Student loans are big business, both for private lenders and the federal government. And with $1.4 trillion dollars in education debt outstanding, it should come as no surprise that these companies and the government would want to recoup these costs. However, that often comes at a cost to borrowers, from those who have fallen on hard times, to those failing to receive proper notice and options from servicers, or those who believe they were defrauded by the educators who promised them a better life. [More]

navient

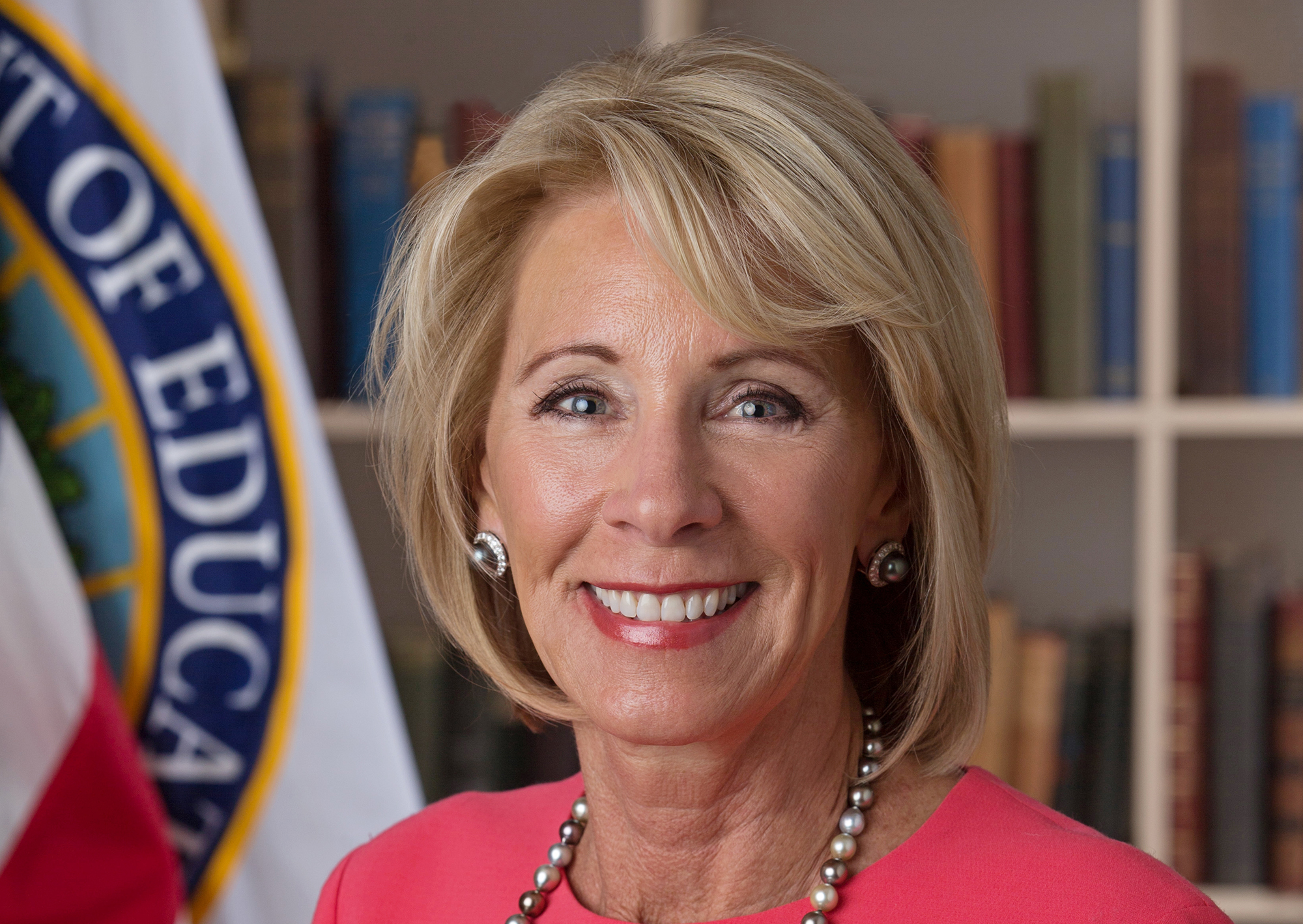

Education Secretary DeVos To Give All Student Loan Accounts To One Company; Strip Away More Protections

Education Secretary Betsy DeVos has made another sweeping change to the student loan system that consumer advocates claim favors student loan collectors over the American people repaying those loans. [More]

Complaints About Student Loan Servicing Increase In Nearly Every State

Newly released complaint data from the Consumer Financial Protection Bureau appears to support recent claims by nearly two-dozen states that Education Secretary Betsy DeVos may be making a big mistake by rolling back protections for student loan borrowers. [More]

21 Attorneys General Call Out Education Secretary DeVos For Removing Student Loan Protections

In response to the decision by Secretary of Education Betsy DeVos to roll back protections for student loan borrowers, a coalition of state attorneys general are accusing DeVos of failing America’s students. [More]

Education Secretary DeVos Withdraws Protections For Student Loan Borrowers

Relatively new federal guidelines intended to to make the student loan repayment process more accurate and transparent have all been rescinded today by Secretary of Education Betsy DeVos — a move that consumer advocates says removes accountability for debt collectors and loan servicers. [More]

Navient Claims It’s Under No Obligation To Help Student Loan Borrowers

Navient, the largest student loan servicer in the country, is here to simply collect your monthly education loan payments, not help you find ways to more easily afford those payments. [More]

Complaints About Student Loan Servicing Increased 429% In Past Year

In the past year, federal regulators and consumer advocates have highlighted issues with student loans and the servicing of these often crippling debts: from finding that educational loans continue to haunt older borrowers, to suing Navient, the largest student loan servicing company. Because of this, it might not come as much of a surprise that the number of complaints the Consumer Financial Protection Bureau received related to student loans has skyrocketed. [More]

More Than 1.1M Federal Student Loan Borrowers Entered Default Last Year

With the cost of college tuition continuing to increase, it likely comes as no surprise that more borrowers are finding themselves in default. In 2016 alone, 1.1 million borrowers entered default for their federal student loans. [More]

Student Loan Giant Navient Sued By CFPB & Two States Over Alleged Illegal Practices

Eighteen months after Sallie Mae spin-off Navient revealed that its wholly-owned subsidiary Navient Solutions Inc could one day be on the receiving end of a federal lawsuit related to its student loans servicing practices, the day has come to pass. The Consumer Financial Protection Bureau, along with two states, filed lawsuits against the nation’s largest student loan company for allegedly cheating borrowers out of repayment rights. [More]

Sallie Mae Spinoff Navient Could Face CFPB Lawsuit Over Student Loans

In the short time since Navient – the nation’s largest student loan servicing company – spun off from Sallie Mae, the company has come under scrutiny for it allegedly unfair practices of overcharging and imposing excessive fees on consumers’ loans. While those practices resulted in a $97 million settlement with the Depts. of Education and Justice, and the Federal Deposit Insurance Corp, they could soon lead to a lawsuit from the Consumer Financial Protection Bureau. [More]

Wells Fargo to Sell $8.5B In Government-Backed Student Loans to Navient

Earlier this year, Wells Fargo announced plans to get out of the payday loan-like business of direct deposit advances. Now it looks like the banking giant is getting ready to shed another aspect of its business: government-guaranteed student loans. [More]

Sallie Mae, Navient To Pay $97M To Settle Servicemember Student Loan Violations

Taking advantage of members of the military isn’t looked upon lightly by federal regulators. This idea was driven home today by the Depts. of Education and Justice, and the Federal Deposit Insurance Corp., who jointly announced a sizable settlement against student loan servicers Sallie Mae and Navient for overcharging and imposing excessive fees to military members.

[More]

Sallie Mae’s Federal Loan Business Is Now Navient. What’s A Navient?

Sallie Mae is the country’s largest originator and servicer of student loans and a regular contender in our Worst Company in America tournament. They’re about to become two much-hated companies, spinning off their loan servicing, loan management, and collections as a new company called Navient. [More]