More and more local banks are turning to the internet to entice deposits, offering high yields and favorable loans terms. But how do you know if a bank is legit? Ask the FDIC.

banking

Taco Bell Typo Causes 11 Overdraft Fees

A Vancouver man says he was overcharged by Taco Bell — costing him hundreds of dollars in fees. The man used his debit card to buy $15 worth of Taco Bell for his family. The receipt read the correct amount, and he says he didn’t notice that his card had been debited $150 until he started receiving overdraft fees for each item he bought after Taco Bell.

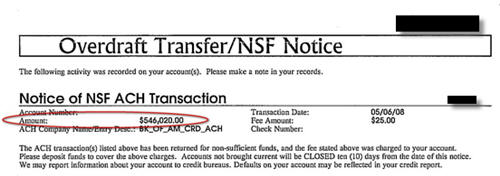

Whoops: Typo Causes You To Overdraft $546,020

Reader Thomas was celebrating the birthday of his 1 year old when a letter arrived from his credit union. It was a notice informing him that he had overdrafted his account. By $546,020. Whoops.

HSBC, Wells Fargo Accused Of Racism In Mortgage Issuing

The NAACP this week filed a class action suit accusing Wells Fargo and HSBC of charging unfairly high interest rates to African American homeowners with high incomes and high credit scores. The banks were quick to slap down the charges as “totally unfounded and reckless,” even in the face of convincing evidence from the NAACP.

Banks Didn't Pay Into FDIC Coffers From 1996 To 2006

For 10 years—including the boom times banks enjoyed in the first half of this decade—the FDIC was prevented from collecting fees from 95% of financial institutions, which it would have used to further build up its safety net in the event it would someday have to bail out a bunch of stupid losers who confused banking with alchemy.

Why Is The AIG Bailout Money Being Given To Banks?

The Wall Street Journal recently unleashed a wave of anger by reporting that much of the $173 billion given to nationalized insurer AIG went to banks — including billions to European institutions like Societe Generale and Barclays.

Gee, What's More Expensive Than A Share Of Citibank?

The Huffington Post (yeah, yeah) suggested: An episode of Family Guy on iTunes, Starbucks coffee, and a bag of peanut M&M’s. (Dead animal free, we hope.)

See The Bank Failure And Foreclosure Rates In Your State

CNN Money has put together a couple of quick interactive maps of the U.S. that let you see the bank failure rates and foreclosure rates for each state. According to these two maps, Wyoming is the place to be.

NY AG To Find Out Who Got The Merrill Bonus Money "By Whatever Means Is Necessary"

The NY AG has served Bank of America with a subpoena after they refused to release the names of the individuals who received over $3 billion in bonuses while Merrill Lynch was hemorrhaging money.

B of A Heiress Says Bank Is "Repulsive", Run By "Idiots"

Virginia Hammerness, the 75-year-old heiress to A.P. Giannini’s family fortune and a significant stockholder in Bank of America, the bank her grandfather founded in San Francisco in 1904, has harsh words for the people in charge.

What Should We Do With All These #@$@& Empty WaMu Branches?

WaMu went on an insane building spree in Chicago a few years ago, and when combined with Chase, already a huge player in the Chicago market, it became obvious that there are just too many damn bank branches. Chase recently announced that it would close almost 300 WaMu locations nationwide — 57 of them in the Chicago-area alone. The bank branches replaced local businesses during the boom, but will they come back during the bust?

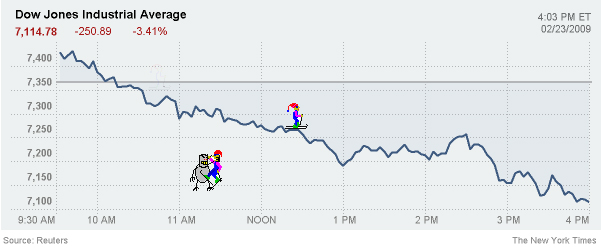

Freak Out Continues: Markets Close At Lowest Level Since 1997

Bad day on Wall Street today, folks. The S&P 500 closed at the lowest level since April 1997.

Merrill Lynch CEO: "Nothing Happened In The World Or The Economy" That Would Justify Suspending Bonuses

You know how Merrill Lynch recently lost $15 billion? Remember how we’re in a unbelievably huge global financial crisis that threatens to unravel the fabric of our economy? John Thain says that’s no reason not to pay billions of dollars in bonuses.

../../../..//2009/02/23/the-wall-street-journal-is/

The Wall Street Journal is reporting that the government may end up owning a 40% stake in Citibank. [WSJ]

Laid Off? Get Ready To Pay Bank Fees On Your "Unemployment Debit Card"

The Associate Press says that 30 states have cut deals with bailed out banks like JP Morgan Chase, Citigroup, and Bank of America to distribute unemployment benefits on debit cards instead of paper checks. The catch? All of these programs have fees — and in some states the cards are mandatory.

Market Convinced Banks Will Be Nationalized, Freaks Out

Shares of banking stocks are dragging down the markets as investors become increasingly convinced that the banks will be nationalized, says Reuters. Investors are shunning the companies, worried that shareholders will be wiped out in a government takeover, and are fleeing to U.S. Government bonds and gold, which rose to above $1,000 an ounce.

Before Traveling, Make Sure AmEx Hasn't Canceled Your Card

Ronnie Sue’s recent trip to Germany was a financial nightmare. Though she warned her bank she would be traveling to Germany, when she arrived, she couldn’t withdraw needed cash. The bank gently suggested that Ronnie Sue draw cash from her credit card, and even offered to refund any cash advance fees. It wasn’t until Ronnie Sue whipped out her AmEx that she learned it had been silently canceled two days before she left…