages given to people with good or excellent credit to be “terrible.” According to the New York Times, “The first wave of Americans to default on their home mortgages appears to be cresting, but a second, far larger one is quickly building.” How can this be?

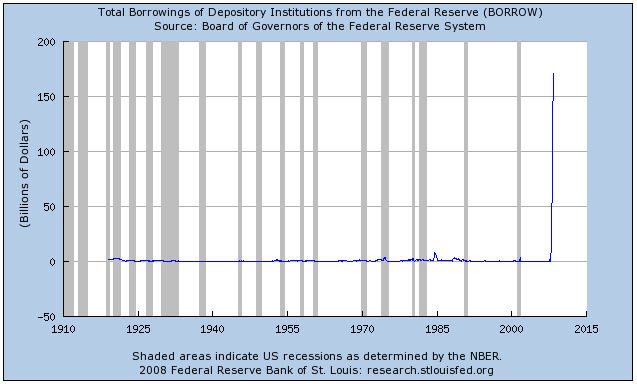

So, How Much Money Are Banks Borrowing Thanks To The Mortgage Meltdown?

Here’s a graph from the Federal Reserve Bank of St. Louis that shows, historically, how much money banks have borrowed from the Federal Reserve.

Two More Banks Fail, Including The Largest Arizona-Based Bank

Yesterday the FDIC shuttered the 28 branches of the First National Bank of Nevada and the First Heritage Bank. Federal regulators will perform a nifty little magic trick over the weekend, and on Monday, the branches will reopen as Mutual of Omaha Bank. Aren’t bank failures fun?!

Wachovia: We Just Lost $8.9 Billion!

Wachovia just lost $8.9 billion dollars, and will cut 6,350 workers as the credit crisis keeps on truckin’, says the Associated Press. This is um, a lot more than Wall Street had been expecting. Earlier this month, Wachovia had projected a $2.6 billion loss.

What It Takes To Qualify For A Mortgage In A World With Standards

The party is over. If you want a mortgage you’re going to have to be able to afford it. Oh no! Now what are you going to do? Kiplinger’s has an article that explains how mortgage lending works when there are “standards” involved. How quickly we all forget…

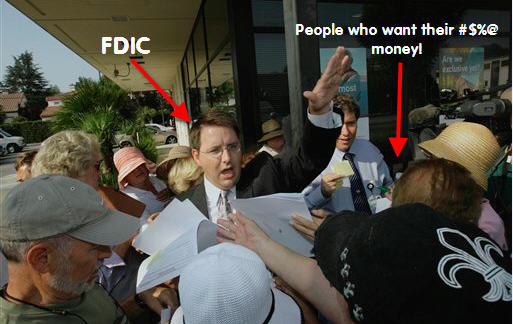

IndyMac Failure Demonstrates That The FDIC's Customer Service Skills Could Use Some Work

We’re always told not to worry about our bank failing because our deposits are insured up to $100,000 by the FDIC. Well, in case you were wondering what happens when a bank actually does fail, look no further than the great state of California, where IndyMac has been taken over by federal regulators and its customers are getting a taste of all the FDIC has to offer.

AOL Repackages Personal Finance Content, Names It WalletPop

Apart from the quite adequate assortment of calculators, it’s all a big heap of plain-Jane articles slotted into categories by simple tags.

Disgruntled Computer Technician Outs Super-Rich Tax Cheaters To The IRS

U.S. law allows whistleblowers to collect 30 percent of any taxes recovered as a result of their information, and it seems that one disgruntled computer technician is taking advantage of the program. Meet Heinrich Kieber, a nefarious criminal-type turned “good guy” who will be testifying in front of the “Senate’s Permanent Subcommittee on Investigations Thursday via a video statement from a secret location,” according to ABC News. Mr. Keiber is from Liechtenstein, a tiny country with very secretive banking laws. He stole banking information that showed how the world’s super-rich were skirting their countries tax laws. Keiber then sold the information to tax authorities in 12 countries, including the U.S, hence the whole “secret location” thing.

WaMu: "It Is Not My Problem If You Did Not Plan To Pay Your Bills On Time"

WaMu goes out of its way to convince you that it is staffed by friendly, outgoing people who want to help you if something goes wrong. Their “About” page on the WaMu website says: “We’re informal, friendly and fun. We take our customers’ money seriously, but not ourselves.” We suspect that reader Drew would disagree with the whole “friendly” part of that sentence. He arrived home a day late from a business trip to Europe and was in a rush to pay his rent before it was due. He made it to the WaMu branch 5 minutes before it closed, but it was already locked.