Nearly 1-In-3 Privately Insured Americans Received A Surprise Medical Bill In Last Two Years Image courtesy of frankieleon

When you visit your doctor for a blood test, get an ultrasound, or have surgery at a medical facility that accepts your insurance, you likely expect that you’ll only be required to go out-of-pocket for the co-pays and deductibles detailed in your health plan. But the results of a new survey show that there’s a decent chance you’ll be hit with a surprise charge or two when those medical bills finally arrive.

According to the results of a nationally representative online survey by our colleagues at the Consumer Reports National Research Center, 30% of privately insured Americans received a medical bill during the last two years in which their health plan paid less than they expected.

When it came to privately insured individuals who visited an emergency room or underwent surgery during that same time period, nearly 37% received a bill that was more than they were anticipating.

LOOPHOLES IN YOUR COVERAGE

Barring cases when it’s not just possible, most insured consumers only see physicians or go to hospitals listed as in-network by their insurers. So why are many patients receiving invoices for hundreds, and sometimes thousands, of dollars in unexpected charges?

In some cases, loopholes in the health insurance system have created a scenario in which consumers are blindsided by their medical expenses they simply can’t avoid.

“Even if you go to a hospital in your network, the unfortunate truth is that there is no guarantee that all your treatment — whether it’s the radiologist, anesthesiologist or lab work — will be treated as in-network,” explains DeAnn Friedholm, Director of Health Reform for Consumers Union.

For example, while a patient’s insurance may cover the full cost of a planned surgery and the time spent in the hospital, the lab furnishing test results for the hospital or a specialist called in to assist with the procedure might not fall under the insurance company’s coverage. The patient’s insurance won’t necessarily cover the full cost of these out-of-network providers, so the patient is left with debt they could never have anticipated.

COSTLY ASSUMPTIONS

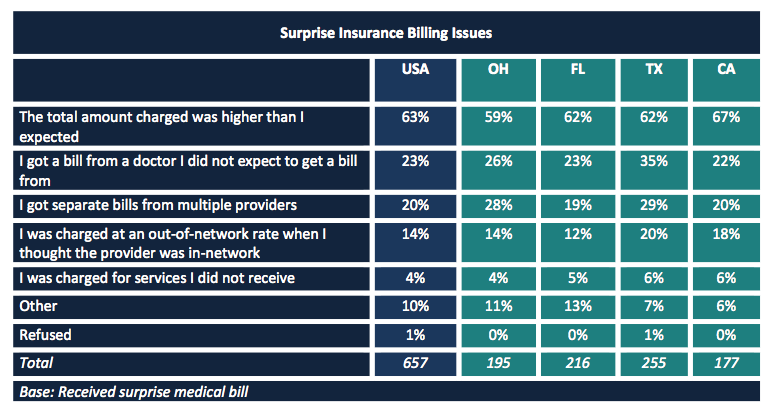

Nearly 63% of the consumers in the survey say they assume that doctors at an in-network hospital were considered in-network by their insurance company. But that’s simply not the case.

In the past two years, nearly one-in-seven Americans say they have found out that a doctor, lab or facility they thought was in-network was actually out-of-network.

The use of out-of-network facilities and consultants by in-network hospitals and doctors likely contributed to the fact that one-in-four consumers say the recently received a bill from a doctor they didn’t expect to receive one from.

The overwhelming majority of survey respondents say insurance companies and hospitals could do better when it comes to preparing consumers for the reality of hefty, unexpected bills. Nearly 85% of them believe that hospitals should be required to notify patients if a doctor or technician involved in their procedure will be out-of-network.

While the survey lends credence to reports that surprise medical bills are becoming an increasingly prevalent issue for millions of consumers each year, it also points out that most of the time those consumers don’t know what to do about the hefty bills.

CONFUSION LEADS TO COMPLAINTS… AND MORE CONFUSION

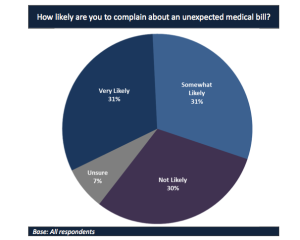

Most survey respondents said they were very likely or somewhat likely to complain about unexpected medical bills.[click to enlarge]

But for those who did complain about their bills about 53% say the issue was either not resolved to their satisfaction or not resolved at all, with 57% of the group eventually paying the bill in full.

Part of the problem related to the unsatisfied or unresolved issues likely stems from consumers’ lack of knowledge of the proper channels for airing their grievances.

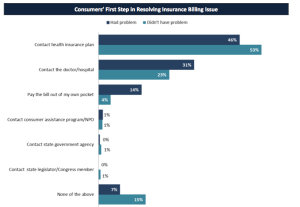

When faced with a billing problem, 46% say they would first contact their health insurance plan, while 31% say they would contact the doctor, hospital or health care provider to resolve the issue.

While both of those options might result in a lower bill, it also illustrates that consumers are often unaware of their health insurance rights and what state entities are available as resources.

Most consumers would start the complaint process by contacting their insurance provider. [click to enlarge]

Additionally, 67% of consumers don’t know which state entity is responsible for resolving issues with health insurance billing, while 87% don’t know the state agency or department tasked with handling complaints about health insurance.

SO WHO AM I SUPPOSED TO COMPLAIN TO?

To assist those facing unforeseen medical bills, Consumers Union has launched an online tool that allows users to find the right resources for assistance in their state.

In addition to providing consumers with needed tools, Consumers Union is also supporting legislation in California and Texas that would strengthen protections against these surprise bills.

“Opponents of legislation to strengthen consumer protections against surprise medical bills often say this isn’t a big problem for consumers and point to a lack of complaints at state insurance departments,” Friedholm says. “This survey clearly shows that consumers want to complain about bills, but don’t know who to contact or even if they should be complaining.”

Consumer Reports Survey Finds Nearly One Third of Privately Insured Americans Hit with Surprise Medical Bills [Consumers Union]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.