More than 12 million U.S. college students applied for federal aid for the school year starting this fall, but around 126,000 of these applicants have been flagged by schools and the government as potential scammers looking to cash aid checks without ever intending to get an education. [More]

Education

The Pros And Cons Of Using A Home Equity Loan To Pay Off Your Student Debt

American consumers currently owe around $1 trillion in student loan debt, and many of them are paying it back at a higher interest rate than what you’d pay on a home equity loan. Furthermore, many student loans don’t offer the ability to refinance at a lower rate. So does it make sense for homeowners with student loan debt to take out an equity loan in order to pay off that lingering college debt? [More]

House Passes Bill Tying Student Loan Rates To Treasury Notes

While Senator Elizabeth Warren pushes for legislation that would allow student borrowers to enjoy the same insanely low interest rates as big banks (for one year at least), the House of Representatives today passed a bill that would link the interest rates on federal student loans to the yield on the 10-year Treasury note. [More]

CFPB Student Loan Ombudsman Now Taking Questions On Reddit

In a series of posts on Consumerist, Rohit Chopra, the Consumer Financial Protection Bureau’s Student Loan Ombudsman, answered readers’ questions about comparing, paying for, and getting out from under student loans. If you missed it, or didn’t get your question answered, head on over to Reddit where Rohit is currently taking part in an Ask Me Anything session with readers. [More]

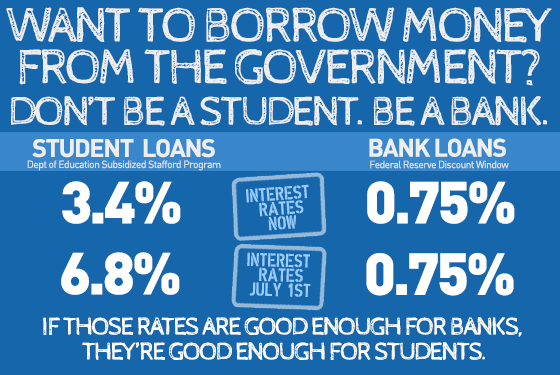

Sen. Warren Introduces Bill To Lower Rates On Student Loans To .75% For One Year

While commercial and personal borrowers are currently enjoying historically low interest-rates on loans, and big banks are able to obtain loans at less than one percent interest, student borrowers have had to fight against lawmakers looking to raise interest rates on federally subsidized student loans. With the rates on Stafford loans set to bounce back to 6.8% from 3.4% on July 1, Massachusetts Senator Elizabeth Warren has introduced legislation that would actually lower that rate for one year to only .75%. [More]

Student Loan Company Implies That If I Don’t Friend Them On Facebook, I Will Default

Great Lakes Higher Education Corporation is a large student loan servicer/guarantor, and a not-for-profit company. Their goal is a worthy one: they want to keep their customers engaged and get them to pay their student loans back. This is for the good of their customers, the good of the company, and really for the good of our entire economy. A recent e-mail they sent to their customers bothered a few readers, though, because it seemed to imply that if they didn’t follow the company on Twitter, they will default on their student loans. [More]

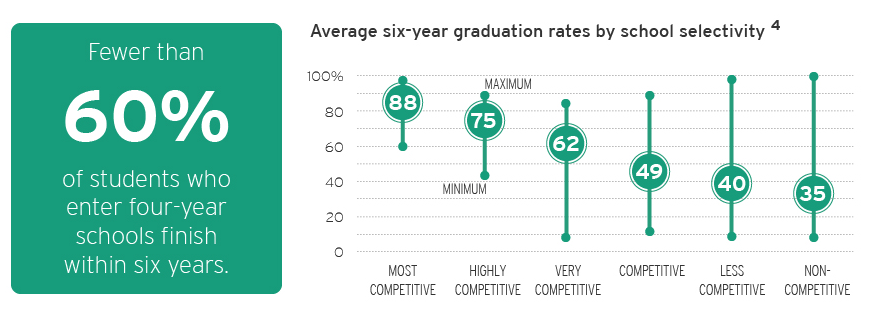

Why College Isn’t Always A Good Financial Investment

There’s no doubt that the average college graduate earns more than the average worker with only a high school diploma, but a new report shows that it may not always make financial sense to invest in a degree. [More]

Loan Co-Signers Should Not Be On The Hook With The IRS If The Debt Is Forgiven

We’ve written numerous stories over the years about parents who co-signed student loans for their children and then were stuck with the payments when their child passed away or could not find employment. Sometimes lenders will choose to forgive that debt, but even then some are making a mistake that could continue to hurt the co-signer at tax time. [More]

Report: Student Debtors Under 30 Are Shying Away From Buying Homes, Cars

If life were a 1950s sitcom, college graduates would zoom out of school, get a job, buy a house, buy a car and get married. But these days, student loans are just one of many reason debtors under 30 are staying far away from the housing and auto markets. That, and life isn’t a sitcom. A new report from the Federal Reserve Bank of New York shows that this age group could be a drag on the economy by the very fact that they aren’t participating in it. [More]

The CFPB Answers Your Student Loan Questions, Part 3: Defaulting And Loan Forgiveness

In the second set of questions and answers about student loans, the Consumer Financial Protection Bureau’s Student Loan Ombudsman Rohit Chopra made a few mentions of the various service-specific loan forgiveness programs out there. Here, he gets into more detail and responds to questions about the one topic no one ever hopes to face: default. [More]

The CFPB Answers Your Student Loan Questions, Part 2: Repaying, Consolidating, Refinancing

Earlier today, Rohit Chopra, Student Loan Ombudsman for the Consumer Financial Protection Bureau, responded to questions from readers about applying for schools and comparing financial aid packages. In this second part, he deals with the many issues involved with repaying your student loans. [More]

The CFPB Answers Your Student Loan Questions, Part 1: For Prospective Students

A little while back, we asked Consumerist readers to send in their student loan-related questions to Rohit Chopra, the Consumer Financial Protection Bureau’s Student Loan Ombudsman. Today, we’re bringing you his answers in three parts, each dealing with a different aspect of the topic. Since it’s about time for next year’s freshman class to decide on schools and financial aid packages, we’re starting with answers for prospective students. [More]

Worst Company In America Round 2: Sallie Mae Vs. Ticketmaster

No better way to ruin a good Friday afternoon than to bring up two companies people simply hate giving their money to. Thankfully, only one of these bad businesses will survive. [More]

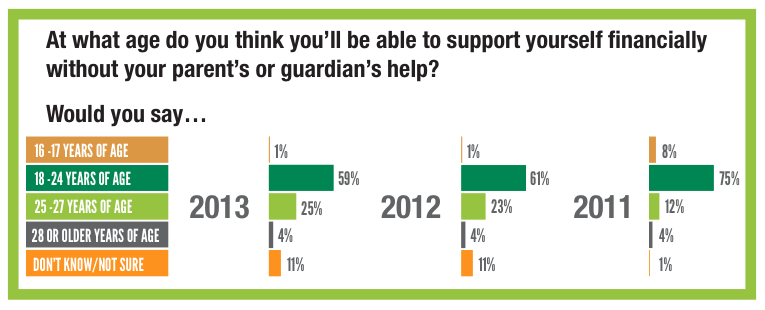

Number Of Teens Expecting To Depend On Parents Into Adulthood Has Doubled Since 2011

In what could be an indicator of either a massive drop in teens’ financial prospects or the fact that teens today are getting more realistic about their financial futures, a new survey shows that the percentage of teenagers who expect to remain dependent on mom and/or dad until at least age 27 has doubled in just the last two years. [More]

Meet Your Worst Company In America Not-So-Sweet 16!

Last week, 32 terrible titans of industry stepped on to the blood-stained mat of WCIA Death-and-Dismemberment Arena, but only 16 remain in this bestial battle royale to take home the treasured Golden Poo. [More]

Worst Company In America Round 1: PayPal Vs. Sallie Mae

Ready or not, it’s time to start Day 2 of bloodthirsty competition in the Worst Company In America tournament. Kicking things off for today is a match-up between two companies that love processing your payments, but don’t really show the love when you call to complain. [More]

13 Attorneys General Voice Support For Federal Bill To Curb Advertising By For-Profit Schools

Earlier this week, Senators Kay Hagan (North Carolina) and Tom Harkin (Iowa) decided to take another go at introducing legislation that would seek to limit the amount of federal money for-profit schools could spend on advertising. At the same time, the Attorneys General from 13 states penned a letter to the chairs and ranking members of key Senate and House voicing their support for the bill. [More]

Send Us Your Questions For The CFPB’s Student Loan Ombudsman

In addition to the masses of consumers currently paying down their student loans, there are millions of Americans who are either about to pick a financial aid package for college or are just being hit with their first post-college loan payments. So we figured it was a good time to take some questions on the subject. [More]