Newly released complaint data from the Consumer Financial Protection Bureau appears to support recent claims by nearly two-dozen states that Education Secretary Betsy DeVos may be making a big mistake by rolling back protections for student loan borrowers. [More]

Protections

21 Attorneys General Call Out Education Secretary DeVos For Removing Student Loan Protections

In response to the decision by Secretary of Education Betsy DeVos to roll back protections for student loan borrowers, a coalition of state attorneys general are accusing DeVos of failing America’s students. [More]

Education Secretary DeVos Withdraws Protections For Student Loan Borrowers

Relatively new federal guidelines intended to to make the student loan repayment process more accurate and transparent have all been rescinded today by Secretary of Education Betsy DeVos — a move that consumer advocates says removes accountability for debt collectors and loan servicers. [More]

New Guidelines Aim To Improve Customer Service, Enhance Protections On Federal Student Loans

The fact that two-thirds of college-bound students who take out loans to finance their higher education have little to no idea what they’re agreeing to, doesn’t mean these borrowers shouldn’t receive adequate protection from unscrupulous loan servicing companies. New guidelines from a pair of federal agencies are aimed at ensuring student loan borrowers get the service and protection they deserve. [More]

11 Attorneys General Agree: For-Profit Colleges Shouldn’t Have Unfettered Access To Military Bases

A number of for-profit college chains market their schools directly to active-duty U.S. servicemembers, sometimes going too far in the process. Now a group of state attorneys general are voicing their concern that a new piece of legislation will weaken existing protections against overzealous recruitment of servicemembers by these controversial colleges. [More]

New Rules Aim To Rein In Predatory Payday Lending, But Will They Work?

After nearly four years of studying the issue of high-cost, short-term financial products like payday loans, and auto-title loans, the Consumer Financial Protection Bureau has finally released its proposed rules intended to prevent borrowers from falling into the costly revolving debt trap that can leave people worse off than if they hadn’t borrowed money in the first place. [More]

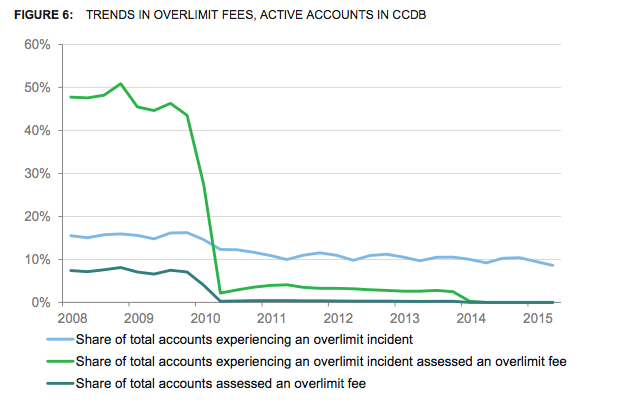

Report: Credit Card Reforms Saved Consumers $16B In Six Years

In 2009, lawmakers passed a massive set of reforms for the credit card industry – known as the Credit Card Accountability Responsibility and Disclosure Act (CARD Act) — aimed at protecting consumers though transparency, fairness, accountability and better access to an array of financial products. A new report from the agency tasked with enforcing these rules, finds that nearly six years after implementation, consumers have saved nearly $16 billion in fees. [More]

Pew Charitable Trusts Illustrates The Devastating Effects Of Payday Lending, How It Can Be Fixed

Back in March, the Consumer Financial Protection Bureau took its first long-awaited step in reining in the payday loan industry by releasing an outline for potential regulations over the small-dollar lines of credit known to thrust consumers into a devastating cycle of debt. While consumer groups were quick to applaud the steps, they also expressed concern that more could be done to protect people from the devastating consequences of such loans. This week, Pew Charitable Trusts released a video detailing the predicament nearly 12 million Americans face every year when taking out payday loans and how regulators might be able to find an answer. [More]

Defense Dept. Aims To Close Predatory Lending Loopholes For Military Personnel

While the Military Lending Act aims to protect military personnel and their families from predatory lenders’ often unsavory lending practices that include high interest rates and excessive fees, it still allows for clever lenders to get their hooks into borrowers. That’s why the Obama Administration and the Department of Defense announced a proposed overhaul of the rules – much to consumer advocates’ delight. [More]