Two-Thirds Of College Students Who Take Out Loans Have No Idea What They’re In For Image courtesy of Jeff

Would you walk into a bank — or call up the federal government — and borrow $50,000 or more without having some idea of when or how you’ll be expected to pay it back, or what can happen to you if you fall behind? That probably sounds unwise to you, but the results of a new survey show that a large majority of college students who take out loans are jumping into the deep end of the debt pool without any advice or guidance.

In fact, according to the survey [PDF] from our colleagues at Consumer Reports, 62% of Americans with student loan debt did not attend any financial aid information sessions prior to enrolling in college.

The survey, part of CR’s new cover story on the education debt, looked at student loan borrowers between the ages of 21 to 40 to assess the availability and usefulness of high school and college financial aid guidance and student loan debt and its impact on financial, lifestyle and relationship choices.

Know Before You Owe? Not So Much

When asked if they were offered any presentations, workshops, or one-on-one meetings with a college counselor to discuss financial aid while in high school, 36% of respondents said they weren’t aware of any sessions, while another 38% said they did attend such meetings.

For those who attended presentations, the information was disseminated in a number of ways: 60% said they went on to have individual meetings with a college counselor; another 58% attended school assemblies or in-person presentations; and 28% attended workshops.

As for what prospective students got out of the sessions, most information tended to be logistical in nature, rather than providing details on what their obligations would be after graduation.

For example, nearly 75% say they learned about different types of financial aid, 81% say they were educated on the financial aid application paperwork, process, and timeline, and 71% received information on the timeline and requirements to apply for scholarships.

Less than half of respondents — about 47% — say the “terms and conditions for each financial aid type” was clearly explained to them, while 42% say the “different repayment options” were explained.

Additionally, just 16% of students said their college counselors offered advice about maximizing their financial aid packages and 24% they were offered advice about budgeting and financial debt management.

While a large number of borrowers described receiving a lack of information about financing their education, it should be noted that 22% to 30% of students surveyed didn’t remember whether terms and details about their obligations were offered to them.

Of course, students aren’t the only ones that may be affected by student loan debt; parents are also often involved in the process, whether it is taking out a parent loan or co-signing for a private loan.

According to the survey, many of these borrowers may not have received adequate information about the loans and their options.

Just 21% of consumers with student loan debt said their high school offered college financing counseling sessions that their parents or guardian could attend. Another 35% said they did not know if such sessions were offered.

Learning As You Owe

When it comes to life after filling out dozens of scholarship and loan forms, students say they weren’t exactly prepared for the reality of repayment, budgeting, or understanding the terms of their newly acquired debt.

The CR survey points out that a lack of information and guidance on student loans wasn’t simply reserved for the time before school began.

Nearly two-thirds (or 36%) of borrowers with student loan debt say they never met with a financial aid officer, while another 28% said they met with an officer less than once per year.

Of the students who met with their counselors at least once, most reported that the financial aid officers were not prepared for or tasked with helping students understand the reality and consequences of taking on student loan debt.

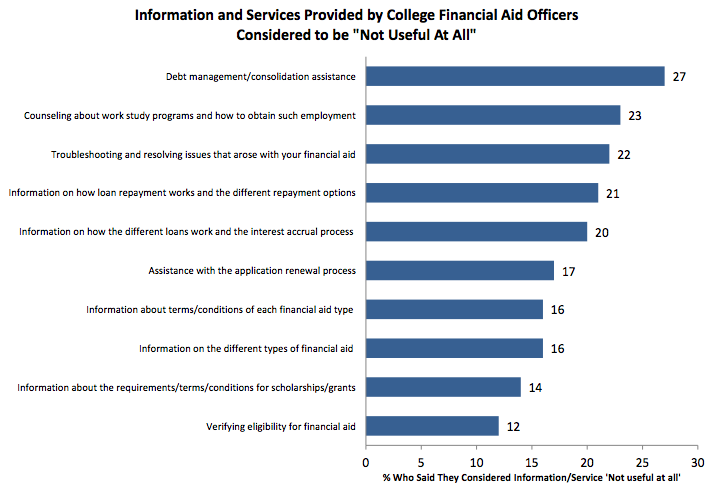

For example, 27% of respondents said information about debt management and consolidation assistance was not useful at all.

Another 20% said they found the “information on how the different loans work and the interest accrual process” and “information on how loan repayment works and different repayment options” to be “not at all useful.”

When it came to troubleshooting issues with financial aid, borrowers say their college advisors did not provide useful information on the application renewal process, or eligibility for other financial aid options and scholarships.

For Education Debt, Hindsight Is 50/50

Although we’re still waiting on a time machine that will take us back to our former years and change a few of our less-popular decisions, those with student loan debt already know what they would do differently.

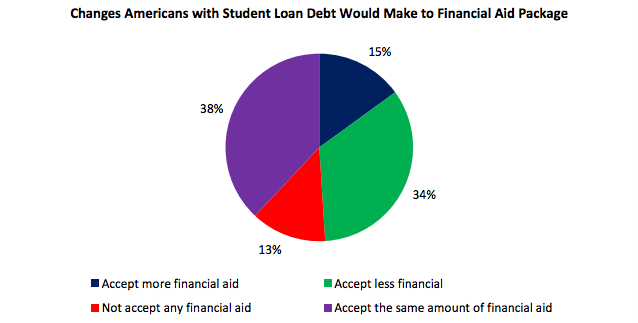

When asked if they could “do it all over again, would you change the amount of financial aid assistance you received?” nearly half of respondents said they would.

About 47% of respondents said they would accept less financial aid assistance. That includes the 13% who now say they would not accept any aid if they had to do it all again.

Still, 38% of borrowers say they would still take out the same amount of financial assistance, and 15% would accept more.

In the end, many survey respondents said that looking back over their experience, college was not worth the cost.

The Student Debt Crisis: Lives On Hold [Consumer Reports]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.