Coping with the death of a loved one is often a devastating emotional and psychological process, and for those tasked with tying up the loose ends of a late friend or family member, it probably doesn’t help when you’ve got to repeatedly explain to a seemingly endless string of customer service reps why they can’t speak to the account holder. [More]

Search results for: surprise medical bill

$164 Per Mile: Surprise Ambulance Bills Are A Growing Problem & Difficult To Avoid

We’ve already seen that unconscious patients can end up with huge medical bills when an ambulance takes them to a hospital that doesn’t accept their insurance. But even if you’re conscious enough to point the driver toward the right hospital, you could still be stuck owing hundreds, even thousands, of dollars because that ambulance ride isn’t covered by your insurance. [More]

Walmart Ordered To Pay $31 Million For Retaliating Against Pharmacist Whistleblower

A federal jury in New Hampshire has slapped the nation’s largest retailer with more than $31 million in penalties for unlawful retaliation and gender bias against a former pharmacist who blew the whistle on safety concerns involving her co-workers. [More]

Our Picks From 2015: Editors’ Favorite Stories Of The Year

We write thousands of posts every year at Consumerist, and before we hit “publish,” we tell each of them that they’re our favorite. That’s a lie, though: everyone has their favorite projects or tasks at work, and so do we. Whether it’s because of their real-world impact, delicious research, important topics, or strange paths they led us down, we each have our favorites out of our work for the year. Each of our writers chose theirs along with some honorable mentions, and explained precisely why they enjoyed it so much. [More]

24 Stories We Covered In 2015 That We Never Saw Coming

The following is a true story: One day, two Consumerist staffers were chatting about the work day. One said, “I can’t believe I’m writing about the legal ramifications of butt-dialing.” The other replied, “We should probably remember this conversation for a year-end story about things we didn’t expect to ever write in 2015.” A calendar alert was made, and our future selves were duly reminded. [More]

Another Year That Shouldn’t Have Been: The 50 Most Embarrassing Stories From 2015

The end of the year is a time to reflect on the good times, bad times, and those that just made you scratch your head in disbelief. While there were plenty of really great – and not so great – things that happened in 2015, we’re here to remind you of some of the most baffling, embarrassing, and gaffe-worthy business and consumer stories that graced the pages of Consumerist in the last 12 months. [More]

Blasts From The Very Recent Past: Consumerist’s Most-Read Stories For 2015

Another 365 days, another 6,000 or so Consumerist stories in the can. We’ve seen the biggest name in TV fail miserably (again, and again), cooked our own burgers and pondered the history of the hot dog, investigated surprise medical bills while getting the sense of what it’s like to own a very small share of a very large NFL team. In short, it’s been your typical sort of year for us. [More]

Medical Data Privacy Laws Don’t Actually Cover Apps, Wearables, And Other Consumer Stuff

The future’s really cool sometimes: We get to use all sorts of new technology tools and cloud-based services to help us manage our health. That constellation of apps, trackers, tests, and gadgets gives huge insight into our health and bodies, which is useful to millions… but it also lets a stunning amount of the most personal data out into the wild, unregulated and uncontrolled. [More]

Why Emergency Rooms Are A Hotbed For Surprise Medical Bills

When you head into the emergency room, you might assume that the doctors you see are hospital employees who accept the same insurance plans as their employer. But nearly two-thirds of hospitals now staff their ERs with freelance physicians who might not accept your insurance plan, meaning you’ll be on the hook for whatever your insurer doesn’t pay. In addition to the potential added financial burden, some patients now have to drive far out of their way to find an ER that won’t hit them with a surprise medical bill. [More]

Lawmakers Introduce Legislation To Curtail Surprise Medical Bills

There are good surprise and there are bad surprise. Falling into the latter category are unexpected medical bills, which affect nearly 30% of privately insured Americans. This week, lawmakers took steps to shield consumers from these often burdensome tabs. [More]

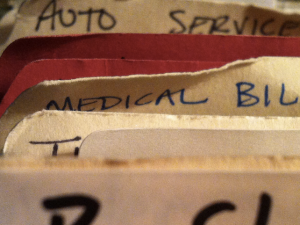

Insurance Loopholes & Master Pricing: How Surprise Medical Bills Knock Consumers Down

Most of us know which local hospitals and doctors are covered by our insurance providers, but even when we make sure that we only see an in-network physician or surgeon, nearly one-third of privately insured Americans are still hit with higher-than-expected medical bills, often because their in-network hospital brought in or contracted out to an out-of-network service provider. How did we get to the point where so many consumers have so little information about what to expect when their hospital bill arrives? [More]

California Assembly Passes Measure To Ensure Consumers Don’t Face Costly Surprise Medical Bills

When you’re recovering from surgery, the last thing you want is to be blindsided by an unexpected bill for hundreds, if not thousands, of dollars because the hospital hired an out-of-network anesthesiologist or other specialist without telling you. Unfortunately, this type of surprise medical bill has become an unwelcome reality for nearly 30% of privately insured Americans. California lawmakers have just cleared a major hurdle in their goal of enacting a law that would protect consumers from unforeseen and often unavoidable medical charges. [More]

That Was Then, This Is Now: How 72 Brands From ‘Mad Men’ Have Changed Since Don Draper Was In Charge

Because nothing gold can stay, AMC’s popular Mad Men has reached the final episode of its final, seventh season. Over the course of the show, we’ve seen pitches for a multitude of companies, brands, sports, groups and even cities. While some of those brands were created for the show, the large majority were very real — and some continue to exist today. In the spirit of nostalgia, we thought now might be the right time to check in on those products and companies pitched by Sterling Cooper (and its various rebirths), to see which have been lost to the mists of time, and which still remain. [More]

Nearly 1-In-3 Privately Insured Americans Received A Surprise Medical Bill In Last Two Years

When you visit your doctor for a blood test, get an ultrasound, or have surgery at a medical facility that accepts your insurance, you likely expect that you’ll only be required to go out-of-pocket for the co-pays and deductibles detailed in your health plan. But the results of a new survey show that there’s a decent chance you’ll be hit with a surprise charge or two when those medical bills finally arrive. [More]

Report: Billing Errors, Varying Procedure Costs Create Environment For Excessive Medical Debt

Making a trip to the doctor undoubtedly leaves many consumers’ wallets a little (or a lot) lighter. While some people going in for planned medical procedures might seek out doctors covered under their insurance to help alleviate out-of-pocket costs, a new report found that even with advances in medical policy consumers are feeling the burden of medical debt. [More]

Corinthian Colleges Employee: “We Work For The Biggest Scam Company In The World”

Corinthian Colleges — the operator of for-profit school chains Everest University, WyoTech, and Heald Colleges — is selling off or shutting down campuses as it faces lawsuits and investigations from multiple state and federal agencies. The allegations involve bogus job-placement stats, grade manipulation, and misleading marketing. We recently spoke to several current and former CCI teachers and admissions staffers who confirmed these bad practices and explained that it was all done in pursuit of billions of dollars in federal aid from taxpayers. [More]