Sallie Mae The Subject Of Nearly Half Of Student Loan-Related Complaints Image courtesy of (phildesignart)

In fact, of the nearly 2,900 complaints registered with the CFPB since March, 87% percent of them were directed at just seven companies, showing both the concentration of the market and the fact that it’s really just a few people screwing it up for everyone. The only other company representing a double-digit percentage of complaints was American Education Services (PHEAA), with 12%.

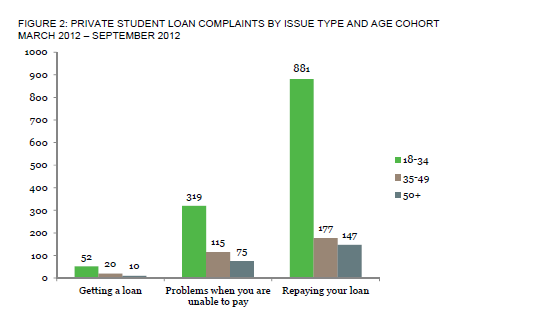

So it only makes sense that an overwhelming majority of the complaints (95%) involved how loans are serviced after they’ve been disbursed, whether it was problems repaying the loan (60%) or when the borrower was unable to pay (35%). highlighting the fact that, like the mortgage market not so long ago, it’s too easy to get a private student loan and a huge pain in the butt when you have issues about making payments.

The major problems brought to the CFPB portal sound an awful lot like the complaints of struggling homeowners trying to refinance or restructure their loans:

Inability to speak with personnel empowered to negotiate a repayment plan.

The most common complaint from student loan borrowers dealt with their difficulty or inability to make contact with anyone with actual authority at the loan-servicing companies when borrowers needed to discuss changes to payment plans because of unemployment, underemployment, or financial hardship.

Inability to refinance.

Because student loan borrowers often have a limited credit history when they apply for a a private student loan, they get stuck with a higher-than-usual interest rate.

In theory, as they later build up a credit history by making payments on the student loans and other accounts, they should be able to refinance to a lower interest rate that reflects the lower risk to the lender. But that doesn’t seem to be the case for a number of borrowers.

“We heard from a borrower who reported that he had $40,000 in private student loans and large monthly payments, reflecting the high interest rates for his loans, writes the ombudsman Rohit Chopra. “He reported that his credit profile is ‘leaps and bounds’ better than when the borrower applied for these loans… Nevertheless, he said that his servicer informed him that they do not offer any opportunity to refinance and urged him to seek alternative financing elsewhere in the marketplace. But the borrower reported that alternative financing was not readily available.”

“Good faith” partial payments leading to default.

Borrowers who can’t pay in full will send in partial payments while they try to refinance, often with detailed explanations. But servicers are still flagging these borrowers as defaulting on the loan. In some cases, this could lead to the full outstanding value of the loan coming due right away. Obviously, to someone who is having trouble making monthly payments, this is likely not an option — unless they’ve been stashing tens of thousands of dollars away for a rainy day.

What’s worse is that student loan borrowers, much like a lot of underwater mortgage holders, say they are being told by employees at the servicer to just pay what they can, without mentioning, “Oh, by the by, not paying in full will result in default.”

Unexpected checking account transactions.

The CFPB reports that some borrowers who have loans with the same bank that hold their checking account have found that when they don’t pay their monthly payment in full, the bank will deduct the difference straight from the borrower’s checking, often without alerting them to the transaction.

This can be avoided by not having your loan and your checking in the same financial institution, but as Chopra writes, “Consolidation in the banking industry and changes in ownership of private student loans may mean that borrowers are unaware that the owner of their loans and their checking account provider are part of the same financial institution. In these cases, a checking account offset can catch borrowers unaware, leading to overdraft fees in addition to the surprise transaction.”

Which leads directly to…

Confusion when loans and servicing rights are bought and sold.

The report has the story of on borrower who took out a private student loan in 2003 with a large commercial bank. In 2010, her loan was sold off to another lender. “One day, she stopped receiving paper statements entirely,” writes the CFPB. “In the absence of monthly statements, she has had to call to confirm her payment amount each month. She has experienced payment processing delays and has been charged late fees several times since her loan was sold.”

And everyone’s favorite —

Debt collection practices.

Judging by complaints filed with the CFPB, it appears that some private student loan debt collectors are trying to exploit borrowers’ confusion between the collection tools available to recover private loans and the extraordinary powers granted to federal student loan debt collectors, like garnishing wages without a court order, seizing Social Security checks and offsetting tax refunds.

“We heard from a delinquent borrower who was told that if he signed up for $250 monthly, automatic payments, he would be able to avoid default,” writes Chopra. “After beginning these payments, he was contacted and informed that his loan had been charged-off — his balance of almost $50,000 was due immediately, in full. He described his payment arrangement, but was told ‘it doesn’t matter.’”

Reps for the two singled-out servicers tell Pro Publica they get all the complaints because they have the highest volume.

The Sallie Mae mouthpiece says the company — a perennial Worst Company In America contender — has “modified $1.1 billion in private education loans with interest rate reductions or extended repayment since 2009,” while the AES rep said the company works “daily with borrowers to explain repayment options and to help them avoid delinquency and default using all available means.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.