You Still Hate Your Cable Company As Much As Ever, But Think Your Mobile Carrier’s All Right Image courtesy of flash.pro

Every year, a major customer satisfaction survey comes out with an updated look at how the country’s cable, phone, and pay-TV companies are doing. And every year, it turns out the answer is still: really badly. But while many cable companies continue to suck, one trend is clear — the more competition there is, the higher the satisfaction scores tend to be.

The American Customer Satisfaction Index (ACSI) ranks how happy consumers are or aren’t with a wide swath of American industries, including fast food, retail, and travel. But if you want to find the really unhappy customers — the ones who are angriest and most dissatisfied with what they’re getting for their money — you need to have a look at the annual telecom survey.

This year’s survey is the latest installment in a sad trend: By and large, Americans are really, really unhappy with their cable companies.

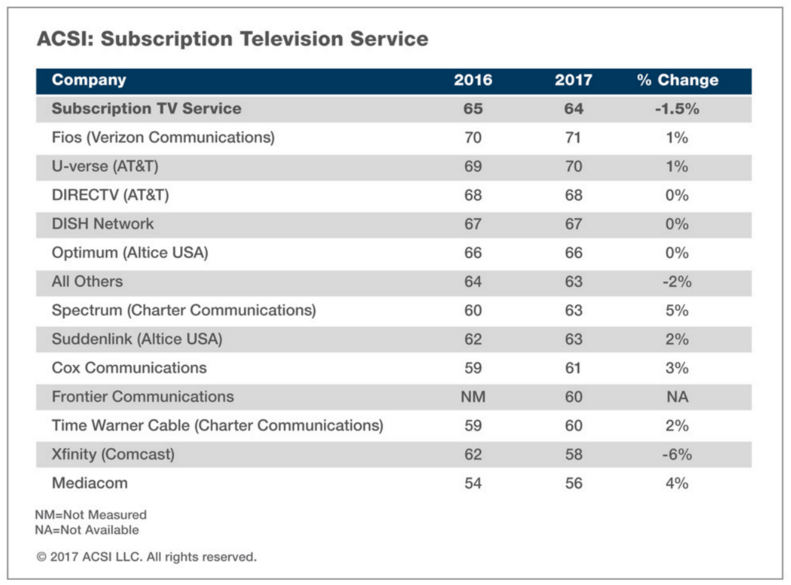

The top performing cable company in the pay-TV survey is Optimum (Altice), which ties its score from last year with a 66% satisfaction rating. Just behind it is Charter (not including TWC), which lands exactly at the overall average of 63%. Altice’s other company, Suddenlink, also comes in at 63%.

At the bottom of the heap is Mediacom, which managed to rise two points from its bottom-of-the-barrel terrible 2016 score (54%) to a frankly still pretty terrible 56%.

Mediacom at least prevents Comcast from coming in last; the nation’s largest company dropped several points from the 62% it eked out last year to scrape out a 58% this year. Coming in just above are Time Warner Cable (Charter) and Frontier, both tied at 60%.

Cox managed to best those scores with a 61%, also a modest increase from its 2016 score.

However, while cable companies all scrape the bottom of the satisfaction index, all is not completely grim in the world of pay-TV. The satellite and fiber companies — which unlike cable, are not generally geographic monopolies and actually have to compete a little bit — receive much more favorable ratings. In pay-TV overall, Verizon’s FiOS comes in at the top, actually managing to score a 71%, with AT&T’s Uverse and DirecTV right behind. Even Dish Network, the lowest scorer among the satellite and fiber companies, still manages to beat out the cable giants.

As you might guess, overall it’s the availability and quality of customer service, more than the actual product on offer, torpedoing the cable companies’ scores. Satisfaction with features like HD picture quality, signal reliability, and range of channels available tends to hover between 75% and 80% — but “call center satisfaction” languishes at the bottom, with only 65% of customers happy with how their phone calls go.

The internet side of the cable business varies a little bit from the TV side. FiOS and Uverse are still the most popular providers, scoring 71% and 69% respectively, but thanks to the abysmal scores of Windstream (57%) and Frontier (56%), Mediacom’s sad 58% manages to come in third from the bottom instead of dead last.

Comcast manages to eke out 60% satisfaction on the internet side, which is better than its pay-TV score, and Time Warner and Cox tie just below the overall average at 62%. However, Charter and Altice’s two companies all manage to beat the average, fractionally, coming in from 65% to 68%.

Once again, failing grades in customer service tank what otherwise might have been decent scores for the ISPs. Overall, more than 70% of customers say that their service is reliable and their bills are understandable — but only 61% report call center satisfaction, and only 66% are happy with the variety of plans available to choose from.

Americans’ overall dissatisfaction with their cable providers is, at this point, an entirely predictable trend. We saw the same in 2013, 2014, 2015, and 2016. But there’s an interesting parallel: customers’ satisfaction with their mobile phone companies is, mostly, going up.

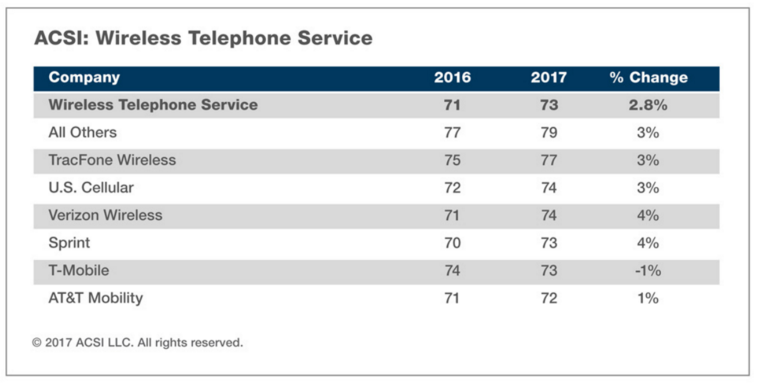

Every single one of the prepaid and postpaid wireless companies included in the ACSI survey this year had scores higher than 72%. Only one company declined since last year — T-Mobile — and even it only dropped by one point, from 74% to 73%.

The lowest scoring cell phone company — AT&T with a 72% — still manages to rank better than the highest scoring pay-TV company (Verizon FiOS with a 71%):

As to why, the ACSI does indeed seem to think competition is the culprit.

Customer satisfaction is up in mobile “as carriers engage in increasingly competitive price wars,” the report notes. “Compared with other telecom categories where customers have little choice, the wireless industry is a good example of how competition impacts customer satisfaction. When companies fight for customers, prices are competitive, service improves, and customer satisfaction is higher.”

“The threat of competition does not appear to be encouraging improvement fast enough for pay TV,” Claes Fornell, ACSI’s chairman and founder, said in a statement. “Customer service remains abysmal, and viewers are continuing to switch over to streaming services with much higher satisfaction.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.