Complaints About Student Loan Servicing Increase In Nearly Every State Image courtesy of Adam Fagen

Newly released complaint data from the Consumer Financial Protection Bureau appears to support recent claims by nearly two-dozen states that Education Secretary Betsy DeVos may be making a big mistake by rolling back protections for student loan borrowers.

The CFPB’s latest monthly snapshot [PDF] shows a triple-digit year-over-year increase in complaints about student loans.

According to the report, the Bureau received 3,284 complaints during the first three months of 2017, a 325% increase over the 773 complaints received during same time period only a year earlier.

These increases aren’t exactly surprising considering the CFPB’s March snapshot showed a 429% increase in complaints related to student loan servicing.

As of April 1, the Bureau says it has handled approximately 44,400 student loan complaints from consumers since it opened this complaint portal in Feb. 2016.

The CFPB notes that the surge in complaints is likely tied not only to an increased awareness of student loan servicing issues, but the fact that the Bureau updated its intake form on accepting complaints in Feb. 2016.

Additionally, the Bureau believes that taking “major enforcement action” against a student loan servicer Navient contributed to a student loan complaint volume spike in Jan. 2017.

What Are They Complaining About?

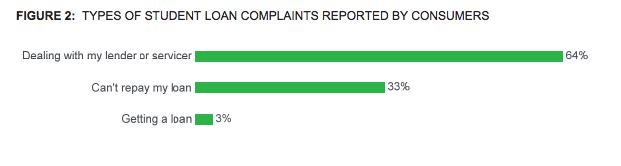

Of the student loan complaints the Bureau received, 64% involved trouble dealing with lenders or servicer, 33% related to difficulty repaying debts, and 3% reported difficultly in obtaining loans to begin with.

Many federal student loan borrowers complained to the CFPB that when they reached out to servicers regarding financial distress, they were given information about forbearance or deferment, instead of potentially beneficial repayment options like income-driven repayment plans.

When borrowers were given information about income-driven repayment plans, they reported having difficulty actually enrolling. For instance, borrowers say servicers lost documentation, extended application processing times, and offered unclear guidance when seeking to switch from one income-driven repayment plan to another.

As part of income-driven repayment plans, student loan borrowers are required to resubmit their annual income recertification. However, many borrowers tell the CFPB they received insufficient information from their servicers to meet deadlines and lengthy processing times.

In another issue, borrowers tell the CFPB that they encountered problems with the way payments were applied to their accounts.

For example, some borrowers reported that overpayments were not applied to specific amounts, but applied to all accounts managed by the servicer.

In other cases, the borrower’s overpayment, which were meant to reduce principal balance, were credited as an early payment, resulting in an account reflecting a paid ahead status.

Both federal and private student loan borrowers reported issues of incorrect reporting of their loans to the credit reporting companies.

Additionally, borrowers complained that their accounts were paid in full or not in a delinquent status but were being reported negatively to credit reporting agencies. In fact, some borrowers reported being contacted by collection companies for accounts that had been paid in full or for debts that were not owed.

Where Are Complaints Coming From?

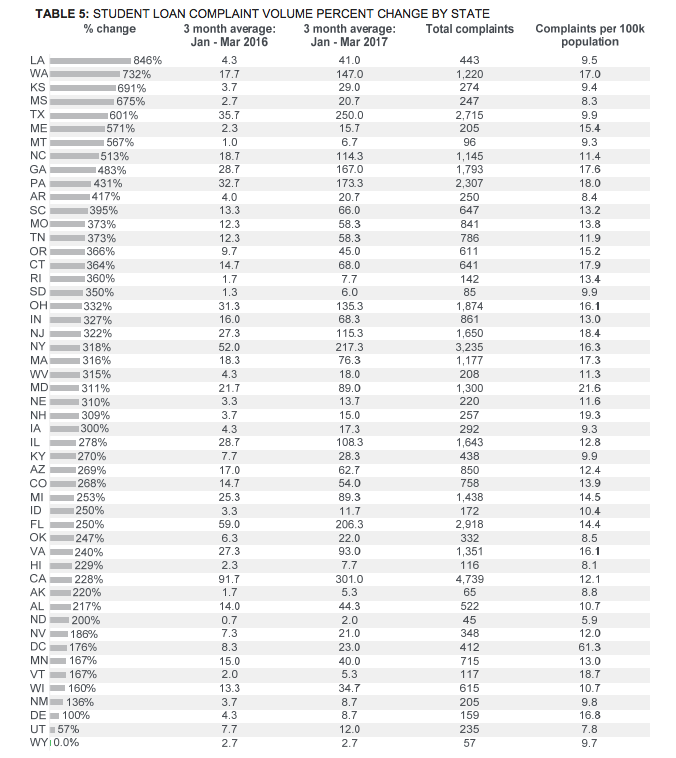

While student loan servicing increased by 325% nationally year over year from January to March, it found that 49 states experienced a 100% or more increase in complaints for the same time frame.

Only Wyoming and Utah experienced complaint increases below 100%, with Wyoming recording no change and Utah receiving 57% more complaints.

On the other end of the spectrum, Louisiana experienced the largest increase in student loan complaint volume with 846% more complaints submitted from Jan. 2017 to March 2017, compared to the rate received from Jan. 2016 to March 2016.

Washington saw a 732% increase in complaints, while Kansas recorded an increase of 691% for the same time frame.

Of the five most populated states, Texas experienced the greatest increase of 601% and California experienced the least increase at 228%.

Who Are They Complaining About?

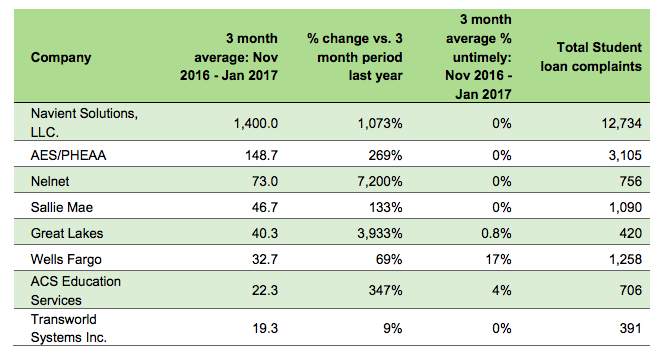

As with the Bureau’s March complaint snapshot, the April report found that Navient was the most complained about student loan servicer.

This perhaps isn’t a surprise, as the CFPB and two states sued Navient in January, alleging the company cheated borrowers out of repayment rights.

Navient received an average of 1,400 complaints from Nov. 2016 to Jan. 2017, a 1,073% increase from the same three-month period the year before.

The next two most complained about student loan servicers received far fewer average complaints. According to the complaint, Fedloan and AES received an average of 148 complaints, while Nelnet received 73 complaints.

Despite the low number of average complaints, Nelnet saw a 7,200% increase in complaints year-over-year during the three-month window.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.