2013 is gone, a collection of memories never to be dealt with again. Next week, the 113th Congress returns for its second session, ideally to enact legislation throughout 2014, some of which could help consumers if they were to become law. [More]

Education

One Company Is Working Hard To Make Sure Your Student Loans Stay With You Until You Die

Sometimes, terrible things happen in life. When something like cancer strikes, despite your best intentions and hardest efforts, medical bills and unemployment can leave you in a position where paying off your student loans is just not a thing you can make happen. [More]

71% Of Recent College Grads Owe Average Of $29K In Student Loans, Are Scared Pantsless About Paying It Off

The total of student loan debt in the U.S. has long since passed the $1 trillion mark, and a new report shows that this mountain of owed money is just going to keep getting bigger, while a recently released survey indicates just how terrified young adults are of folks’ ability to repay that debt. [More]

CFPB Adds Oversight Of Largest Student Loan Servicing Companies

While many banks offer student loans, much of the servicing of that $1 trillion in loans is actually done by non-bank, third-party companies, some of which have been criticized for being difficult to deal with and having byzantine repayment rules. Today, the Consumer Financial Protection Bureau, which already oversees student loan servicing by large banks, issued a new rule giving the agency the authority to supervise certain non-bank servicers in an effort to further ensure borrowers are being treated fairly and to rein in abusive loan servicing practices. [More]

Today’s College Grads Can Expect To Retire When They Are 73

Dear college seniors, if you’re planning on living out a long, comfortable retirement, you need to start saving now… or hope that medical science figures out how to extend life even further, because it looks like the average millennial will have a few years of retirement time before they kick off to a higher plane of existence. [More]

Getting Ahead On Paying Down Student Loans Is A Good Plan, But Not Without Problems

For people looking to get out from under student loan debt before they have grandchildren, paying more than is owed each month has traditionally been an option. But according to a new report from the Consumer Financial Protection Bureau, questionable practices and a lack of transparency at loan servicing companies have resulted in prepayment causing undue headaches. [More]

California Sues For-Profit College Operator For Lying To Students & Investors

California Attorney General Kamala Harris filed suit yesterday against a company that operates three for-profit colleges, alleging that it lied both to students about the prospects of job-placement, but also to investors about the success rate of its graduates. The complaint also accuses the colleges of illegally using military seals in its ads to lure in members of the armed services. [More]

New Rules Could Hold Career Education Programs Accountable For Graduates’ Success

While college tuitions and student loan debt has skyrocketed, a number of institutions — especially for-profit schools — have been criticized for failing to provide sufficient education and guidance to students who are then stuck without jobs and without the ability to pay back student loans. Starting Monday morning, the Dept. of Education will begin hearing feedback on a recently drafted regulation that would hold schools accountable for the performance of their students in the real world. [More]

CFPB: Many Of The 33 Million American Workers Eligible For Loan Forgiveness Aren’t Using It

Are you working in a job that serves other Americans — in a school, hospital, city hall perhaps — while living saddled with student loan debt? You could be part of the more than 33 million workers eligible to have student loans forgiven, a large number of which aren’t even aware they can do so. The Consumer Financial Protection Bureau says loan forgiveness program are too confusing for many to take advantage of, leading to a large number of wasted opportunities. [More]

Federal Student Loans Affordable Again (For Now)

To all the incoming college freshman and other first-time student loan borrowers, you need no longer worry about paying 6.8% interest rate on the federal Stafford loan disbursement you’re about to receive, as today the President signed much-debated, long-delayed legislation that will only result in a slight uptick in interest rates for the coming school year, but could also go much higher in years to come. [More]

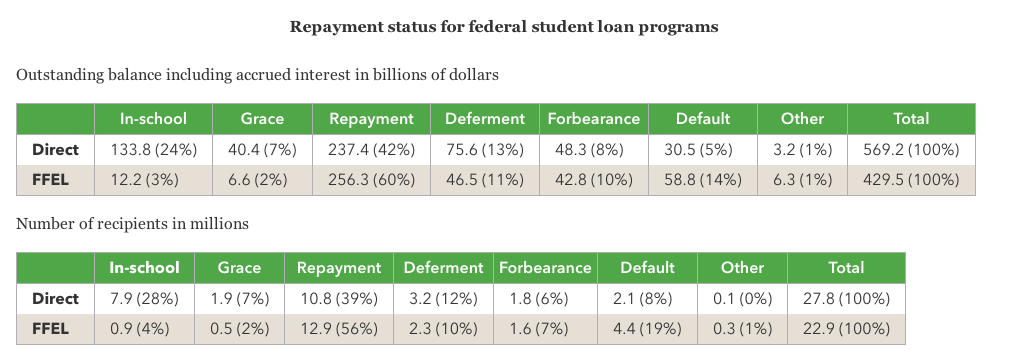

Fewer Than Half Of Federal Student Loans Currently Being Repaid

It’s scary enough to think that the federal government has around $1 trillion in student loan money out there waiting to be repaid. More frightening is the fact that not even half that amount is currently being paid back. [More]

Drop In Number Of First-Time Home Buyers Is Cause For Concern

The notion of buying your first home, building equity, and eventually moving up the property ladder is still something many young Americans aspire to, but between more stringent underwriting procedures, lingering student loan debt, competition from real estate speculators and higher interest rates, first-time buyers are being squeezed out of the market. [More]

Sen. Elizabeth Warren: It’s Obscene That The Govt. Profits Off Student Loans

There were several sticking points that bogged down the U.S. Senate from quickly passing legislation that would provide a long-term solution to the problem of interest rates on federal Stafford student loans. Among these was whether the government should be able to charge a rate that would allow it to make a profit. [More]

Senate Reaches Tentative Deal On Student Loan Interest Rates

One day after failing to move forward on a one-year extension of low interest rates on federal Stafford student loans, the U.S. Senate has reportedly reached a tentative agreement that tie interest rates to the 10-year Treasury bond, thus resulting in a moderate increase in interest rates for students taking out their first loan this fall. [More]

Senate Fails To Figure Out Solution To Keep Student Loan Rates In Check

As we mentioned before the holiday, the U.S. Senate had gone off to make sandcastles and enjoy fireworks without figuring out a way to keep interest rates on federal Stafford student loans from doubling. Now the first attempt to retroactively fix that problem has failed, with the Senate unable to move forward with a one-year extension on the lower rate. [More]

Lawmakers Letting Stafford Loan Interest Rates Double, But Don’t Freak Out Just Yet

U.S. Senators are taking the next week off to relax, which means the June 30 deadline for figuring out a way to keep the interest rates on subsidized federal Stafford student loans from doubling will pass without even an attempt at a last-minute resolution. But some lawmakers aren’t so worried and say they’ll get it all resolved when they come back after the fireworks. [More]

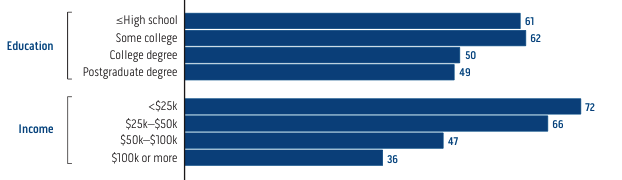

More Than Half Of People With Student Loans Are Worried They Can’t Repay

Only 1-in-5 American adults is carrying some sort of student loan debt, and yet that relatively small group of consumers accounts for more than $1 trillion owed to lenders, more than either auto loans or credit card debt. And a new survey finds that nearly 60% of these borrowers are worried that they won’t be able to pay off their student loans. [More]