Number Of Teens Expecting To Depend On Parents Into Adulthood Has Doubled Since 2011

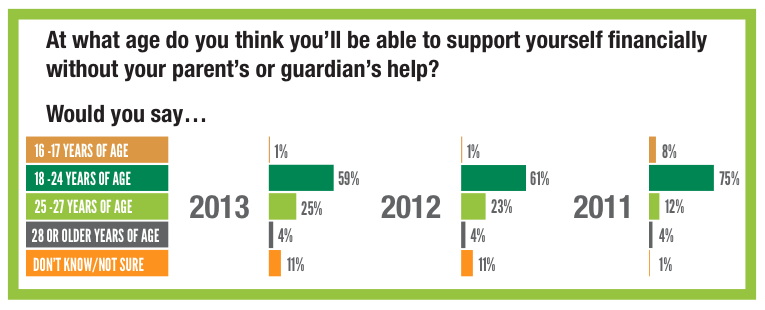

In 2011, only 12% of respondents to the Junior Achievement Teens and Personal Finance Survey said they would probably be financially dependent on a parent or guardian until the age of 27. According to the newly released 2013 survey [PDF], that rate now stands at 25%. Meanwhile, those who are completely unsure of when or if they will ever be dependent has jumped from 1% in 2011 to 11% in 2013.

Of course, these increases come with in a corresponding drop in the percentage of teens planning to have cut the parental purse strings by the time they hit 25. In 2011, 75% of teens said they would be supporting themselves at some point between 18 and 24. In just two years, that has decreased to 59%.

There has also been a shift over the last two years with regard to teens’ expectations for outperforming their parents financially. Two years, ago 36% said they believed they would ultimately be better off than the people who raised them, while 29% gazed into the crystal apps on their phones and saw a similar financial situation to their parents’.

Now, more than half (51%) of respondents only hope to do as well as their parent, while the number of those expecting to be better off than ma and pa remains at 38%.

Of course, a college education can be both a huge, long-term expense and an important factor in a young person’s long-term financial prospects. Kids today seem to know this, with 52% saying that students are borrowing too much for school and 64% claiming they have discussed paying for college with their parents. Yet only 9% of the surveyed teens are actively saving for a higher education.

And even though they are talking to their parents about paying for school, 48% say they have no idea how much, if any, will need to be borrowed so they can go to college.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.