Only two short years ago, Citibank was worth $244 billion. Now, after its stock lost half of its value in just the past week, the bank is estimated to be worth $20.5 billion. What happened? The New York Times attempted to answer that question Saturday, and it pointed the finger at the usual suspects — conflicts of interest between those who were supposed to manage risk — and those who stood to benefit from making risky bets.

banking

../../../..//2008/11/20/if-you-have-an-account/

If you have an account with Mint, and you’ve enabled mobile alerts, you can now text “Bal” or “Balance” to 696-468 (MyMint) and receive a summary of all of your accounts. [Mint]

../../../..//2008/11/18/are-you-so-loaded-that/

Are you so loaded that you exceed the FDIC’s guarantee limit for deposits? Consider the Certificate of Deposit Account Registry Service. Deposit the funds at one of 2,500 CDARS member banks and they’ll automatically spread your cash among other member banks as needed to stay within FDIC coverage limits. Kiplinger says, “You’ll earn one rate (set by the home bank) and get one statement and one form at tax time.” [Kiplinger]

Banks Want To Forgive Credit Card Debt — But The Government Says No

The next wave of the credit crisis — the skyrocketing defaults on credit cards — is coming in and odd alliances are being formed. The Consumer Federation of America, along with the Financial Services Roundtable ( a self-described “major player on Capitol Hill and with the regulators” which represents the securities, investment, insurance and banking industries) has requested a “special program that would allow as much as 40 percent of credit card debt to be forgiven for consumers who don’t qualify for existing repayment plans.”

../../../..//2008/11/12/the-government-has-officially-announced/

The government has officially announced that they will not be buying troubled mortgage assets — the original point of the so-called Trouble Asset Relief Program, and will instead be offering the bailout money to financial firms that are getting hit with a wave of defaults in credit cards and car loans. [CNNMoney]

American Express Becomes A Bank… And Wants Bailout Money

American Express won U.S. Federal Reserve approval to become a bank holding company — giving it access to the bailout party as credit card defaults climb. Bloomberg News says that the Fed waived the usual 30 day waiting period because (in the words of Fed Chairman Ben Bernanke) we’re experiencing “unusual and exigent circumstances affecting the financial markets.” Today, American Express has requested $3.5 billion in taxpayer-funded capital from the federal government, says the WSJ.

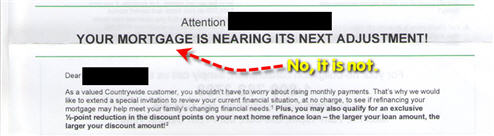

Countrywide To Fixed Rate Customer: Your Mortgage Is About To Adjust!

Countrywide either doesn’t know, or doesn’t care that reader Graham has a fixed rate mortgage, because they keep sending him “notices” that his mortgage is about to “adjust.”

Greenspan Says That His Free-Market Ideology Was Flawed

Here’s something that probably doesn’t happen too often. Former Federal Reserve chairman Alan Greenspan had a crappier day than you did. He had to admit before our federal government that his free-market, anti-regulation ideology was “flawed.” Ouch.

../../../..//2008/10/22/wachovia-announced-their-237-billion/

Wachovia announced their $23.7 billion third quarter loss with an all-too-easy-to-mock pre-taped conference call. “Let’s just close our eyes and imagine what the combination of Wells Fargo and Wachovia will create,” said CEO Bob Steel. We suppose that does make it easier not to rudely stare at the number “23,700,000,000.” [WSJ Deal Journal]

Bank of America CEO Explains How He Beat Wall Street

Is the new financial capital of our country located in Charlotte, NC? 60 Minutes traveled down south to talk to CEO Ken Lewis about his bank, its recent purchase of Merrill Lynch, whether or not the bank bailout is “socialism” and the economic crisis in general.

Treasury Expected To Pump $250 Billion Into Banks In Exchange For Stocks

The Treasury Department is expected to announce that it will be pumping $250 billion into banks both large and small tomorrow… and the FDIC is expected to offer an unlimited guarantee on bank deposits in accounts that do not bear interest.

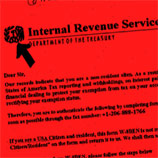

Fake IRS Fax Demands Your Bank Account And Passport

Nick has written in to warn us about a fake IRS scam that lately has been targeting nonresident aliens (e.g. teachers and researchers) working in the U.S., as well as American citizens working abroad. In the scam, which has been going on since at least 2002 (pdf), the target receives a faxed request from the IRS to provide his name, SSN, and pretty much every other bit of data you’d need to take over a person’s financial identity.

Government May Begin Buying Bank Stock Within Weeks

As it is now apparent that the credit crisis has spread to the global economy and has not been contained in any way, the Bush Administration is considering an option included in the $700 billion dollar bailout package that would allow them to invest directly in banks — buying preferred stock in exchange for a “cash injection.” White House spokesperson Dana Perino said taking partial ownership of banks and other moves associated with the financial rescue plan would not be “part of [Bush’s] natural instincts,” according to the NYT, but acknowledged that the situation has gotten sufficiently dire as to warrant a change of heart.

Don't Keep Your Money In A Shoebox, Or At Least Don't Pose For A Photo With It

Thanks to the New York Post, we know there’s a 48-year-old man named Richard Cruz somewhere in Manhattan who’s hoarding his daughter’s college fund in a shoebox. We even know what he looks like, because in the photo that accompanies the article, Cruz is posing on the sidewalk with his withdrawn cash like he just won the shoebox lottery. “‘No one hides their money under a mattress any more,’ he said. ‘That’s the first place people would look.'” Good thinking.

Citibank, Wells Fargo May Carve Up Wachovia, Feast On Its Bones

Bloomberg is reporting that Wells Fargo and Citibank may split Wachovia. Neither bank would get assistance from the government and taxpayers under the deal being discussed now.

Not So Fast: Judge Blocks Wachovia Sale To Wells Fargo, Citibank Rejoices

Tsk tsk, Wells Fargo. You should’ve known that stealing Citibank’s unspoiled bride at the alter was going to draw a bitter legal challenge. Late last night, Citibank’s team of repo-lawyers claimed a partial victory, announcing that a New York judge has agreed to block Wachovia’s sale. Citibank is also demanding $60 billion from Wells Fargo for interfering with the deal.

7 Stupid Online Security Mistakes You're Probably Making

A new study National Cyber Security Alliance says that you’re probably making one of these 7 stupid mistakes when it comes to your own online security. The study shows that when Symantec, polled 3,000 online users and scanned the computers of 400 of them, 81 percent of respondents said they were using a firewall, but only 42 percent indeed had a firewall installed on their computer. Whoops.