Should bailout out banks be buying naming rights? Dennis Kucinich doesn’t think so, and last week he urged the Treasury department to cancel one such deal between Citibank and the New York Mets. Now Bloomberg says that seven more bailed out banks are spending money on stadium rights.

banking

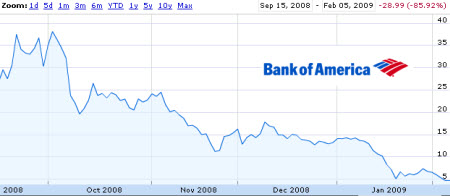

Is Bank of America About To Become THE Bank of America?

Bank of America‘s stock slid to a 20 year low today as investors became increasingly convinced that the bank would be nationalized. Share tumbled 18% early today, before climbing back up in the afternoon, says CNNMoney.

Gee, How Much Does A Bailed Out Executive Make, Anyway?

The New York Times is reporting that the Obama administration announced a $500,000 pay cap that prohibits bonuses for any companies that take additional taxpayer assistance.

Should Banks Be Required To Ask Permission For Overdrafts?

When you sign up for a checking account, most banks automatically enroll you in a “courtesy overdraft protection” program. This program means that the bank will approve overdrafts from your ATM or debit card — and charge you a $35 fee for each transaction, etc. But what if you don’t want the service? Well, the Federal Reserve has proposed a new regulation that will require banks to ask your permission before they sign you up.

Despite Economic Disaster, Wall Street Collected $18.4 Billion In Bonuses

Bonuses are for a job well done, right? Well, despite the economic disaster, it seems that the folks on Wall Street rewarded themselves with $18.4 billion in bonuses in 2008, which is around the same amount as they received in 2004 — when the Dow was “flying above 10,000, on its way to a record high,” says the New York Times.

9 In 10 Executives At Bailed-Out Banks Kept Their Jobs

Over 100,000 people have been laid off by banks, but 9 in 10 executives at banks that accepted bailout money are still working says the Associated Press.

Bank Of America Fires Former Merrill Lynch CEO

It seems that Bank of America didn’t really appreciate that unexpected $15.4 billion dollar 4th quarter loss by Merrill Lynch — because its former CEO, John Thain has been shown the door.

Claim Your Share ($78) Of The Bank Of America Overdraft Settlement

Bank of America has settled a class action lawsuit over its dirty overdraft tricks—things like approving transactions that generate overdraft fees, for example, or clearing transactions in high-to-low order to increase the number of overdrafts. If you’re a former customer of BoA, Fleet, LaSalle Bank or United Trust Company, you can claim your part of the settlement fund.

WaMu To Close 299 Branches, Many In Chicago

Chase has announced that they will be closing 299 branches, 57 of them in the Chicago-area alone. The Daily Herald says that most of the branches are across the street or down the block from existing Chase branches and consolidation is necessary. The remaining WaMu branches will be converted to the Chase brand.

../../../..//2009/01/16/macys-now-admits-that-it/

Macy’s now admits that it was an in-house software glitch that caused them to charge in-store debit card users twice on the Saturday before Christmas. [StorefrontBacktalk] (Thanks to Evan!)

Citibank Will Split Into Two Companies, Promises To Lend To Consumers

Vikram Pandit, CEO of Citigroup, announced today that the company would be split after reporting a net loss for 2008 of $18.72 billion. He also promised to put the money from the $700 bailout to work by extending credit to consumers and businesses… responsibly.

What's The Difference Between Money Market Accounts And Money Market Funds?

This year, many investors learned the hard way the difference between a money market account and a money market fund. Do you know the difference?

Was George Bailey Just A Subprime Lender?

It’s A Wonderful Life is a heartwarming classic film — but it now seems to have wrecked our economy. Whoops!

If Bank Of America Makes You Angry, Do Not Call 911 And Say The Bank Is Being Robbed

Here’s a suggestion for all of you who bank at Bank of America. If the bank makes you angry, do not try to get revenge by calling 911 and reporting a fake robbery in progress.

Help! They Closed My Credit Card Because I Didn't Use It!

Reader Kevin is upset with WaMu because they closed his credit card due to inactivity. Had he known they were going to do this, he says he would have been happy to pay a small fee to keep it open, etc. The card is the oldest one on his credit report — and closing it has affected his FICO score.

WaMu Told Washington That Adjustable Rate Mortgages Were Safer Than Some Fixed Ones

The Associated Press says that a review of regulatory documents shows that years before the subprime mortgage crises developed into a full blown economic meltdown— the government ignored warnings and listened instead to lobbyists who represented some of the same banks that have now failed.

Top 3 Foreclosure Scams To Avoid

With so many people facing foreclosure these days, it’s a good idea to educate yourself about the types of scams that take advantage of folks who are having trouble paying their bills. Even if you are doing ok, perhaps you can help someone else by recognizing a scam.