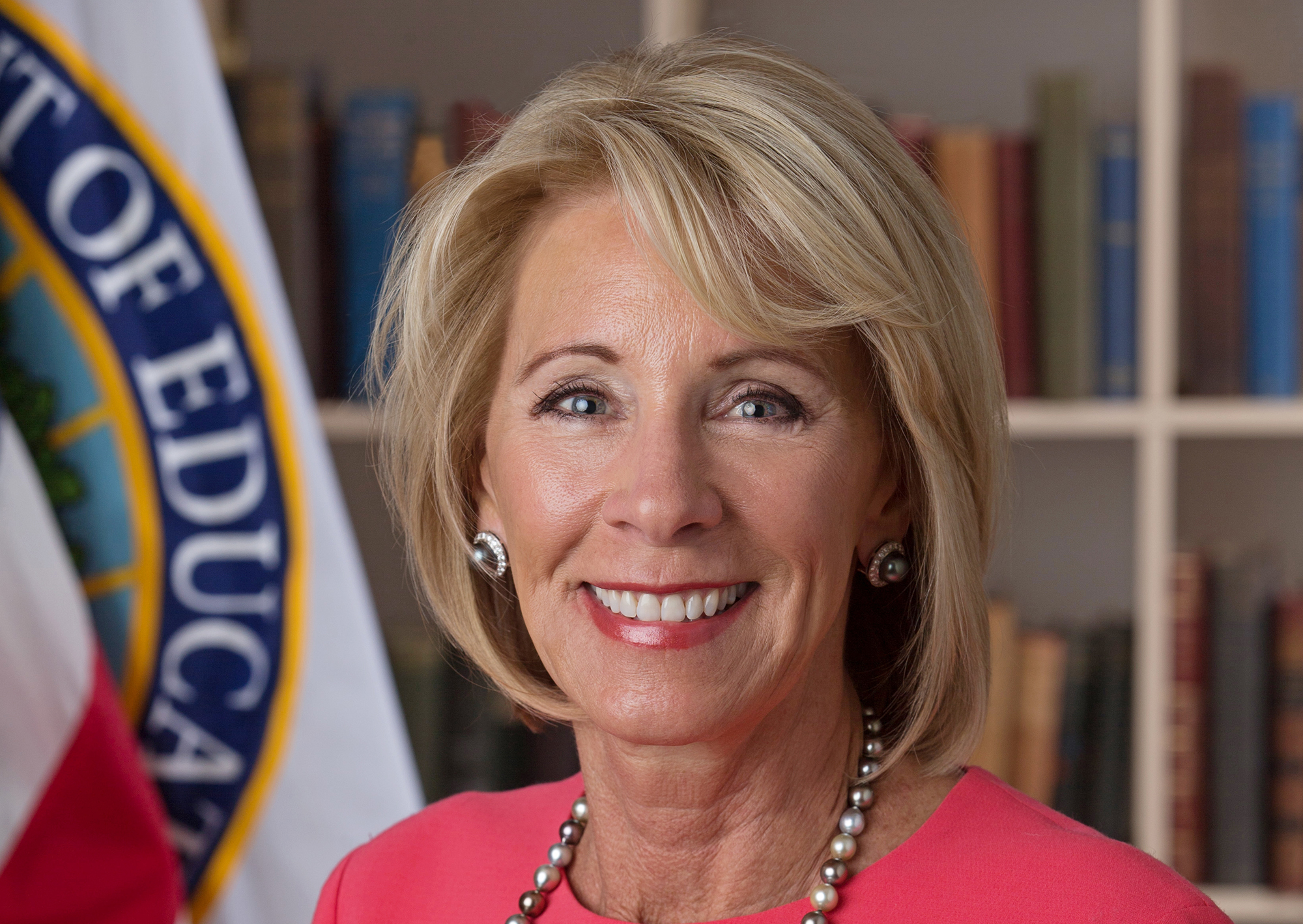

The Department of Education will no longer work with the federal Consumer Financial Protection Bureau to root out bad players in the student loan servicing arena. That’s according to Education Secretary Betsy DeVos, who recently notified the CFPB that her department is ending years of formal cooperation combating student loan fraud. [More]

student loan debt

Student Loan Repayment Programs Will Eventually Forgive $108B In Debt

While several recent reports have suggested that many student loan borrowers face needless hurdles when trying to reduce their monthly payments through the Department of Education’s income-driven repayment plans, a new study has found the programs are working and will eventually forgive $108 billion in outstanding student debt. [More]

Student Loan Debt For Recent College Graduates Increases Again, Now At $30K

With college tuition continuing to increase, it probably won’t surprise many people to learn that college graduates are leaving school burdened with more loan debt. According to a new report, the average amount of student loan debt for new graduates has passed $30,000 for the first time. [More]

Two-Thirds Of College Students Who Take Out Loans Have No Idea What They’re In For

Would you walk into a bank — or call up the federal government — and borrow $50,000 or more without having some idea of when or how you’ll be expected to pay it back, or what can happen to you if you fall behind? That probably sounds unwise to you, but the results of a new survey show that a large majority of college students who take out loans are jumping into the deep end of the debt pool without any advice or guidance. [More]

Report: For-Profit College Students Earn Less After Graduation Than They Did Before

For-profit college chains often market themselves to non-traditional students — single parents, lower income individuals, military servicemembers — as a viable path to better job prospects and more money. However, a new report suggests that enrolling in of these sometimes costly schools may not help students reach their goals. [More]

Man Claims He Was Arrested For Unpaid Federal Student Loan Debt

More than a century ago, the U.S. did away with the idea of debtor’s prison, and the Fair Debt Collection Practices Act explicitly forbids debt collectors from using the threat of jail time as a way to collect on owed money. So how does a Texas man end up with U.S. Marshals at his door, ready to arrest him for a nearly 30-year-old student loan debt? [More]

Student Loan Debt For Recent College Graduates Increases Again

With college tuition prices continuing to rise, you might assume that college students are entering the real world with more debt on their shoulders. According to a new report, that assumption would be correct.

[More]

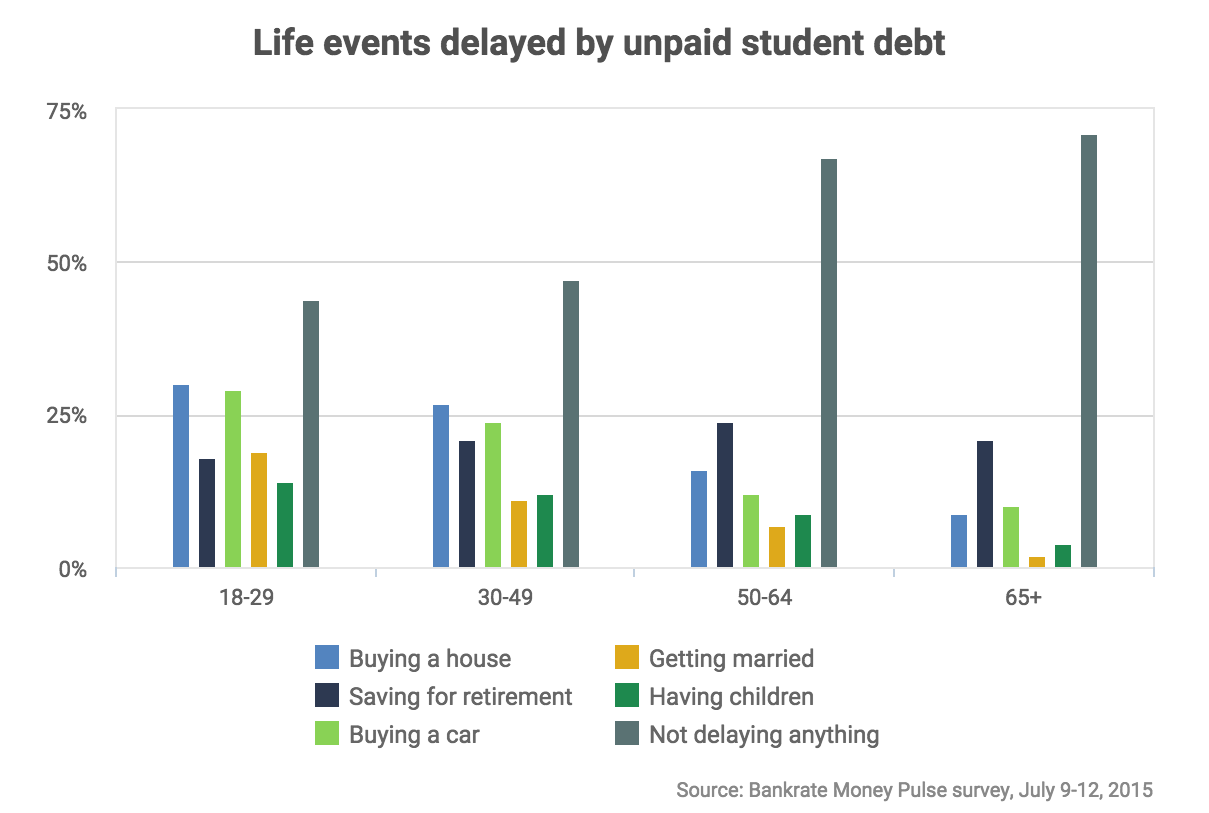

Student Loan Debt Causing Millennials To Delay Marriage, Kids, Home-Buying

We’ve written before about the idea of a “debt backpack,” this notion that young adults are graduating from college already burdened by debt. The more burdensome that backpack, the less able and likely they may be to not only make major financial investments — like a home, or a new car — but also might be putting off important personal milestones, including marriage and kids. The results of a new survey back up this theory and show the delaying effect that student loan debt has on Millennials. [More]

CFPB Asks Google, Bing & Yahoo To Help Stop Student Loan Debt Scams That Imply Affiliation With Feds

The Internet is teeming with scammers, fraudsters, and hustlers determined to part consumers from their money, and as a $1.2 trillion venture, student loans often present an attractive avenue for these ne’er-do-wells. In order to better protect individuals from such schemes, the Consumer Financial Protection Bureau is enlisting the help of the country’s major search engines. [More]

Current, Former Corinthian College Students Go On “Debt Strike,” Refuse To Pay Private & Federal Loans

With for-profit educator Corinthian Colleges Inc. selling off campuses and closing schools, thousands of Everest, WyoTech, and Heald College students are waiting to learn the fate of the more than $1 billion in private and federal student loan debt used to finance their education. While the Department of Education and the Consumer Financial Protection Bureau have worked to secure deals in which some of that debt will be forgiven, some students are increasing the pressure on such deals by staging a “debt strike.” [More]

69% Of 2013 College Graduates Left With A Degree And An Average Student Loan Debt Of $28,400

By now we are well aware that college tuition continues to rise and consumers continue to take out hefty student loans to meet those growing costs. So it should come with relatively little surprise that the average debt graduates leave college with remains high; this year with an average of $28,400. [More]

Study: Housing Market Poised To Lose $83B This Year Because Of Consumers’ Student Loan Debt

Back in February we reported that student loan debt was preventing some first-time home buyers from entering the housing market. Now a new study aims to put a price tag on those missed opportunities for the real estate world. [More]

Parents Stuck With $200K In Student Loan Debt After Daughter Dies

The last thing families want to deal with after the death of a loved one is a phone call reminding them of their departed’s debt. But that’s the case for a number of parents who have inherited the obligation to repay the student loans they co-signed for their deceased child. [More]

Illinois Files Suits Against Debt Settlement Companies That Allegedly Scammed Student Loan Borrowers

We already know that some debt settlement programs provide little relief for debtors, and consumers who contributed to the $1.2 trillion student loan debt tab appear to be the top target for these companies. Today, the Illinois Attorney General announced lawsuits against a pair of debt-settlement companies that targeted, and allegedly misled, student loan borrowers. [More]