Attention Wachovia customers: Wells Fargo just rode on on that stagecoach thing of theirs and stole your bank from Citibank, says the NYT. Rather than pick apart the pieces of Wachovia, Wells Fargo is going to buy the whole darn thing.

banking

../../../..//2008/10/03/surprise-wells-fargo-is-buying/

Surprise! Wells Fargo is buying Wachovia, even though Citibank said at the beginning of the week that it was going to. (Check out the full post here.) Unlike Citibank, Wells Fargo will absorb all parts of Wachovia, including its securities and retail brokerage biz, in a “$15.1 billion all-stock merger.” [DealBook] (Thanks to Stephen!)

The 10 Cities With The Most Crazy Expensive Loans

The Chicago Reporter took a look at some recently released mortgage data with an eye to how many successful refinances there were last year. In addition to concluding that people who most needed a refinance (those with crazy expensive loans) were also the least likely to get one, the Reporter also found that Chicago lead the nation in the total amount of high-cost loans for the fourth year in a row. High-cost loans are loans that are at least 3% above the U.S. Treasury standard.

10 Things To Expect From The New Post-Apocalyptic Economy

Kiplinger’s has put together a list of 10 things that you, fair consumer, can expect from our new post-wall-street-apocalypse economy. Should you be scared? Maybe.

WaMu Says, "Take A Picture It Lasts Longer…"

Reader Steve says this photo was taken at the Austin City Limits Festival on the same day that WaMu was seized by federal regulators — making it not only funny, but extremely accurate.

Now That The Largest Bank Failure In U.S. History Is Over, Is Wachovia Next?

The collapse of Washington Mutual and the FDIC-engineered fire sale to JPMorgan Chase has people worried — about Wachovia. Wachovia’s stock is down 45% for the week, and 27% today as bailout talks stalled in Washington and WaMu held a garage sale at the FDIC.

House Passes Credit Card Bill Of Rights… But Senate Is Too Busy With The Bailout

The House of Representatives passed legislation that’s commonly known as the Credit Cardholders’ Bill of Rights today, but the bill is expected to be ignored by the Senate while they work on that whole $700 billion bailout thing.

Finance Officials Beg Congress To Give Them $700 Billion

Treasury Secretary Henry M. Paulson Jr. was not warmly received at today’s bailout hearing when he stared down an angry and disenchanted Senate Banking Committee. Federal Reserve chairman, Ben S. Bernanke, who appeared with Mr. Paulson, warned that unless Congress gave Mr. Paulson $700 billion that “inaction could lead to a recession.” Oooh, they said the “R” word….

../../../..//2008/09/18/were-not-the-only/

We’re not the only ones with a credit crunch. HBOS, Britain’s biggest mortgage lender, is going under.

Nobody Gave A Crap About The FDIC Until Fairly Recently

Spend a little time looking at Google trends and you’ll notice that no one really gave a crap about the FDIC until fairly recently.

What Types Of Accounts Are FDIC Insured? Are My Investments Safe?

What accounts are FDIC-insured? Which aren’t? Now that a fund that markets itself as the world’s “first and longest running money fund,” suddenly found itself in the nearly unprecedented position of having to “break the buck,” we thought we’d help clarify. Here we go:

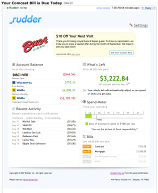

'Rudder' Provides Your Daily Financial Status Via Email

Rudder is a new personal finance service that differs from the dozens of other ones now available in two key ways: it presents a simplified overview of your available funds, which it calls “What’s Left,” and it delivers it (along with bill reminders and balance notifications) to your email inbox instead of requiring you to visit a website. Think of it as a highly customized “Very Short List” or “Daily Candy,” only the topic is always your current financial health.

Ex-Countrywide Employee Sells Your Data, They Offer Credit Monitoring Service, Hang Up When You Ask For It

Re: Countrywide Sends Fraud Alert Letters: ‘Your Info May Have Been Sold,” Reader Esqdork writes, “Yesterday, I phoned Countrywide to get them to extend the credit monitoring service [that they offered in their apology letter] to my co-borrower and was promptly hung up on.” The only surprise here is that they even picked up in the first place.

Countrywide Sends Fraud Alert Letters: 'Your Info May Have Been Sold'

I received a letter from Countrywide today that says:

Facing Foreclosure? Buy A Second Home! Wait, What?

ABCNews says that more and more people who are facing foreclosure are just buying cheaper homes and then just walking away from their original mortgage. It only works for people who can afford the down payment on a new home and carry both mortgages until they’re in the new home, but for some people whose payments are about to balloon, it’s the most attractive option out there right now.

Help! Chase Suddenly Wants Me To Buy Tons Of Flood Insurance!

Reader Nate and his wife recently bought their dream home, which they admit is more modest than most people’s dream homes, for $60,000. During closing, they wrote in their offer “that if the home was found to be in a flood plane we withdrew our offer,” but were happy to find out that the house was, in fact, not in a flood plain. That is, until Chase, decided that their house was in a flood plain after all and is requiring $185,000 in flood insurance.

If Enough Banks Fail, The FDIC Could Run Out Of Money

Everyone knows that your money is safe in an FDIC insured bank because if the bank fails (Hello, IndyMac!) the FDIC will step in and repay your money (generally, up to $100,000.) But what if the FDIC runs out of money? It doesn’t have an unlimited supply and enough bank failures could completely drain its fund, says ABCNews:

Homeowners Sue Countrywide!

Who isn’t suing Countrywide lately? Phuong Cat Le from the Seattle Post-Intelligencer says that a group of homeowners are now suing Countrywide, alleging that the lender steered them toward high-risk loans without disclosing the inherent risks.