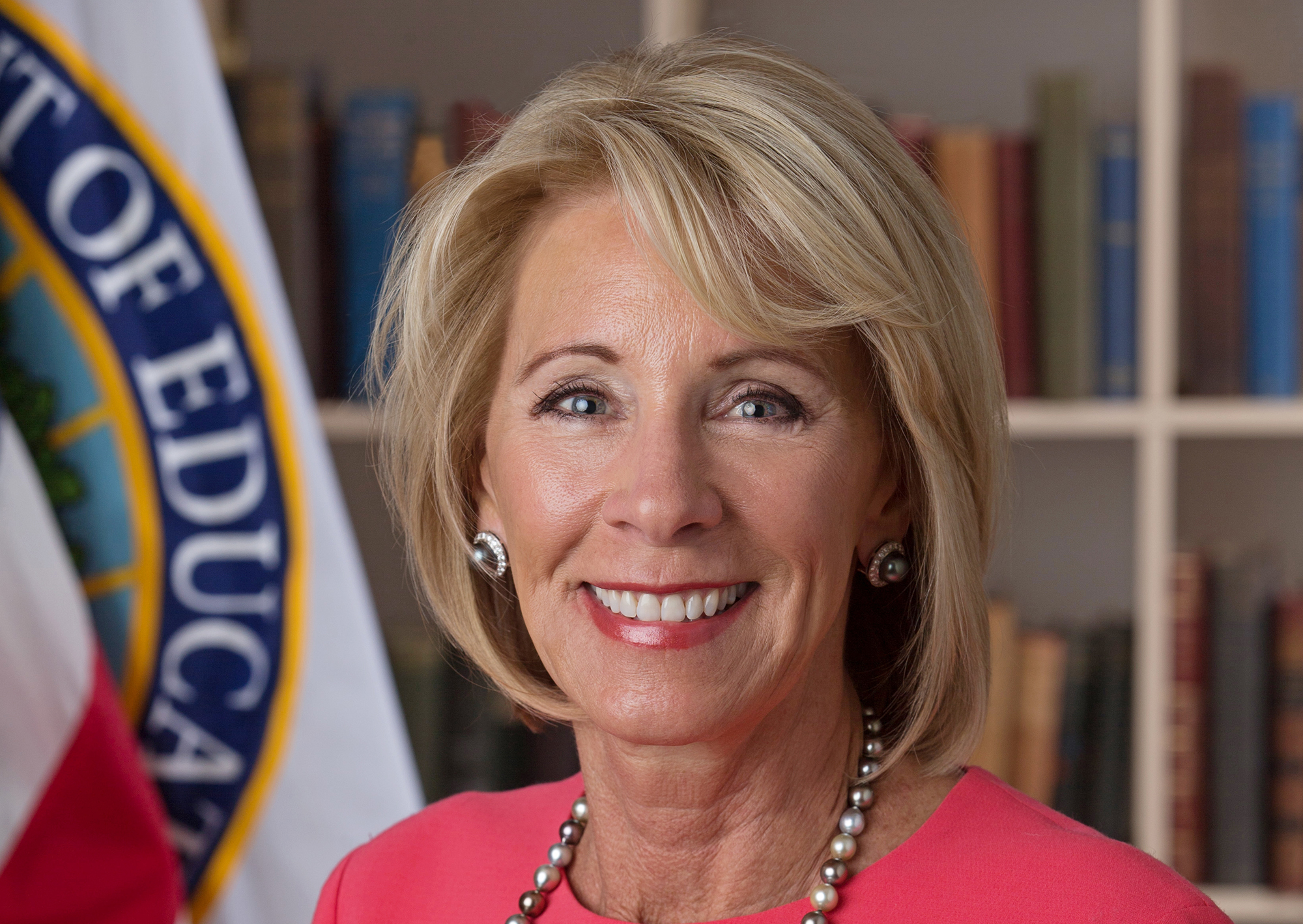

Earlier this month, Secretary of Education Betsy DeVos declared that the Department of Education would no longer work with the federal Consumer Financial Protection Bureau to root out bad players in the student loan servicing arena. While the CFPB fired back, accusing DeVos of misunderstanding just what the Bureau does, a coalition of state attorneys general are now joining the choir, claiming the decision to end the agencies’ agreements undermine protections for student borrowers. [More]

student loan servicing

Education Secretary DeVos To Give All Student Loan Accounts To One Company; Strip Away More Protections

Education Secretary Betsy DeVos has made another sweeping change to the student loan system that consumer advocates claim favors student loan collectors over the American people repaying those loans. [More]

Complaints About Student Loan Servicing Increase In Nearly Every State

Newly released complaint data from the Consumer Financial Protection Bureau appears to support recent claims by nearly two-dozen states that Education Secretary Betsy DeVos may be making a big mistake by rolling back protections for student loan borrowers. [More]

Student Loan Giant Navient Sued By CFPB & Two States Over Alleged Illegal Practices

Eighteen months after Sallie Mae spin-off Navient revealed that its wholly-owned subsidiary Navient Solutions Inc could one day be on the receiving end of a federal lawsuit related to its student loans servicing practices, the day has come to pass. The Consumer Financial Protection Bureau, along with two states, filed lawsuits against the nation’s largest student loan company for allegedly cheating borrowers out of repayment rights. [More]

Xerox’s Federal Student Loan Servicing Under Investigation Over Inaccuracies, Overcharges

When you think of Xerox, photos of large, office printers is likely the first thing to come to mind. But it turns out the company also dabbles in the education business. And it’s that venture that federal investigators are probing after discovering nearly a decade of errors. [More]

Wells Fargo Reportedly Under Federal Investigation Related To Student Loan Servicing

According to a new report, Wells Fargo is the latest big-name bank to be scrutinized as part of the Consumer Financial Protection Bureau’s ongoing investigation into student loan servicing practices.

[More]

Feds Recommend Overhaul Of Student Loan Servicing

Earlier this year, the Consumer Financial Protection Bureau launched a public probe into potentially anti-consumer practices of the student loan servicing industry. More than 30,000 people responded, leading the Bureau, along with the Departments of Education and Treasury, to release a framework they hope will curb these questionable practices, promote borrower success, and minimize defaults. [More]

Sallie Mae Spinoff Navient Could Face CFPB Lawsuit Over Student Loans

In the short time since Navient – the nation’s largest student loan servicing company – spun off from Sallie Mae, the company has come under scrutiny for it allegedly unfair practices of overcharging and imposing excessive fees on consumers’ loans. While those practices resulted in a $97 million settlement with the Depts. of Education and Justice, and the Federal Deposit Insurance Corp, they could soon lead to a lawsuit from the Consumer Financial Protection Bureau. [More]

Citigroup Facing Federal Investigation Into Student Loan-Servicing Practices

Just last month federal regulators announced that an ongoing probe into potentially unscrupulous student loan-servicing practices resulted in nearly $18.5 million in refunds and fines from Discover Bank. Now, regulators appear to have Citigroup in their crosshairs, as the financial company announced it was party to an investigation. [More]

Discover Bank Must Pay $18.5 Million Over Illegal Student Loan Servicing Practices

As federal regulators continue to probe potentially unscrupulous student loan servicing practices, the Consumer Financial Protection Bureau has ordered Discover Bank and its affiliates to pay nearly $18.5 million in refunds and fines for, among other things, overstating amounts due on student loans and failing to notify borrowers of their rights. [More]